In this episode, entrepreneur Rob Harmon discusses his new method for tracking and monetizing energy efficiency in commercial buildings. Traditionally, efficiency policy has consisted in subsidizing equipment up front. Harmon explains how to get reliable numbers about actual performance and begin to build a market around them. Surprisingly fascinating.

Full transcript of Volts podcast featuring Rob Harmon, March 28, 2022

David Roberts:

Like everyone else, I’ve been thinking a lot about the war in Ukraine. I don’t have much expertise in foreign affairs, so unlike every other pundit on the planet, I’ve mostly chosen to keep my hot takes to myself.

One aspect of the conflict, however, overlaps with my interests. Everyone seems to agree that the top priority going forward is to wean the West off of Russian oil and gas. As usual, such discussions are dominated by supply-side considerations — how to find the oil and gas elsewhere.

But as all good energy nerds know, the fastest and cheapest way to use less oil and gas is … to use less oil and gas — to reduce demand, not frack more.

So I thought it would be nice to do a series of podcasts focused on clever, innovative ways to reduce oil and gas demand.

We begin today with energy efficiency, specifically with one of its biggest challenges: commercial buildings, which are responsible for around 18 percent of US primary energy use (more energy than all of Canada consumes) and 16 percent of US carbon emissions. Today, according to the EPA, they waste around 30 percent of that energy. Almost a third! And they are coming under increasing pressure from policymakers to emit less.

Efficiency in commercial buildings is an enormous opportunity, not only to reduce emissions but to keep money in local communities and create local jobs.

Despite that, it has never quite taken off like proponents hoped. The tough nut to crack is developing a model that can make deep efficiency retrofits of existing commercial buildings work without ever-escalating public subsidies.

That brings us to today’s guest, Rob Harmon, a long-time energy expert and entrepreneur who lives here in my home city of Seattle. Over the last eight years, he has been developing, evangelizing, and road-testing a model that he thinks can finally scale up efficiency in commercial buildings.

I will warn listeners that the model — called MEETS, for Metered Energy Efficiency Transaction Structure — is somewhat complex. There are some unfamiliar terms involved. But once it clicks into place I think you will see that it is incredibly clever and the opportunities for growth are boundless. I’m eager to talk to Harmon about how it works, where it is currently working, and the opportunities he sees ahead.

So without further ado, Rob Harmon, welcome to Volts. Thanks for coming on.

Rob Harmon:

Well, thank you, David. It's really great to be here. I'm a longtime listener. It's great to be a participant, so thank you very much.

David Roberts:

Commercial buildings are big energy users and incredibly wasteful, an enormous opportunity for efficiency, but they’re a tough nut to crack. What is it about the ownership and regulatory structures of commercial buildings that has made them so difficult to get at?

Rob Harmon:

Let me do a little preamble so I don't offend my colleagues right off the bat. In what I'm going to talk with you about today, I'm speaking in very broad strokes about the majority of large commercial buildings in the United States. There are plenty of exceptions to the rule of the basic impression I'm going to give you. We have a very large percentage of buildings that fit the pattern, but I'm not suggesting that this is true of every building.

I also want to clarify that when I'm talking about efficiency, I’m not looking at cream skimming, taking the first 10 or 15 percent off the top. Climate and energy issues are pretty serious these days, so we can’t afford to lightly touch buildings and call it good. We need to decarbonize buildings and turn them into grid assets. These are big things – and to me, that's the only way we can reach our climate and grid-stability goals.

So, I'm talking about relatively large commercial buildings, and I'm talking about going deep into those buildings, not just skimming the cream off of them. With that said:

Most buildings, particularly large buildings, are not occupied by their owners – they're occupied by tenants. The first problem with getting efficiency done in those buildings is that the tenants pay the energy bills, but they don't own the building. They won't spend money to make the building more efficient, because they don't want to put money into the building they don’t own. Tenants have no reason to invest.

The second problem is a little bit more complicated, and it has to do with why the building owners won't invest. You’d think, well, they own the building, they should put money into it. The efficiency industry’s existing approaches to buildings ask building owners to do just that, to borrow money to pay for efficiency upgrades. But those upgrades lower the energy bills for the tenants, so the building owner has no financial reason to upgrade the building either. The vast majority of those benefits flow to somebody else.

That's called a split incentive, and inside the efficiency community, it's a well-known barrier to moving projects forward. Nobody's got an interest in doing this. Neither the tenants nor the owners will invest in the building.

We have a lot of clever people in the industry, so some folks have tried to crack that problem by having energy service companies, usually called ESCOs, pay for the upgrades to the buildings and charge the building owners over time.

That sometimes works, but it has a lot of its own problems. For example, the ESCO in that situation is essentially charging the building owner over time. If the building owner can't send those charges to the tenants, which is probably not in their leases, then we're back to the problem we had before, where there's no cash flow for the building owner to use to repay the ESCO. The building owner has no way to pay them back, so they say no again. We have somebody else's money, but we still can't get it done.

Another issue for this is that the building owners don't want additional liabilities on their books. This is an accounting problem. In many cases, their liabilities, in particular, are heavily leveraged, and they don't have room on their books for more liabilities. Even if somebody else pays the upfront costs, we still can't fix the building, because the owner says no, I can't have any more liabilities on my books.

All that is to say that the existing approaches to efficiency don't work for building owners who have tenants, which represent a huge portion of the buildings, particularly the big ones. The tenants won't invest, the building owners won't invest, and building owners won't let other people invest.

Even if you can find a way around all that, now you have to find an investor who wants to invest.

Nearly all the structures for efficiency are based on the idea that an investor is supposed to lend money to the third party to make efficiency upgrades. But building owners for commercial buildings sell their buildings every five to seven years, and investors want all their money back during that window. So the types of investments in the buildings that we need to make to really get deep in the buildings take longer to pay for themselves than five to seven years.

David Roberts:

The five to seven years is cream-skimming stuff.

Rob Harmon:

Yes, exactly. The investors want to invest only short term, and we need long-term investments.

As if that's not bad enough, most of the building owners aren't seen as credit-worthy counterparties for long-term efficiency investments. Their balance sheets just don't support it. So investors don't want to invest in them because they're not credit-worthy counterparties.

I'm going to give you an analogy here that sounds a little bit ridiculous, but I think it's a useful way to think about this. We've built a boatload of wind farms in recent years. Imagine if we’d tried to do that by going to a landowner (building owner) and saying to them “you should pay for the turbines to put up on your land, or we'll pay for them and you pay us back over time.”

We wouldn't build any! It's comical, right? We certainly wouldn't get wind to scale if that was the model, relying on the property owner as the core of the thing. But we built our entire commercial efficiency architecture around that idea, making the property owner the financial centerpiece of what is essentially a problem with the energy system. We keep thinking it's a real estate problem, but the real estate's working fine for its real estate purpose. What we have is an energy problem. We keep thinking we can solve that as a real estate problem, and it hasn't worked. In my view, it can't work.

David Roberts:

What about the role of utilities in all this?

Rob Harmon:

If you went to a farmers market and told an apple farmer that you wanted him to sell fewer apples, he might not like that idea. What we're saying to the utilities is “sell fewer units.” They have all these fixed costs, and when they sell fewer units, they have to collect for all those fixed costs by selling fewer units, which means they have to raise the price of the units, and that's what they call the death spiral. Higher units means more people try to reduce use, and then they've got to raise rates more.

It's certainly not that simple. There are plenty of reasons why it makes sense for utilities to do efficiency, so I don't want to pretend that it's cut and dried. This is a very complicated issue.

David Roberts:

The utilities want to spend more money and invest more in infrastructure and sell more energy, and energy efficiency is selling less energy. There are complications around the margins, but that basic misaligned incentive is everywhere. Utilities don't want to sell less of their primary product, and we socially and environmentally want them to. That basic split incentive is a problem everywhere in the energy world.

Rob Harmon:

Part of the solution here is whether we move to performance-based rate making. When you talk about a utility, there's the staff, the ratepayers, and, if it’s an investor-owned utility, the shareholders. You have three different groups there, all of whom have needs. That's just three of the 17 parts that the problems all break down into, and each one of those has several parts associated with it.

I agree with you entirely that we have a huge challenge in the way we regulate utilities. MEETS doesn't solve all those problems, but it does help.

David Roberts:

So the basic problem with commercial buildings, as we’ve reviewed, is that literally none of the parties involved anywhere along the line have an incentive to create this efficiency. Even though efficiency has value, no one gets enough value to induce them to do anything about it. Why have traditional efficiency programs and measures failed here?

Rob Harmon:

They haven't failed everywhere. But in large commercial buildings, it's really a problem.

I got my first job in efficiency in 1982, which was my first year in college. I've been in this for a very long time, and I spent many years working in the industry that I am now trying to shift, so I've lived and breathed the challenges of the industry.

What's important to remember is what was happening in the country when the efficiency programs were developed. At that time, energy use was growing very rapidly and there was a big push across the country to build lots of power plants. Some very smart people, many of whom are still kicking around, looked at that and realized that at least in some cases, it was much less expensive to save energy than it was to acquire it. Our efficiency programs were born out of that essential contribution – that it was much cheaper to just save energy than it was to go build another plant. Given that context, in many places, those programs were very successful. We built far fewer power plants than we would have without that essential contribution.

Another bit of context is that we couldn't meter efficiency the way we could meter energy from a coal plant. But again, a lot of very smart people figured out how to measure it well enough to realize that if you paid somebody $5 to buy an efficient light bulb, it would at least on average more than pay for itself, compared to the cost of going out and building a new resource.

We built the whole industry around those two notions: we could pay incentives to people up front to do efficiency, it was cheaper than building new power plants in many cases, and it was good enough to use averages, which are essentially deemed savings. We weren't metering anything; we were deeming the savings.

We really had a limited set of tools, and perhaps more importantly, we were focused on saving money by investing in efficiency when it was cheaper to build a power plant.

It’s important to recognize what’s changed in the last five or 10 years that makes it possible for us to have these programs evolve. Our ability to meter efficiency has grown immensely. In many cases, we can now know, with an accuracy that is plenty good enough to do business with, how much efficiency is being created by the things we do to fix buildings.

David Roberts:

Not just estimating in advance what they will do, but measuring what they are doing in real time.

Rob Harmon:

Computers and building science have come a very long way since my first efficiency job in 1982. A lot of the programs haven't changed that much, but we now have much better tools than we had then.

David Roberts:

The lifetime of efficiency, up until relatively recently, was all based on averages – an average light bulb will use this, the average LED will use this, the one minus the other is the average savings of an LED bulb. As to the actual savings of a particular LED bulb, we were in the dark.

Now we have the AI and the close monitoring and measuring that allow us to quantify the savings produced in real time, ongoing. If a building owner uses seven units of energy, he can then use five units of energy and two units of energy efficiency. We now have a measurable unit.

Rob Harmon:

Some of that technology can actually meter efficiency on a whole building level to revenue-grade accuracy. This is accurate enough to transact in the utility system.

David Roberts:

When you do these efficiency measures and you save energy, you are creating value. Now we have the metered value, which means we have a pool of a measurable value.

Then we return to where we started with all of these misaligned incentives. Now we have this pool of value, and we've got to figure out how to divide it up such that it will induce people to take the actions necessary to create it.

Rob Harmon:

The way I would say that is that we can transact on efficiency in the same way we transact on every other kind of energy. It's a metered resource; someone produces a unit of it and sells it to someone else. That can scale. That's what caused wind and solar to scale; we had a thing we could create and sell to somebody.

That's why I got back into efficiency – because it seemed like an actual business. That's like every other thing that we buy and sell. When you go to the farmers market, nobody deems the number of apples you get.

The other big change, besides the fact that we can meter now, is that the problems we're trying to solve for are not the same as they were even five or 10 years ago. It's no longer our goal to only build four coal plants instead of eight; our new goals, in my view at least, are that we've got to electrify everything, and in the process we have to maintain a stable grid.

David Roberts:

Those sometimes overlap with, but are not the same thing as, reducing energy use. There are new goals and new considerations on the table here. This is a thing a lot of people have tried to emphasize about electrification: for a given building, if you switch from natural gas to a heat pump, you're using more electricity, not less, and yet the benefits accrue to the system. We're not only trying to divide up the efficiency pie, we're trying to align that program with other goals as well.

Rob Harmon:

The tasks that are in front of us compared to what they were in 1982, or 1992, or even 2002, are hugely different. Our existing approaches to efficiency weren't designed with those tasks in mind. It doesn't mean they're a failure; it just means we need some new tools in the toolbox.

David Roberts:

We're not trying to do four coal plants instead of eight; we're trying to do zero coal plants, which means, by definition, using a fossil fuel more efficiently is not going to cut it.

Rob Harmon:

In fact, it's not even that we're trying ultimately to not build any new coal plants; we're trying to remove coal plants from the system. No one was talking about that when these efficiency programs were built.

David Roberts:

With all that in place – why commercial buildings are so hard to get at, why conventional programs have failed to get really deep into them, this now measurable quantity of items that we're selling so we have at least the capacity to have a real market – let's talk about MEETS.

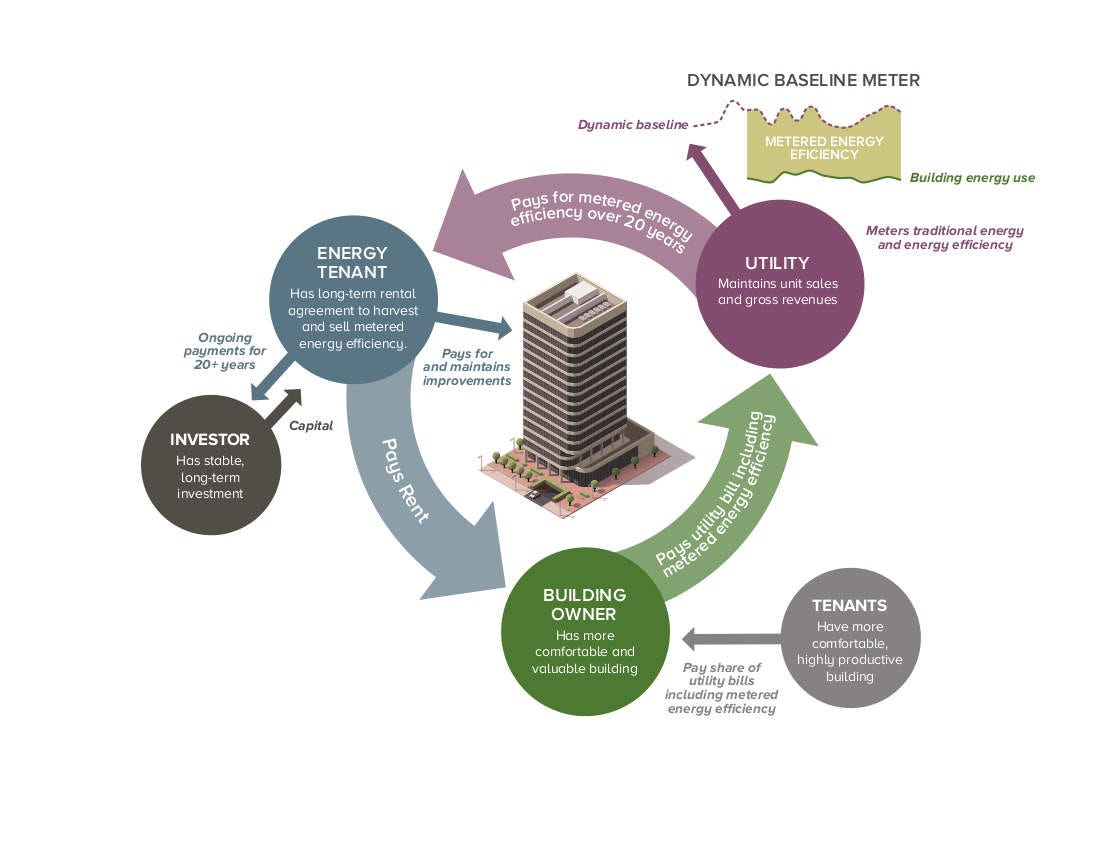

The problem MEETS is solving is this incentive problem: how do you create a business model where tenants, owners, investors, and utilities all want to do it, when none of them want to do it now? Walk us through MEETS and explain how the participants are incentivized to go after this.

Rob Harmon:

When we created it, we realized that we could meter efficiency and look at it like a resource, and that it opened an opportunity to transact in ways that we hadn't been able to transact: somebody creates this resource and sells it to somebody else.

Once you have this resource, you can put all the benefits together on the metaphorical table and start seeing how all the parties can transact and benefit. We're gathering up all these benefits, because we've metered them; there's a unit associated with a whole pile of benefits for efficiency. So if we have this big bag on the table of benefits that are metered, what do the tenants want? What do the building owners want? What about the investors and the utilities and the regulators? How do we use this apple that we have that we can buy and sell?

Efficiency metering allows us to step back and say, what are we trying to accomplish here? How do we get everyone rowing in the same direction? What's in each party's self-interest? That's what made us excited about this.

There are lots of benefits that get created, but you can only get those to parties that care about them if we have a transaction structure that allows for that – and that's where MEETS comes in. How can we put this together so we can actually deliver the benefits to the parties that want them?

Let me walk you through the model. I'll start with the acronym. MEETS stands for the Metered Energy Efficiency Transaction Structure.

I’ll break that apart a bit. First of all, we're obviously talking about metered efficiency. We’re not deeming anything here; this is all based on a meter reading. MEETS wouldn't be possible without all the computer and building science stuff we talked about.

We’re dealing with a resource, and In fact, we are now starting to call it efficiency energy to distinguish it from other approaches. There's solar energy, there's wind energy, and now there's efficiency energy. That's the way we're thinking about it.

David Roberts:

Aren’t those negawatts? Is there a reason you're not using negawatts?

Rob Harmon:

Absolutely. The problem with negawatts is that it falls into the trap of not delivering anything. That’s the problem: the whole industry is associated around this idea of reducing energy use, and what we're saying is this is not about reducing energy use; it's about a new form of energy that can compete in the system. As soon as you start talking about nega-anything, the whole thing starts falling apart.

David Roberts:

Okay, efficiency energy, another form of sellable energy.

Rob Harmon:

Exactly. Then the important thing to keep clear in one's mind is that MEETS is a transaction structure. That's the TS in MEETS. It's not a new incentive. It's not a financing mechanism. It's essentially a set of contractual relationships between the parties.

David Roberts:

Ideally, once it's up and running, it should require no public subsidy. It's quite notable, because all efficiency policy, for as long as I've heard it discussed, is about dumping public money on people to induce them to do things. The idea here is, let the value be divided among the participants; you don't require public subsidy.

Rob Harmon:

That's exactly right. So let's talk about what the stakeholders do in this structure and what they get.

Imagine a 100,000-square-foot, 20-story commercial office building. The building plays a key role in the structure, because the building needs to be more efficient. The role that the building plays in the transaction is the host where the efficiency energy is harvested. You can think about that like a piece of land where we're going to put a solar farm. It's the host site.

To fix that building, we need a company that's good at that. You can call them an ESCO or an efficiency developer; in the MEETS structure, we call them an energy tenant.

David Roberts:

It's worth explaining at least a little bit why it's called a tenant, because the relationship between the ESCO and the building owner is the key thing where this all starts. The energy tenant, the ESCO, pays the building owner rent as though they were a tenant. Right up front, instead of asking the building owner to take on a liability, you're asking the building owner to take on a new income stream – take on a new tenant.

Rob Harmon:

If you need to fix the building long term, the relationship needs to be a long-term relationship, so the energy tenant signs a long-term agreement with the building owner. In Seattle, it's up to 20 years.

What the energy tenant’s going to do is harvest the efficiency and maintain the measures. Think about the person that installs and maintains a wind farm. That's their job. They don't own the land. They're a tenant on the property; they're paying rent.

David Roberts:

Just to clear up any possible confusion, they're not literally living in the building; they're a metaphorical tenant. They’re paying rent to operate in the building.

Rob Harmon:

The contracts they sign with the building owner might be a standard building owner lease right out of BOMA: “I am a tenant in your building; this is what I have the right to do in the building.” I'm not making coffee, I'm not running a law firm, I'm not doing any of those things that your other tenants do – this is my job in the building, and I have a right to do it.

David Roberts:

A tenant goes with the building. If the building owner sells the building, the tenant goes along. There's your long-term relationship.

Rob Harmon:

This thing survives the change of building ownership. In fact, when a building owner goes to flip the building, the new building owner looks at it and says, “How much rent are you getting? What's the income stream?” The energy tenant is an asset on the building owner’s books, not a liability.

That's one of the fundamental problems with the traditional ESCO model; no matter how you slice it and dice it, the ESCO has to get paid back by the building owner or by the cash flows, and that makes them in one way, shape, or form a liability on the books. That's a problem for a lot of building owners.

This breaks a lot of the existing programs. You need that energy tenancy model to get around the building owner balance sheet hassles.

David Roberts:

The energy tenant becomes an asset to the building owner. The building owner is otherwise undisturbed, and also doesn't have to figure out what to do in terms of energy efficiency; they have an expert now that does all that for them. From their point of view, the only change is a new income stream.

Rob Harmon:

And a better building. If you're a building owner, one of the things you love is somebody putting a pile of capital into the building that you don't have to pay back. That's called net asset value.

MEETS changes this paradigm of the developer, the ESCO, being a liability, and it does that by being modeled on this renewable energy transaction structure that has scaled with solar and wind.

This is where it gets interesting, because that's not the only thing we stole from the renewable energy transaction. When a developer develops a solar farm, to whom do they sell the output? Not the landowner – they sell it to the utility. Under MEETS, the buyer of the efficiency is not the building owner; it's the utility. Seattle City Light is buying efficiency energy from the developers.

David Roberts:

Just like a developer could put a solar panel on the roof of a Walmart and sell the energy it produces to a utility, this is like putting an efficiency energy unit on a building and selling the efficiency to a utility.

Rob Harmon:

It's a metered resource, so it's really exactly the same. Every month, we can see how much efficiency has been harvested. We can see it more often than that if we want to; it's fractal, you can look as often as you want.

The energy tenant sells those efficiency energy units to the utility, just like the wind farm, and the utility buys them under a long-term contract known in the industry as a power purchase agreement or PPA.

Basically, there's nothing interesting about MEETS. We stole everything from the renewable energy industry. But those two things scaled in a way that, as you pointed out earlier, efficiency hasn't. So there's a good reason to steal the stuff that works.

David Roberts:

The energy tenant is the equivalent of the developer. It's an efficiency project developer.

Rob Harmon:

Right. Now remember that the problem for the investors in the traditional structure is they don't want the building owner as the counterparty. Here there's a PPA in place for efficiency energy, and the investors’ counterparty is the utility.

That's how you scale. There's a whole huge swath of investors that know all about power purchase agreements with utilities. Now you have all this capital that's been waiting on the sidelines because the building owners don't have the balance sheets to support those investments, and you have a long-term, credit-worthy counterparty in the utility that you're investing behind.

David Roberts:

And your developer has long-term contracts in place. Nobody’s going to be flitting out in five to seven years.

Rob Harmon:

Exactly. What building owners want is a better building (check!), they want rental income (check!), and they don't want any liabilities in the process.

David Roberts:

The other tenants who are paying the energy bills of the building do not pay lower energy bills because of the efficiency. They are paying the same price, but instead of getting 10 units of energy, they're getting 9 units of energy and 1 unit of efficiency energy. Their bills stay roughly the same.

Rob Harmon:

That gets us directly at the last key element of MEETS. The utility is buying the efficiency energy from the energy tenant under the PPA. What do utilities do for a living? They buy and sell energy. This is right in their wheelhouse.

Under MEETS, the utility purchases the efficiency and sells it on the retail energy bill to the building. It's just another form of energy serving the needs of the building. But rather than being harvested from a coal mine, burned at a coal plant, and delivered through the grid, the efficiency energy is harvested in the building and delivered through MEETS.

David Roberts:

Much like a rooftop solar panel locally generates your energy, this locally generates your efficiency energy.

Rob Harmon:

Let's look at what energy is on the grid. What you're paying for on your bill isn't some magical piece of energy; it's all the capital and O&M that went into getting it to your light bulb.

If we can ask a tenant to pay for the light on their desk by paying for their share of the capital and O&M costs of a coal plant, why can't we also have them pay for the light on their desks in a way that covers the capital and O&M for the efficiency or the daylighting that happened in their office?

It's all capital and O&M. There's this myth that there's some magical energy “thing.” According to the law of conservation of energy, the energy was already there. It's really about transforming it from, in one case, coal, into this thing that turns an electromechanical meter. But really, you want light on your desk, so why not transform the sunlight by putting a daylit window in? It's the same thing; we just think it's different.

David Roberts:

To put this from the perspective of the other tenants, the only change they would see if this were implemented is their energy bills would stay basically the same, but the building would get more comfortable around them. If they squint at their utility bill, they'll see “oh, I was paying for 10 units of energy and now I’m paying for 9 units of energy and 1 of efficiency”; I assume that will be broken out on the bill somewhere. Otherwise, from an experiential point of view, nothing really changes for them, except the building starts to get less drafty.

Rob Harmon:

You have to be careful around things like low-income housing, where it's really important to lower bills. But I don't think the law firm at the top of the Columbia Tower in Seattle cares very much about its energy bill.

Every dollar that you deliver to tenants in the form of savings is a dollar you don't have to fix the building, which is what they want. We're getting back to the actual needs of folks. If you want to deliver to tenants what they want, deliver them a better building. Every time you wring your hands to deliver them savings, you rob yourself of the ability to deliver them a better building.

David Roberts:

Honestly, if you're a law firm in Seattle, it's probably worth more to you to be able to say “I occupy a green building” than it is to save a dollar or two on your energy.

Rob Harmon:

There's a classic 3/30/300 rule of thumb that in commercial office buildings, the tenants spend about $3 per square foot on energy, $30 per square foot on rent, and $300 per square foot on their people. So you've got 1 percent of the cost of your person, and we're wringing our hands trying to get a 10 percent savings out of that. In the process, we're robbing ourselves of the ability to fix the building to make the building occupant happier.

We can't get out of our own way. In the industry, we're so used to trying to solve this energy problem, while tenants have a comfort problem, and a lighting problem – that's what they want to solve for. The bill reductions are a really minor portion of the cost of doing business for most tenants, and that pales in comparison to all the other stuff.

The tenants get a better and healthier building, but they pay the same amount. The building owner wants happy tenants, rental income, and a big boatload of cash infused into their building with no liabilities. Well, that's what happens. Now we have a building owner who might actually like what we're proposing in the efficiency community. And for the utilities, it gives them another resource they can buy and sell.

David Roberts:

The utility wants to sell more energy. How have we overcome that? What is the utility getting out of this?

Rob Harmon:

They're selling exactly the same amount of energy they were selling before. They just switched units. They used to only sell apples; now we reduced their apples by 30 percent, but we gave them oranges to make up for it.

David Roberts:

They're selling the same total quantity of energy, it's just that some portion of it now is efficiency energy, and they're selling it to the tenants of the building.

Rob Harmon:

That's right.

MEETS doesn't require the use of incentives. We usually pay those incentives up front, so the math gets a little bit weird, but if you ask utilities what they're paying for an incentive for every kilowatt hour that a light bulb is going to deliver over its lifetime, it's usually about 2-3 cents per kilowatt hour. They frontload it all; they give you $5 for your light bulb. The math all comes down to how much they think this thing's going to deliver over its lifetime.

With MEETS, they don't have to pay any of that. If you're looking at it from the utility’s perspective, we have somebody else financing the development of a resource on our system that generates a product we can sell, and we don't have to pay anybody to make that happen. We don't have to pay any incentives.

We spend hundreds of millions of dollars on utility incentives. That's not bad; there are a lot of places we need those incentives. What those incentives are supposed to represent is the value of that saved unit, because the utility doesn't have to go out and buy or build that unit.

At this point, they're getting that benefit for free. They're getting all this efficiency at depth, but they're not paying out those incentive dollars, so they have them available. When you want to talk about equity, now instead of having to spend a bunch of money out of their efficiency budgets to get commercial efficiency, they can save that money to go after low-income efficiency.

David Roberts:

They can better use and better target their available efficiency funding.

Rob Harmon:

Or they can lower rates by not having to pay the incentives out. That's a regulatory choice. Those decisions are going to be made at the local level.

What I'm suggesting is that if we simply provide the parties the benefits and have them pay for those benefits, we don't need those subsidies.

The other people who were in this transaction are the investors, who have a credit-worthy counterparty. For society, we can get vastly more efficient without having to spend boatloads of cash from the rate base.

David Roberts:

Yes, we can get lower emissions, lower energy use, and presumably some electrification in a market rather than dumping public money to finally set up a market. I said at the outset that this is complicated, but if you think of efficiency as a form of energy, this really is a bog-standard energy development model. If we were talking about a developer putting a big solar array on the top of a Walmart, it's exactly the same structure.

Rob Harmon:

The only thing I would add to your Walmart analogy is that the wire from the solar array goes to the utility, and the utility delivers those solar units to the building, so it's a closed loop. But the point of the solar array on the Walmart is not to lower the energy bills of Walmart.

David Roberts:

Conceptually, this model makes sense. It's analogous to a renewable energy development model. You have a developer producing efficiency; selling it to the utility; the utility sells it to the tenants of the building; the building owner gets rent. Everybody's making money, everybody's getting more comfortable buildings, everybody's happy.

How do we make this happen? Do public utility regulators have to make some official change to enable this to happen?

Rob Harmon:

I think so. Some people will disagree. As long as we all agree that efficiency is energy – which we've been saying is true for a long time, we just haven't been treating it that way – some people will argue that you don't need to do that. I don't think that's politically likely. Utilities do not want to get into situations where they make decisions where they can't recover the costs of making those decisions.

David Roberts:

Generally you don't go to the utility for the bold and risky innovations.

Rob Harmon:

We did this with the Bullitt Center, the greenest commercial office building in the world (at least at the time, back in 2015). The regulator for Seattle City Light is the city council. There were four votes related to Bullitt and the expansion of the program after the Bullitt pilot was completed; all four of those votes were unanimous. They got it – because of exactly what you said earlier, which is that this is what the tenants get, and this is what the building owners get, and this is what the utility gets. Everybody wins, where's the problem?

Regulators aren't used to that. Usually what happens is everybody's arguing. We had a dozen or more people testify to the city council – from labor, from the environmental community, from the energy community, from the low-income community, from the real estate community, and from City Light, who were presenting. And everybody was saying all the things you'd expect them to say: “This is great.”

David Roberts:

If you got this up and running, you're talking about a lot of jobs making these efficiency improvements, all of which are using local workforces. They're good labor jobs, too. It's preventing building owners and tenants from sending money out of the local community; instead of buying energy from far away, they're basically buying energy generated in their own building. It keeps money and jobs more local than the current energy system.

Rob Harmon:

Because you get so deep in the building, you can get at all the HVAC stuff – the heating, ventilation, and cooling – and that requires skilled labor. Part of the problem with a lot of the cream-skimming activities in energy efficiency is that it doesn't require skilled labor. You’d get better quality with skilled labor, but there's a lot of competition for those jobs.

If you're going to go in and rip out the ductwork, or reclad the building, or anything that's really getting you deep in the building, you need skilled labor. These aren't just $12-an-hour jobs.

David Roberts:

The model was pioneered here in Seattle on the Bullitt Center, a pride and joy of Seattle, the greenest in the world. As you said, all the testimony was positive, everybody got it, it worked. So where are we on expansion? Who else gets it and who might get it soon?

Rob Harmon:

We worked with Seattle City Light to develop the Bullitt pilot and launch it for other buildings after the pilot was over. They got the paperwork together – and those were interesting times.

On January 16, 2020, Seattle City Light launched its version of MEETS, which they call Energy Efficiency as a Service (EEaS). On that very same day, China canceled all outbound flights from Wuhan due to Covid.

February 28 was the first US death at a hospital 16 miles from Seattle City Light’s offices, and the governor declared a state of emergency. Over the next few days, commercial office buildings in Seattle started to lock down.

March 23, we’re two months out from the launch of the program – the governor ordered Washingtonians to stay home except for crucial activities.

The initial applications for energy efficiency as a service were due March 31. So we were essentially in lockdown or panic mode for about half of the entire open program.

David Roberts:

Was this a time-limited pilot?

Rob Harmon:

It was time-limited. There were a bunch of buildings who were trying to get their paperwork together, and they extended it by a month, but the shutdown had already begun and everything froze.

So that's how the Seattle program launched. But we're starting to see a tentative return to the office now. And even though EEaS, their MEETS program, was launched into the teeth of a pandemic that emptied commercial offices everywhere, there are six buildings that are still moving through the program right now, which astonishes me.

Two of those buildings are new multifamily construction. They’re built to Passivhaus requirements, so they're designed to be 40 percent more efficient than Seattle's code, which is really strict to begin with. They’re all electric.

The other four buildings are large commercial office retrofits, which is really what we had in mind with MEETS, though it's awesome that the new buildings are taking advantage of it too. Three of those four large commercial office buildings are finalizing agreements with building owners and investors, and those buildings are proposing 30-40 percent reductions in energy use.

The one project that's underway right now is a 500,000-square-foot commercial office building. They're investing $8 million in that building and they expect a 30 percent improvement, and all of that is happening without any incentives.

David Roberts:

Where's it going to go next, and where else could it go? Specifically, I keep thinking about New York City, where they're in the midst of passing very strict mandates on their big buildings, telling them to reduce energy use. To go back to our earlier discussion, if you take the current system with all these misaligned incentives and just lay a mandate on top of it, all you're really doing is mandating that everybody engage in a bunch of transactions that irritate the shit out of them and cause them to lose a little bit of money, which seems politically not great. It seems like this is exactly what New York City needs to get up and running, stat.

Rob Harmon:

You can do MEETS pretty much anywhere you have a decent supply of commercial or multifamily buildings that are 50,000 square feet or bigger. That's a lot of places. Obviously, the cities that are doing benchmarking or mandates are fabulous opportunities.

The kind of mandates that are in place in New York aren’t going to result in building owners losing a little bit of money. They're serious mandates; they're taking it very seriously. What that means is that the building owners are gulping, and they're taking it very seriously.

Mandates are great; they get everybody focused on the fact that something needs to change. MEETS can turn a mandate from a yoke around the building owner’s neck – this massive obligation that they're going to be asked to invest millions of dollars they never get back – into an opportunity to improve both the net asset value of their building and their net operating income from all the rent.

David Roberts:

You could even argue that if something like MEETS was in place, you wouldn't need the mandate. You don't have to mandate people to make money, and the MEETS system sets building owners up where they can make money doing this.

Rob Harmon:

The advantage of the mandate is it gets everybody focused. Reasonable people are going to agree or disagree about the importance of mandates, but the reason we've had to put mandates in place is because the transaction structure hasn't resulted in building owners fixing anything. We say that all these things are cost effective, but they're only cost effective when you look down at them from Mars.

It is true that the value of the savings is more than the cost of the measures over time, but if you're the banker who’s going to lend money to make the thing happen and the other person says “we're going to give all the money to the tenants; you don't mind, do you?” nobody's going to finance that. It just doesn't work.

David Roberts:

Is there a concrete next step for MEETS beyond Seattle, or next place that it might go?

Rob Harmon:

Yes. The challenge I have, of course, is that I work with large institutions who are on their own timeline and who want to make announcements about things when they're good and ready.

I can tell you that I'm spending a lot of my time talking to people in New York. I'm working across the country with energy offices, utilities, and other stakeholders. There is significant movement right now that I'm not going to talk about because my contracts told me I'm not supposed to.

It's easy for me to evangelize about this. Folks inside utilities and at state energy offices and regulators have a job to do; they have boxes they need to check, and it's going to take them longer to do this than it is for me to do a podcast with you. They have a lot of actual problems they have to fix and a lot of understandings they need to come to with their people internally. I want to respect their own process of getting this rolled out; and, I keep encouraging them to hurry up, because that's what I do.

David Roberts:

Something like this – efficiency as a service, MEETS, whatever you want to call it – is definitely in front of the eyeballs of lots of utilities at this point.

Rob Harmon:

Yes. I'm avoiding the “as a service” piece, because unless all energy is a service, efficiency isn't a service either. I don't see why the energy from a coal plant is any less a service than the energy from efficiency. It has to do with the way they're regulated and lots of arcane rules and regulations, so I get it. But I'm going to continue to pound the pavement around the notion that efficiency is energy and we should treat it as such.

David Roberts:

How close are we to utility regulators and utilities being able to pull something like this off the shelf and do it? Is it extremely bespoke in every new area at this point, or somewhat standardized?

Rob Harmon:

We are getting to the place where we will have something photocopy-able. The challenge is that because each utility has its own regulatory scheme, you may have to pull out six pages of the photocopy and replace them with something else. This is one of the challenges of the way we regulate utilities, and that's just the way it is.

David Roberts:

Fifty battles, every time.

Rob Harmon:

Well, it’s more than that, because you have a lot of municipal utilities, you have a lot of public utilities. It's not like it's just one regulator for every state.

David Roberts:

When you're talking to other utilities about this, is there enough evidence on the ground in Seattle that instead of explaining, you can just point and say “look at what's happening?” Do we have a critical mass of actual action?

Rob Harmon:

This is the problem with the Covid launch. I would have expected by now to have a boatload more of these buildings that are humming along, but the commercial real estate industry shut down in Seattle during Covid, and building owners weren’t going to make commitments. So we need a little more time.

There are a bunch of utilities who are curious about this, so I'm trying to bring them along on the educational process so they're ready to do pilots as we come out of the Covid thing. I had to switch strategies. I assumed that we were just going to launch and go gangbusters, and then Covid ate everything we had done.

David Roberts:

Let's imagine that this model takes hold across the country. Then you have a situation where every commercial building owner can make money by increasing the efficiency of their buildings, ESCOs stand to make money, everybody's making money hand over fist and you're getting efficiency produced at scale.

Obviously the benefits of this on a single-building level are clear enough, but what can you see happening if this scales up? We've seen the mind-boggling effects of scale in renewable energy on driving costs down and opening up new technological avenues. It's been an amazing positive cycle. What could happen with deep efficiency as it scales?

Rob Harmon:

The goals have changed. What we're looking for now is a stable grid and a stable atmosphere. That's the goal, and we have to fix buildings to do that. In my world and in my experience, you don't get either one of those things by simply financing things. The grid and the atmosphere are stabilized not by what we finance by, but by how it performs.

What we need to get there is performance, not just finance. Buildings don't perform now; we shouldn't assume they're going to perform after we put a bunch of fancy stuff in them. Unless somebody is being paid to make sure they perform, they won't. We don't build a fancy wind farm and then walk away and hope it performs.

That's a key piece of how we get to the grand vision that you're after here. The other is that you can't finance this important depth in these buildings with short-term contracts. We need long-term pay for performance, like Seattle, 20 years. That's how long it took to finance the first wind farms, that's how long it'll take to finance deep retrofits.

We don’t need a lot of subsidy. This gets back to what are the benefits and who's paying for them.

Efficiency delivers those benefits to the building just like the grid does; same energy benefits, maybe even better ones, because you like daylight better than the light on your desk. I think we should let the building owner and the tenants pay the same price for it. You pay the same price for efficiency energy as you do for grid energy. There's a big part of the cash flow you need right there.

On top of that, both efficiency and demand response deliver benefits to the grid. The efficiency overall delivers some grid benefits that squashes the duck in the duck curve. You can also incorporate demand response, incorporate batteries, do all that other stuff behind the grid, and that provides grid benefits that are above and beyond the benefits to the building.

David Roberts:

If I'm the ESCO or energy tenant, I would have to pay extra to put in batteries that would enable the building to serve as a grid buffer. How am I getting paid for that? You can't really measure units of grid resilience like you can units of efficiency.

Rob Harmon:

A lot of ways you can. When you take your 10 minutes to turn your air conditioning system on and the guy next door waits and does the next 10 minutes, you can measure all of that. A lot of the demand response stuff you can actually meter quite effectively.

David Roberts:

So the utility pays the ESCO for that, just like anything else.

Rob Harmon:

Exactly.

David Roberts:

What about electrification? If you're switching out natural gas furnaces for heat pumps, you're actually substantially increasing the electricity consumption of the building. How does an ESCO get paid for that?

Rob Harmon:

First of all, remember that there's a big cash flow that can be associated with the removal of the natural gas. There's a big chunk there, so you get all that money.

You're right that there is an increase in the electric bill, all other things being equal, but there's also a very large carbon benefit associated with that.

This gets to the societal benefit and how we pay for that. In Washington State, we have what is essentially a cap-and-trade system that's going to create a boatload of money. My guess is that most people are thinking that we're going to pay that money out in big chunks to people to do cool stuff. What if instead we paid it out for metered performance that told you how much carbon you were getting back, and there was a 20-year contract to deliver carbon benefits?

David Roberts:

You're talking about an analogous model. Instead of efficiency energy, you would be hiring a developer to come into your building and create negative emissions. What would you call them? Metered avoided emissions?

Rob Harmon:

It's pretty straightforward if what you're looking at is the energy system. You know what the carbon dioxide is of a therm of gas, and that went to zero, so that number is just going to keep happening. Then the question is what, if anything, do you have to subtract from that number because you added electricity to the system? That's not hard math, and you’re metering it already. It's the same meter reading. It's just a question of, how many tons of carbon dance on the head of a kilowatt hour?

David Roberts:

Can we imagine an energy tenant that's in a building selling efficiency energy to the utility and then via a separate contract selling avoided emissions? Two separate contracts with the utility?

Rob Harmon:

Yes, or you could do the separate contract with the state. It's just a cash flow.

It's going to take a huge amount of capital to fix all the buildings we need to fix, and that's going to take not ratepayer money, because we don't have enough ratepayer incentive dollars to throw at that – you need private sector capital to make that happen.

A good friend of mine in Portland, Bill Campbell, likes to say that investors want a black box with a cash flow coming out. What I'm talking about is a black box with three cash flows coming out: the MEETS contract, which may or may not include the second element, which is the demand response (you could run that separately if you wanted), and the carbon benefits.

We should be paying for the performance of all three of those. We should only pay for the performance; if it doesn't perform, you don't get paid. We should pay for it over 20 years, like we did for all the wind and early solar contracts. If you have three cash flows coming out of that, the amount of capital you can then throw at a building is immense.

David Roberts:

To be clear, that’s only possible in a state or jurisdiction that is somehow pricing carbon emissions.

Rob Harmon:

That’s right. You might only have two of those. In Seattle right now there's no market for grid services, and there's no market for carbon at the moment. All we had was the building owner benefit being recirculated to the energy tenant. Of those three cash flows, we had one – and we're still getting 30-40 percent reductions in these buildings.

David Roberts:

Why is there no grid services market in Seattle?

Rob Harmon:

It hasn't really developed in Washington because it's a hydro-based system, and there's a lot of capacity. It's not like California where you've got all these constraints and a huge duck curve and all of that.

David Roberts:

In California, where they have big advanced problems with variable renewable energy and the duck curve, you can imagine a quite robust market for flexibility services.

Rob Harmon:

In fact, that market’s already going on. I read about it on LinkedIn almost every day.

David Roberts:

You just have to tap buildings into that too.

Rob Harmon:

There's no reason why the developers and the energy tenants couldn't provide those services into the system in the same way they do now and potentially even use the same approach that's used in California to do that.

David Roberts:

The theme here is taking these demand-side benefits and creating a model that treats them the same way we treat supply of energy. What does the world look like then? What happens when you release MEETS into the building sector nationwide and it grows and flourishes?

Rob Harmon:

Buildings make a major contribution to a stable atmosphere and a stable grid, which is what we're trying to do. It feeds on itself. There's nothing like success to breed success.

I was talking to an energy guy in Hawaii several years ago and he was trying to get his head around MEETS. He said, “So you mean every one of these buildings has an energy nanny?”

David Roberts:

Every single large building has a party that is financially incentivized to maximize its energy performance.

Rob Harmon:

Exactly. The buildings become grid assets rather than grid liabilities.

David Roberts:

There are a lot of buildings, and that's a lot of energy. It's a lot of efficiencies, a lot of potential storage, a lot of potential self-generation. People talk about the need for storage and balancing in a high-renewables grid. The nation's commercial building stock is a very large battery.

Rob Harmon:

It is, and people don't think about it that way. But think about all of the malls along the highways near your house. In most places, all of their HVAC systems are on whenever they feel like it. If you said “you guys get the first 10 minutes of the hour, and you guys get the next 10 minutes of the hour” or ”we’ll turn you on when the wind is blowing, and we’ll turn you off for 20 minutes when it's not,” no one in the mall is going to notice. All these buildings are huge thermal batteries. We don't treat them like that, and we could.

David Roberts:

Just as EVs will make the entire transportation fleet a distributed battery, you can imagine this making the entire commercial building fleet a distributed battery.

Rob Harmon:

It's not like we need to invent new gear to do this. The gear exists. The problem is it doesn't have a transaction structure that allows its value to be experienced.

David Roberts:

Thank you so much for coming on and walking through this. We'll talk in a few years and see what's happening with the model.

Rob Harmon:

Great. Thank you so much, David.

Share this post