(If you prefer listening to reading, just click Play above.)

I’ve spent a lot of time on Volts discussing energy storage. As those who read my battery series know, lithium-ion batteries (LIB) currently dominate short-duration storage — in devices, cars, and buildings — and the durations they are able to economically provide are creeping up, from two to four to eight hours and beyond.

However, as I explained in a separate post, the grid of the future, run primarily on renewable energy, will also need long-duration energy storage (LDES), capable of discharging energy for days or weeks.

As that post covered, there are two basic challenges facing LDES. The first is technological: what sort of materials and processes can hold large amounts of energy for cheap?

The second is economic: how can an LDES company make money? Currently, the role they propose to play on the grid (“firming” renewable energy) is being played by natural gas power plants. In a theoretical future clean-energy grid, those plants will be gone, or at least they will be saddled with the additional costs of carbon capture, but for now, they exist, and they are quite cheap. Consequently, there just isn’t much of a market for LDES, as battery industry veteran Cody Hill points out:

A hot new startup called Form Energy believes it can overcome both challenges.

Form Energy has the technology; now it needs customers

I mentioned Form Energy in a previous post. The company — a kind of battery dream team, with Mateo Jaramillo (who built Tesla’s energy storage business), MIT’s Yet-Ming Chiang, and other veterans of previous battery companies — has finally revealed the battery it has been working on lo these many years.

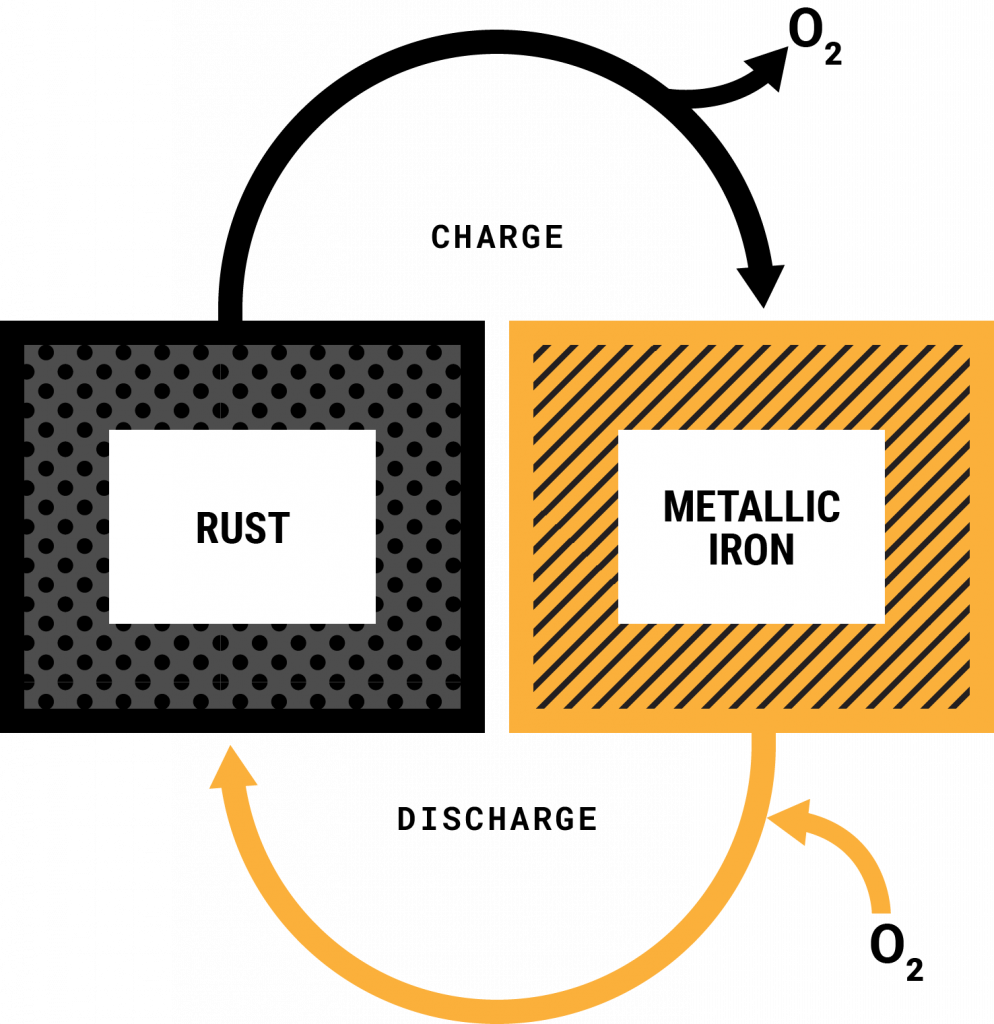

It uses iron as a cathode and air as an anode, in a process called “reversible rusting.”

The best place to catch up on the news is Julian Spector’s piece. (Canary is doing amazing coverage of energy storage.) See also Russell Gold’s piece in the Wall Street Journal for deeper background on the company and its technology.

Neither piece, however, gets deeply into the subject that most interests me, which is the second challenge: where to find markets. So I called Jaramillo to find out more.

Not surprisingly, he sees a clear pathway to profitability. “We see a very compelling business environment for us over the next 10, 20, 30 years,” he says. “It's as much as we can go after, frankly.”

Early markets for clean firming

In terms of its function on the grid, the best way to think of Form’s battery is not as storage, but as the equivalent of a carbon-free natural gas plant. Rather than methane, it runs on renewable energy as fuel, but from the grid’s perspective, it provides basically the same service, which is reliable, dispatchable generation that can run for 100 hours or more when needed.

The problem, as I said, is that natural gas is quite cheap. According to conventional wisdom, natural gas plants will dominate the firming game until policy begins driving them out of the system (or forcing them to install carbon capture). That’s what the models show: when decarbonization of the electricity grid (using mostly renewables and LIBs) goes past about 80 percent, costs begin to spike and more expensive clean firm options like LDES and nuclear become competitive.

That conventional wisdom may be correct at the 30,000 foot level, but closer to the ground, things are much more complicated and varied. As Jaramillo notes, “there's no time at which the country will uniformly be at 80 percent renewables.” In fact, some nodes on the grid are close to that already. More to the point, Jaramillo says, there are a variety of situations in which grid operators need the services a natural gas plant provides but are leery about (or prohibited from) investing in gas.

“Every single US coal plant in the system today has a retirement date on it,” he says, “and all of those dates are sooner than they were five years ago, and they will probably be sooner in two years than they are today.” That means lots of utilities around the country need to replace large chunks of power capacity.

To date, they’ve been doing so with natural gas, but that may be changing. Remember, Form is not talking about entering the market in earnest until 2025. Between now and then, Jaramillo expects two macro trends to continue: first, renewables will keep getting cheaper and cheaper, and second, utilities will grow more wary of natural gas.

“It's not full steam ahead to replace coal with natural gas,” he says. “Indiana [utility regulators] recently rejected a 850-megawatt combined-cycle gas plant and they specifically cited the risk of stranded assets.” Similar rejections of natural gas have taken place recently in Minnesota and Virginia.

Great River Energy, a Minnesota-based electricity co-op, is hosting Form’s first demonstration project, a one-megawatt system capable of discharging for 150 hours continuously. Great River needs to replace lost coal capacity, but while they are under no statutory mandate to phase out natural gas, they “know how to read what direction the wind is blowing,” Jaramillo says.

They don’t want to build a natural gas plant with a 30-year rated lifespan only to face a carbon price or a clean electricity standard (CES) forcing its retirement in 10 or 20. In the long term, gas is on the way out, and every natural gas plant built from here on out is a gamble that could very well come up stranded. That will only be more true in 2025.

There are other reasons utilities might be trending away from natural gas. In California, of course, they are forced by laws mandating rapid decarbonization — and more states, like Washington, Colorado, and Oregon, are joining it in rapidly decarbonizing electricity.

In the New England grid, they’re having trouble importing enough natural gas through the pipelines in times of peak demand; LDES could be the easiest way to ease grid congestion. In grids like Texas’s, natural gas has proven an extremely unreliable hedge against extreme cold snaps; LDES could help improve reliability margins for ERCOT, Texas’s grid operator.

To achieve clean energy targets, many jurisdictions will have to overbuild renewables, increasing curtailment, or wasting of renewable energy. LDES could reduce or eliminate curtailment, allowing renewables to produce at full capacity whenever the weather is aligned. That would have the effect of further boosting the value of existing renewables — something else natural gas plants can’t do.

Finally, there are commercial and industrial (C&I) entities who want to race down the decarbonization curve faster than the jurisdictions they are located in. Both Google and Microsoft have committed not just to running on 100 percent clean energy, but to running on 100 percent clean energy 24/7, throughout the year. Accomplishing that feat will require them to procure their own clean firm generation. C&I customers are the fastest growing segment of market demand for renewables and could prove a key early market for LDES.

There’s no mass market for LDES yet — nothing like the hundreds of gigawatts we may eventually need — but there are several localized markets, adding up to several gigawatts of needed capacity, which is more than enough to keep Form busy from 2025 forward.

Natural gas is as weak as people believe it to be

So that’s Form’s case that it can find a market foothold. It sounds plausible to me, but then, I’ve heard lots of plausible-sounding stories from startups over the years … only to read about dead startups a few years later. Time will tell, etc.

Two things give me some hope that Form might make it. The first is that the capacity price point it now claims ($20/kWh) is extremely low, already close to the price range it will need to start cutting into firm generation. And that’s just the beginning. If it can find a market and start scaling up, it should be able to bring down costs substantially. (It is basically building its demonstration project by hand; standardization and scale will bring enormous savings.)

“We see, in a reasonable timeframe, being able to get to $10/kWh, all in, at the system level,” says Jaramillo. If it can pull that off, Form can start substantially cutting into gas markets. And “we are far from being done thinking about how we might displace ourselves,” he adds. “One characteristic of the team we built is that it's phenomenally creative.”

So Form will be getting cheaper alongside renewables.

The second thing is the sociology of the transition away from gas. Up until fairly recently, gas was seen as a “clean fuel,” reducing coal pollution. Elite opinion is currently lurching in the other direction. None other than Democratic Senate Majority Leader Chuck Schumer has publicly acknowledged that natural gas does not qualify as clean energy.

Gas is the dominant fuel on US energy grids, and still growing, which has given it an aura of inevitability. Adding to that aura is a belief among many utilities that renewables and LIBs can not provide a reliable alternative to gas. They believe they need lots of dispatchable power.

Those fears are likely overblown, especially at this early stage in the energy transition, but they are real. So the turn away from natural gas is tentative and scattered for now. If, in the latter half of the 2020s, alternatives like Form emerge, which allow utilities to build more of the cheapest generation available (renewables), the turn against gas could become more precipitous. Just as fear is contagious, so is FOMO.

It’s one of the most important questions in clean energy right now: whether the shift in US electricity away from natural gas will be slow and steady or whether it will happen the way Hemingway’s character famously went bankrupt: gradually, then suddenly.

It depends, in part, on psychology. The weaker gas looks, the more utilities will shy away from it. If Form — or other LDES — proves viable, it will represent the last piece of the puzzle, the key to a reliable, fully decarbonized grid. That could push US utilities closer to the point of a decisive break with gas.

There's real long-duration energy storage now. Can it find a market?