Over the course of the last few days … [checks calendar] … er, month, I’ve been digging into the new trend in voluntary climate action: procuring 24/7 carbon-free electricity (CFE), matching consumption with production every hour of every day.

In my first post, I introduced the idea and explained what motivates it and what it entails. In my second, I puzzled through the biggest controversy around it, which is about whether it’s the right goal at all — whether companies and cities ought instead to focus solely on reducing emissions (with no regard to who produced them, or where).

This post will make a great deal more sense to you if you’ve read those.

Today, in the final post in this series (promise), we’re going to look at some new modeling of 24/7 procurement from Princeton’s ZERO Lab and see if it can shed some light on the trade-offs among different procurement strategies. Then we’ll wrap up with some provisional conclusions.

The model

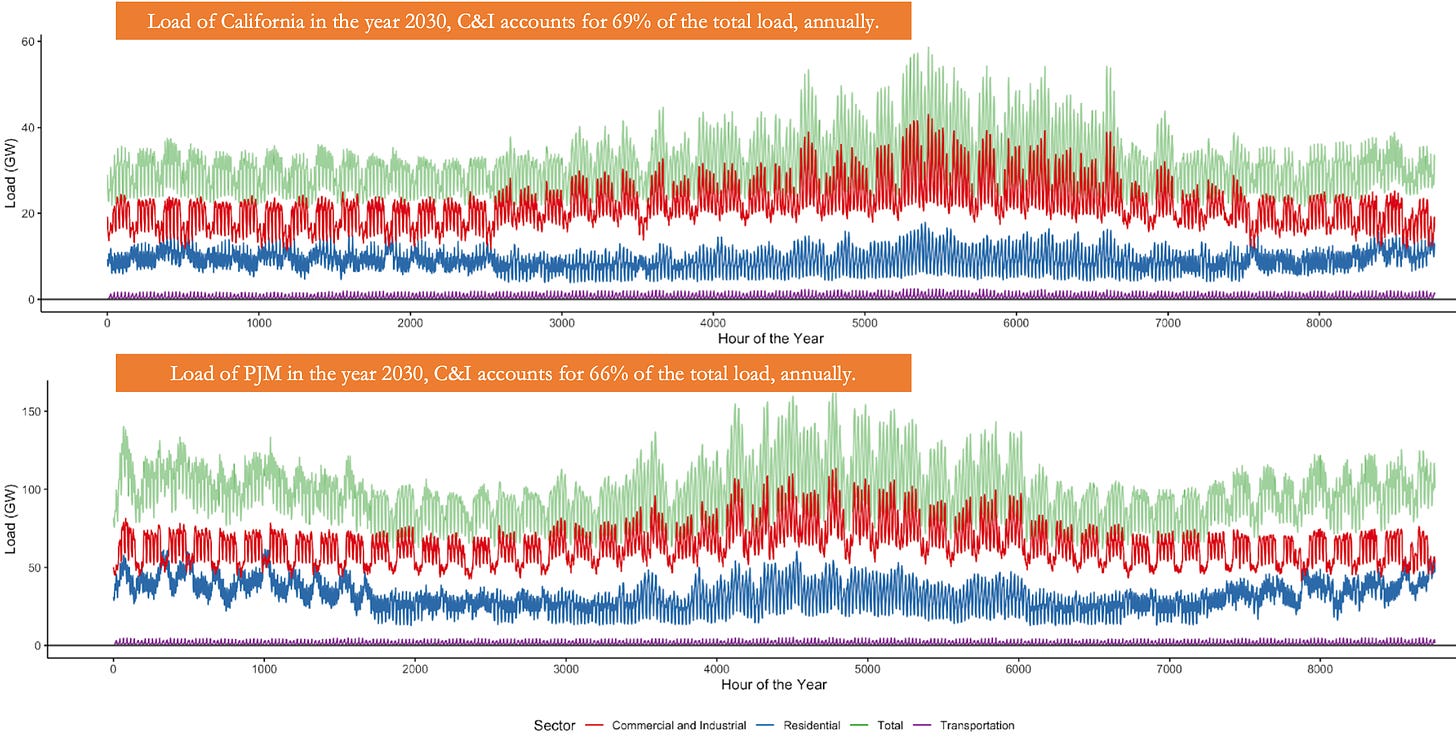

ZERO Lab models three scenarios for voluntary corporate clean-energy procurement, with 10 percent participation from the commercial and industrial (C&I) sector: no procurement (as a baseline), procuring for 100 percent annual match on a volumetric basis, and procuring for 24/7 match.

Each scenario is run in two separate markets, California and the PJM Interconnection (an electricity balancing area that covers 13 Northeastern states and DC). Modeling in two markets helps tease out how 24/7 could unfold differently depending on how clean a grid is to begin with — high penetration of variable renewables in California vs. a relatively dirty grid in the Northeast.

The model is premised on the idea that participating C&I customers aggregate their demand and pool their purchasing power, effectively acting as a miniature balancing authority. This may or may not be how things play out in the real world. Customers could act on their own, disaggregated and uncoordinated. The lab’s going to model that kind of scenario soon.

Note: The lab did not model a procurement strategy optimized to reduce maximum carbon emissions. (Jesse Jenkins, who leads the lab, refuses to use the word “emissionality.” He insists on “carbon-optimized procurement.” Don’t worry, he’ll crack like the rest of us.) Modeling carbon-optimized procurement would have been a lot of extra work and the funder of the research, Google, did not ask or pay them to do it, so if you’re a wealthy corporate or philanthropy out there reading this, pay the lab to model it!

Let’s look at a few of the findings.

24/7 procurement reduces the carbon intensity of a company’s energy portfolio

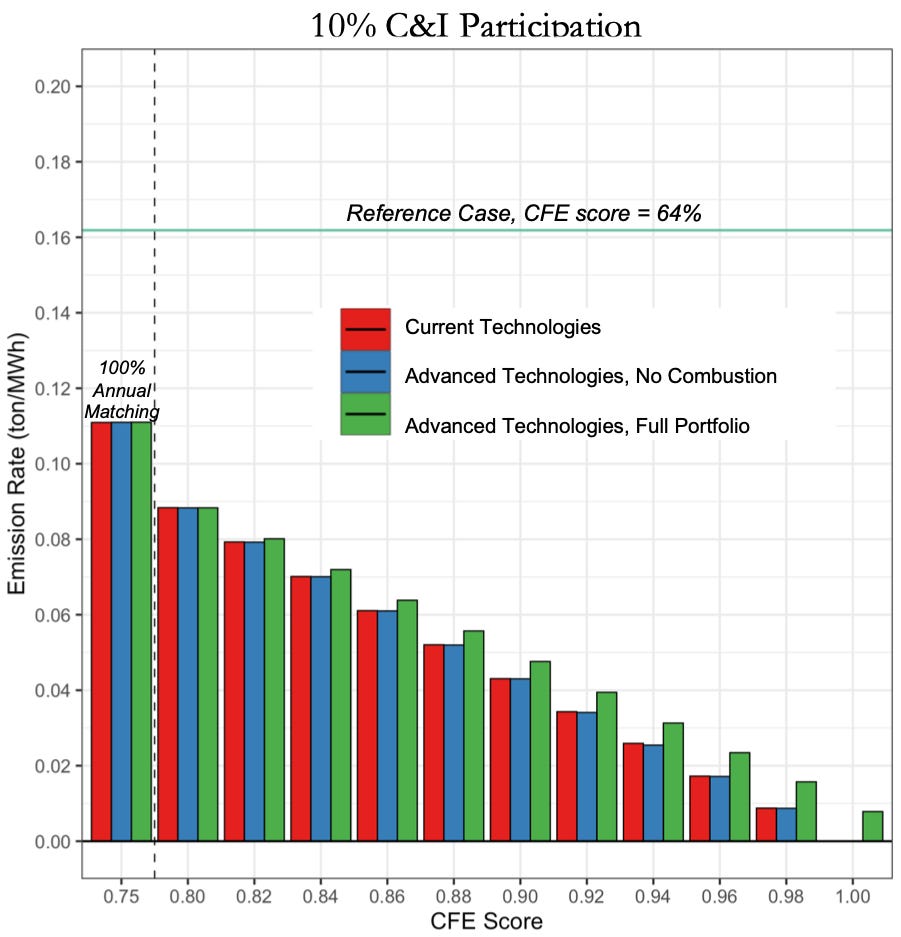

As companies push their CFE scores higher — meaning, as they match more and more of their hourly consumption with hourly production of CFE — they reduce the carbon intensity of their portfolio. At a certain level of CFE, they reduce it beyond what they would accomplish with 100 percent annual matching.

Take California. It already has a fairly clean grid — every company starts with a minimum CFE score of 64 percent, just by being located there. If a company procures the cheapest clean energy to match 100 percent of its annual consumption, its CFE score gets to 75 percent. There are still 25 percent of hours in which it is drawing on at least some fossil energy.

As a company’s CFE scores rise beyond 75 percent, the emissions rate of its portfolio falls further, steadily to zero at a CFE score of 100 percent.

(Another note here: “Current technologies” means wind, solar, batteries, and, at least in California, conventional geothermal. “Advanced technologies, no combustion” includes advanced geothermal and nuclear, along with long-duration energy storage. “Advanced technologies, full portfolio” includes all of the above, plus natural gas with carbon capture and sequestration [CCS] and combustion turbines running on zero-carbon hydrogen fuels. The reason the green bar never fully reaches a zero emissions rate is that there are residual emissions associated with natural gas and CCS.)

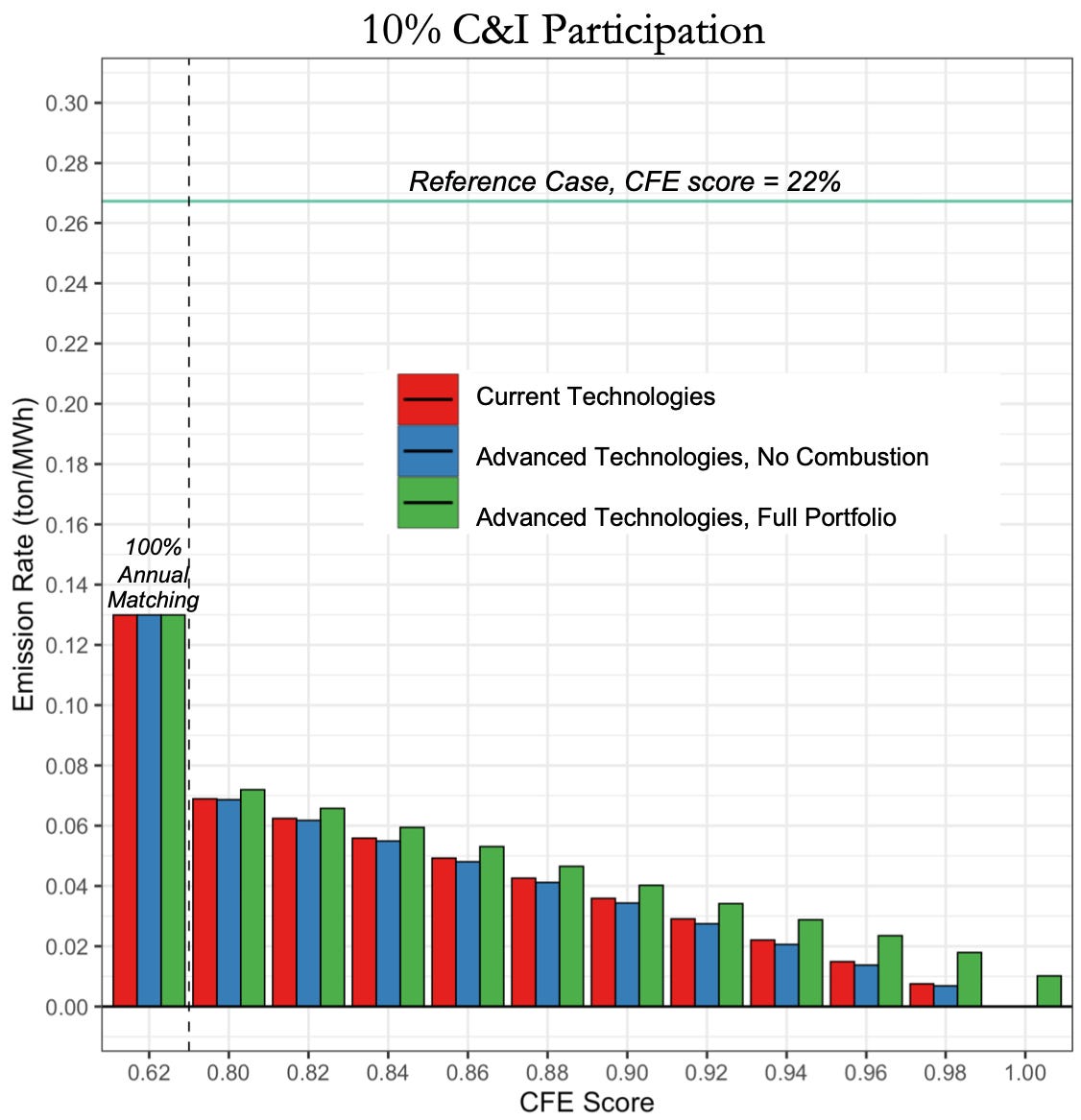

PJM is a different story. It’s pretty dirty — participants there start with a baseline CFE score of just 22 percent. So a simple strategy of 100 percent annual matching results in a huge drop in emissions rate, though it only gets participants to a CFE score of 62 percent. Once again, as participants raise their CFE scores beyond that, the emission rate declines to zero.

However, 24/7 procurement does not just reduce participants’ own emissions rates.

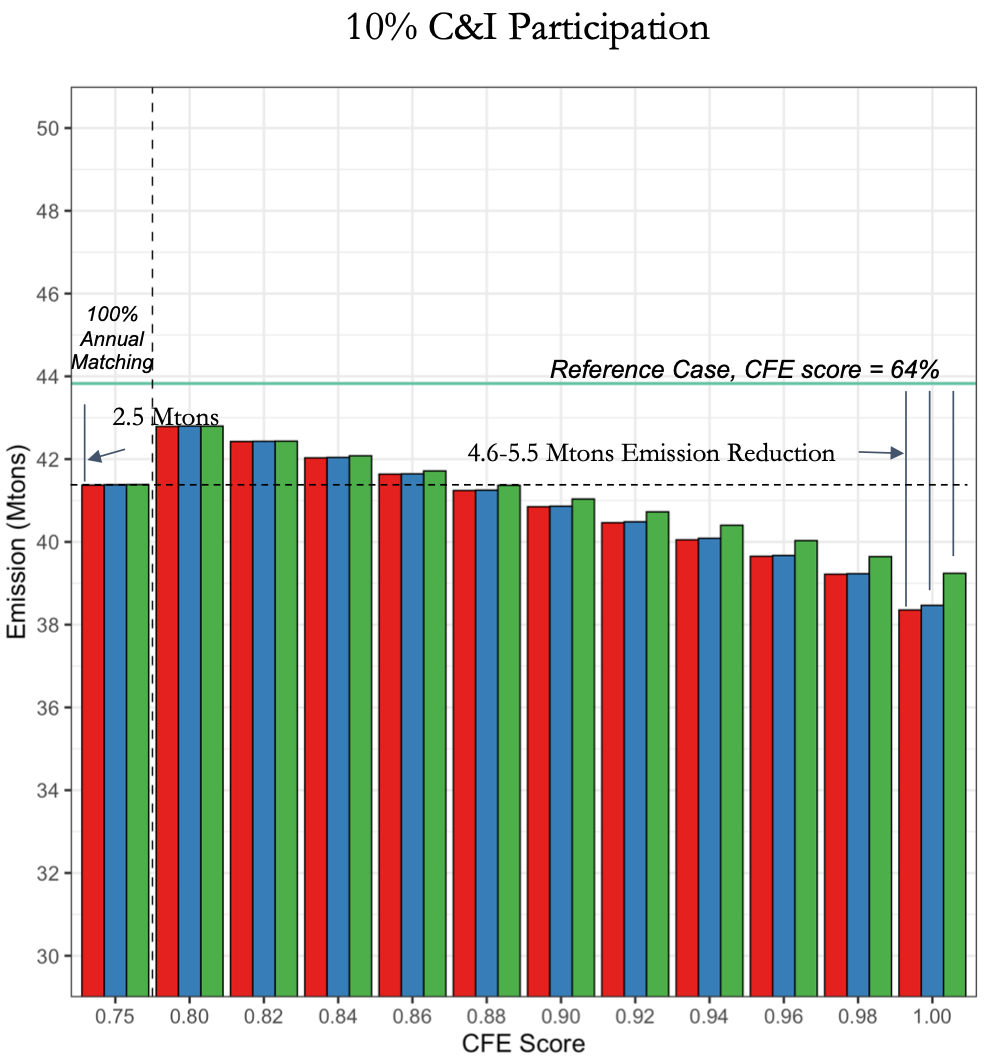

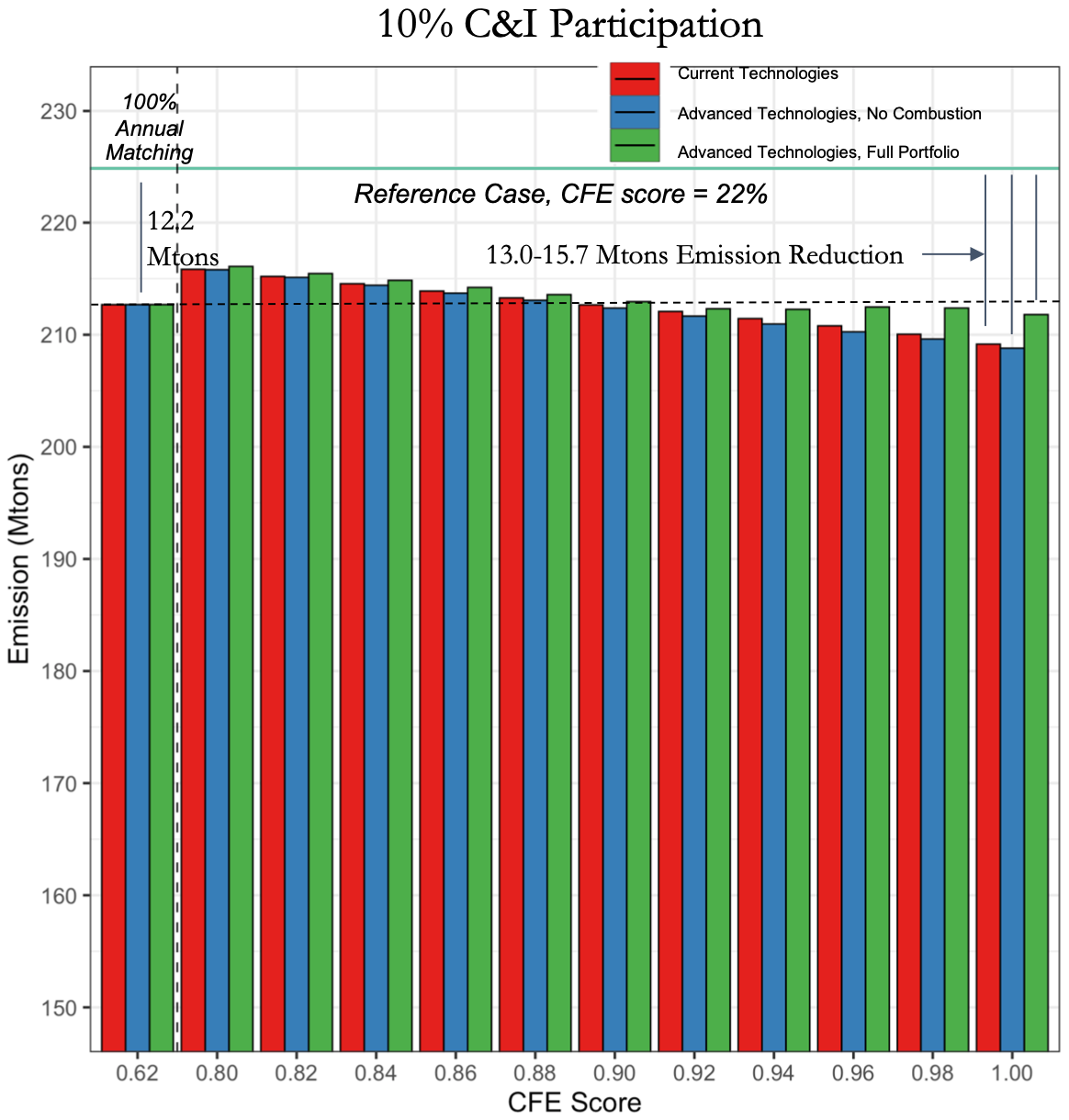

24/7 procurement drives more system-level carbon reductions

In California, if 10 percent of the C&I sector participates, 24/7 procurement would reduce more system-level (as opposed to participant-level) emissions than a 100 percent annual matching strategy, starting at a collective CFE score of 88 percent.

There are two explanations for this. The first is a volume effect — participants doing 24/7 matching simply have to buy more CFE, and with more CFE, more fossil generation is displaced. The second is a timing effect — participants doing 24/7 matching procure resources that better match demand patterns, thus displacing more fossil generation.

Here’s PJM:

PJM starts out with much less solar and wind. That means that, while the volume effect does advantage 24/7 once CFE scores reach 90 percent, the timing effect isn’t very pronounced (the marginal generator is basically always fossil), and the net difference doesn’t amount to much.

So 24/7 procurement reduces more system-level emissions than 100 percent annual matching, but only at relatively high CFE scores and not by a huge amount.

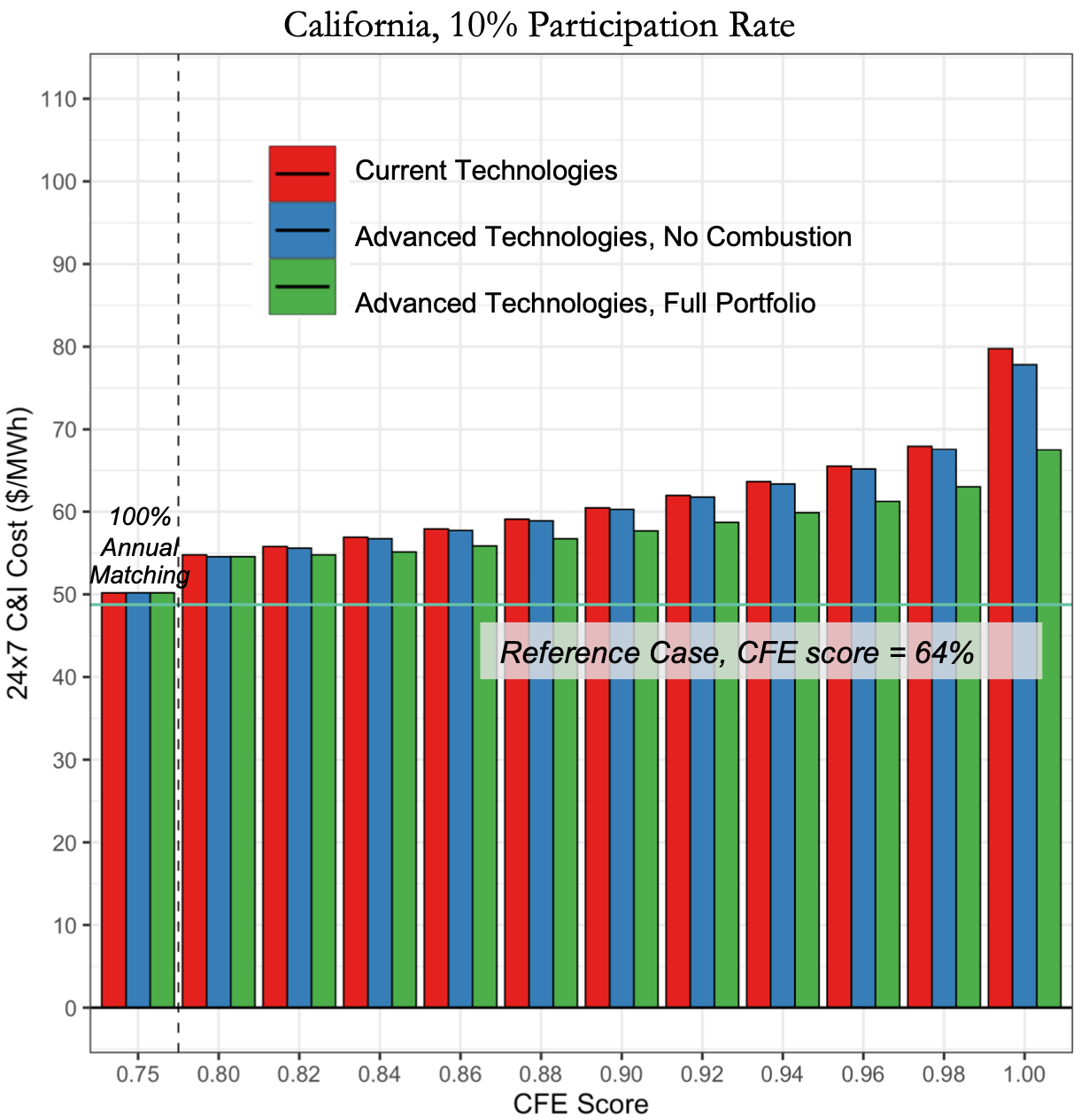

24/7 procurement comes at a relatively steep cost premium

There’s no two ways about it: 24/7 procurement costs more. And the costs rise as CFE scores get closer to 100 percent, especially if only current technologies are available.

Here’s California.

Note that covering that last 10 percent, getting from 90 to 100 percent CFE, sees costs rapidly escalate, especially for the last 2 percent.

If only commercially available technologies are put to use, 24/7 CFE is 64 percent more expensive than 100 percent annual matching. If a full portfolio of technologies is available, it’s only 39 percent more expensive.

The current technology costs are easy to explain: it’s extremely expensive to cover the last 10 percent of consumption with only wind, solar, batteries, and conventional geothermal. But why is the green line so much lower than the blue line?

The difference between blue and green comes down to which clean-firm sources are available. The “no combustion” set — long-duration energy storage, advanced geothermal, and advanced nuclear — has high fixed costs (labor and construction) and low variable costs (operation and maintenance).

But the “full portfolio” set includes combustion-based sources like natural gas with CCS and turbines running hydrogen fuels, which have lower fixed costs but higher variable costs, and that turns out to be much cheaper when the sources are run at low utilization rates, as these will be.

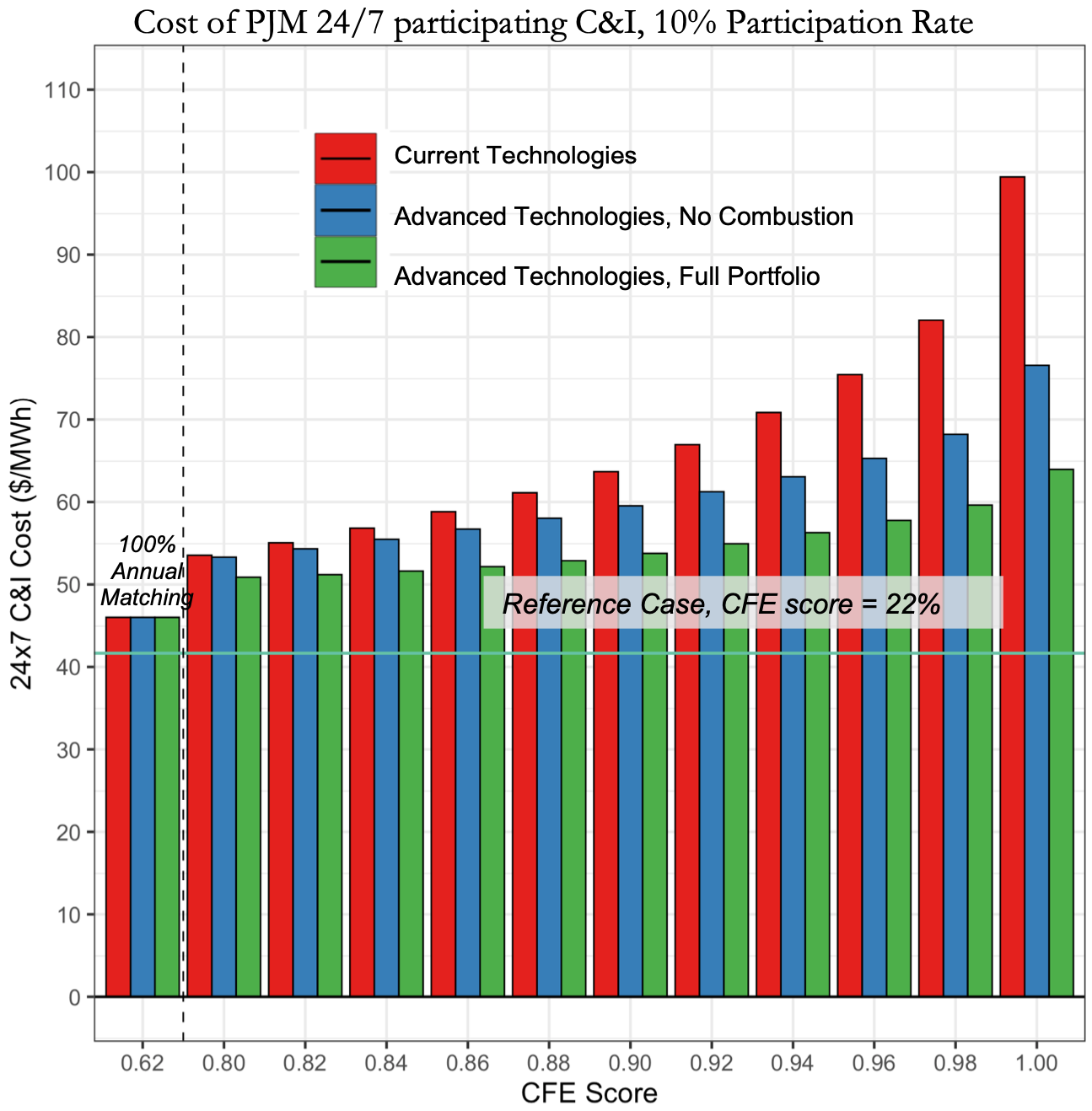

In PJM, the cost differential is even greater:

With only currently available technologies — which, remember, do not include geothermal in PJM — the cost of 24/7 procurement is 139 percent higher than the cost of 100 percent annual matching. Yikes.

But with the full portfolio, 24/7 is only 54 percent more expensive. In PJM, “procuring clean firm generation or long duration energy storage technologies can significantly lower marginal abatement costs, particularly at higher CFE scores.” It really helps, on a dirty grid, to have some clean-firm sources that cover the last few percent.

OK, let’s pause here and assess what we’ve learned. We know that 24/7 procurement can reduce and eventually zero out the carbon intensity of a participant’s own portfolio, though of course, from a climate perspective, that’s basically irrelevant. In system terms, 24/7 procurement reduces emissions more than 100 percent annual matching, but only a modest amount — and that modest amount comes at a substantial cost premium.

Here the emissionality perspective taps us on the shoulder. It points out that, in either case (100 percent annual or 24/7) companies could reduce more emissions with the same amount of money by directing that money to dirtier grids. Companies are spending extra money to reduce “their own” emissions when the atmosphere doesn’t care whose emissions are whose.

Emissionaries (ha ha, another new word!) might ask, what’s so great about 24/7 over and above 100 percent annual matching? Why are the companies procuring for 24/7 willing to spend so much more money for so little additional emission reduction? Why don’t they spend that money on dirty grids where it will reduce more emissions?

The main answer from proponents is that 24/7 procurement will do more to prepare the way for, and reduce the cost of, full grid decarbonization. It is playing the long game.

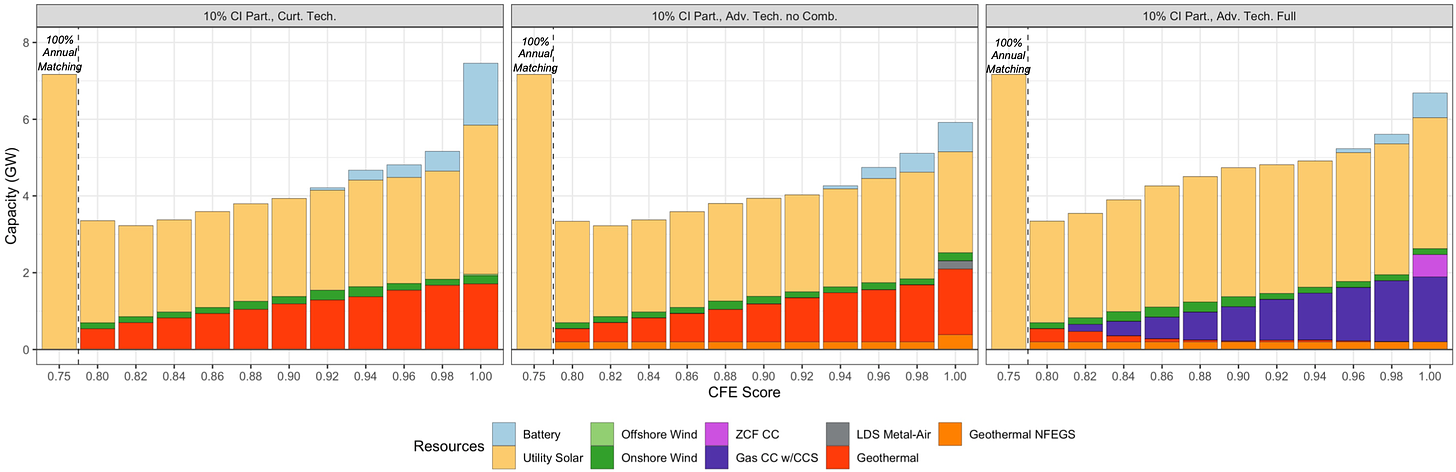

24/7 procurement drives early deployment of clean-firm sources

While procuring for 100 percent annual matching generally means buying only wind and solar, procuring for 24/7 matching will necessarily include, depending on local prices and technology availability, not only batteries but “conventional and advanced geothermal, advanced nuclear, natural gas power plants with CCS, gas plants using zero-carbon fuels, and/or long duration energy storage.”

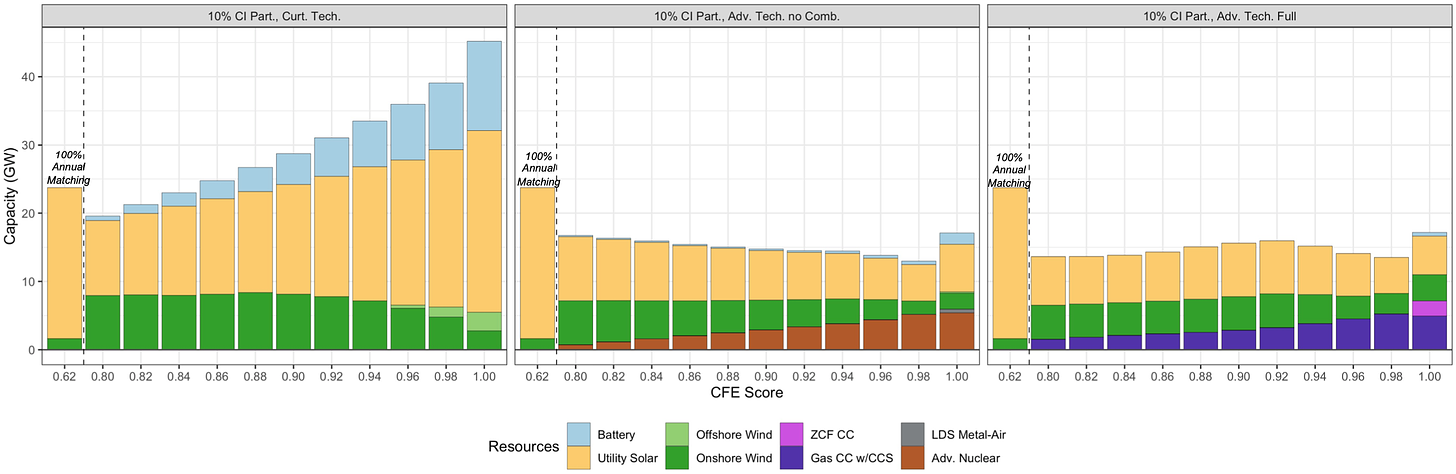

Here’s 24/7 procurement in California with 10 percent C&I participation in 2030 with current tech, advanced tech with no combustion, and the full portfolio:

In the first and second cases, the story is about solar, geothermal, and batteries. But with the full portfolio, geothermal drops out almost entirely, replaced by natural gas with CCS (and a few zero-carbon-fuel turbines), which will be considerably cheaper.

This is not likely to be a popular result — I can’t say I like it — but it looks like, on grids with high penetration of variable renewables that need some low-utilization clean-firm generation to fill the gaps, natural gas with CCS may be the cheapest option.

Here’s PJM:

In the current-technologies case, it’s all about solar and batteries — and as we saw above, it’s expensive AF. In the advanced-tech-no-combustion case, advanced nuclear steps in and vastly reduces the total amount of CFE required, thus shaving off a big chunk of the cost.

In the full-portfolio case, natural gas with CCS once again replaces most other clean-firm generation, including nuclear, reducing costs further.

Summing up: “If 10% of C&I customers participate and reach 100% CFE, 1.9-2.3 GW of clean firm generation and long-duration storage capacity is deployed in California and 5.9-7.1 GW in PJM by 2030.”

That’s a lot! Enough to kickstart those markets.

“Just as 100% annual matching helped transform wind and solar PV from expensive ‘alternative energy sources’ to mainstream, affordable options for the world,” the report says, “24/7 procurement is likely to have similar transformative impacts on clean firm resources.”

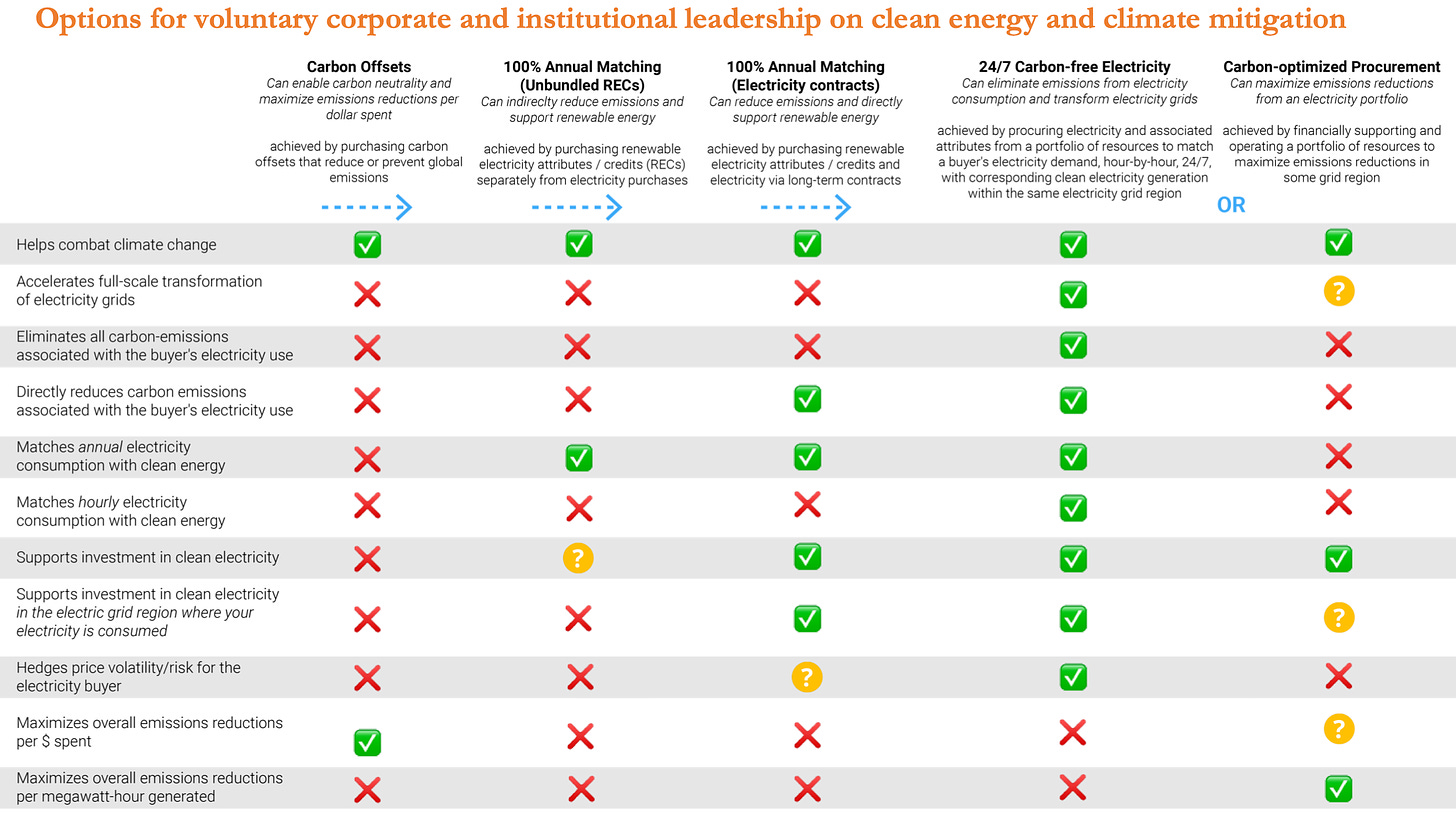

Here’s a chart of what different procurement strategies can accomplish:

What’s the right time horizon for voluntary climate policy?

So where does this leave us on the debate between 24/7 and emissionality? Should companies reduce their own hour-to-hour emissions or should they just reduce the most emissions they can, regardless of location and timing?

Of course, there’s no real reason to pit them against one another. Companies can do one or the other or a mix, depending on their particular values. Nonetheless, it’s an intriguing question, and I admit to remaining torn.

I frequently argue that post-2030 decarbonization is, if anything, drawing too much attention from policymakers, corporates, and tech types, at least relative to the prime directive of climate policy: rapidly reducing emissions in the coming decade by driving fossil fuel power plants off the grid with cheap wind and solar.

That core task is by no means accomplished. Most grids in the US remain much dirtier than California’s, with plenty of room for more wind and solar. Before they get too excited about advanced nuclear and CCS, everyone needs to make sure that wind and solar are growing fast enough to mostly decarbonize the grid by 2030.

I worry that 24/7 procurement is part of this trend: turning our eyes to the 2040-2050 horizon, the last 10 to 20 percent of grid decarbonization, before we have the first 80 percent locked in.

That said, I don’t worry about that too much. Getting to 24/7 CFE will involve buying plenty of wind and solar along the way. Long-term power purchase agreements will remain the gold standard; hourly trading of renewable energy certificates will be used to fill in the gaps with balancing resources. And all the companies pursuing 24/7 procurement will be invested in their local grids building more wind and solar — it raises their CFE baseline.

What’s more, I think the socio-technological process of stimulating innovation and development in these gap-filling clean-energy technologies is going to turn over all kinds of rocks and uncover all kinds of insights. We’re still somewhat guessing about which technologies will best play the clean-firm role. Reality could surprise us. The sooner we run that investigation, the sooner we’ll have a better grasp of exactly what we need and how to craft policy around it.

So for now, I remain excited about 24/7 CFE and I can’t wait to see more companies and cities jump on the bandwagon. People are beginning to think about full decarbonization now. The engineers and accountants are running the numbers. We’re going to see some really cool stuff happen soon.

Share this post