Recently, there’s been a lot of talk in the energy world about the minerals needed by clean-energy technologies and whether mineral supply problems might pose a threat to the clean-energy transition.

To hold warming beneath 1.5°C over pre-industrial levels, the world must cut greenhouse gas emissions in half by 2030 and reach net zero by 2050. To do that, it must radically ramp up production of solar panels, wind turbines, batteries, electric vehicles (EVs), electrolyzers for hydrogen, and power lines.

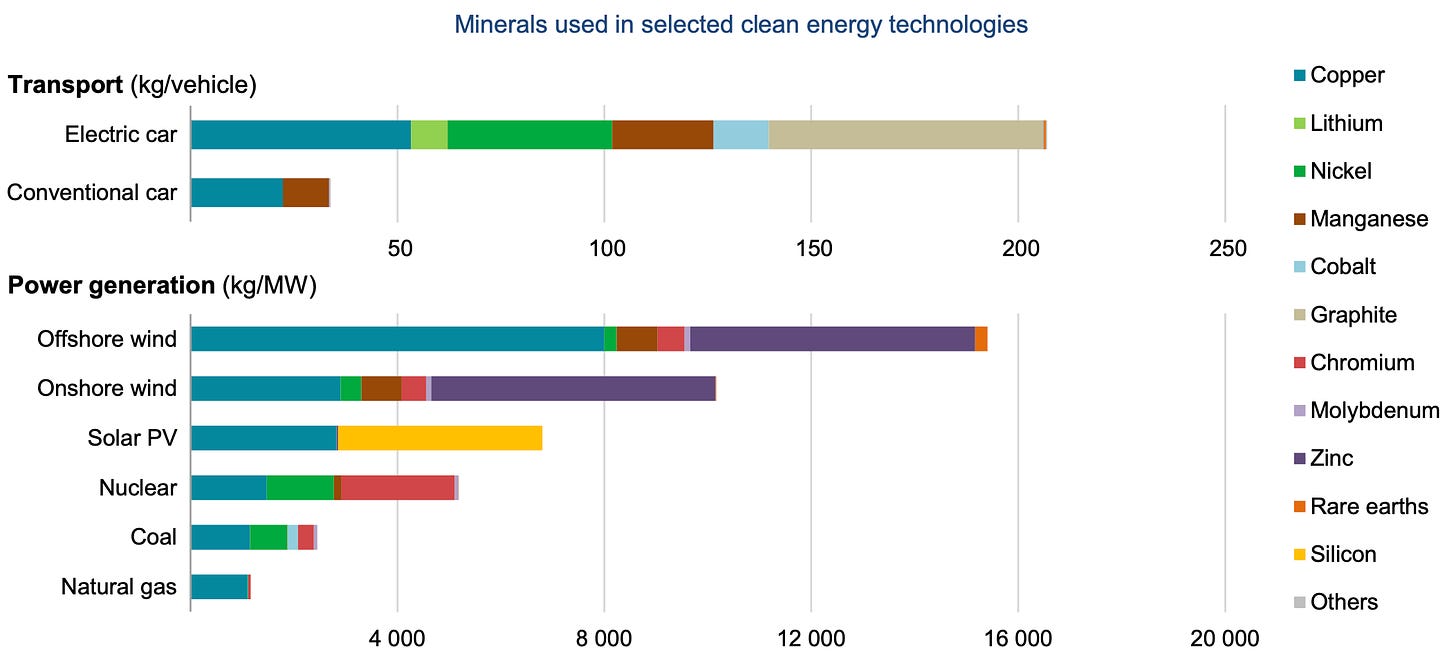

Those technologies are far more mineral-intensive than equivalent fossil fuel technologies. “A typical electric car requires six times the mineral inputs of a conventional car,” writes the International Energy Agency (IEA), “and an onshore wind plant requires nine times more mineral resources than a gas-fired plant of the same capacity.” (The IEA report uses the word minerals to refer to the entire mineral and metal value chain from mining to processing operations, and I do the same here.)

Power transmission and distribution require aluminum and copper. Batteries and EVs require cobalt, lithium, and nickel. Wind turbines require rare earth elements. And so on.

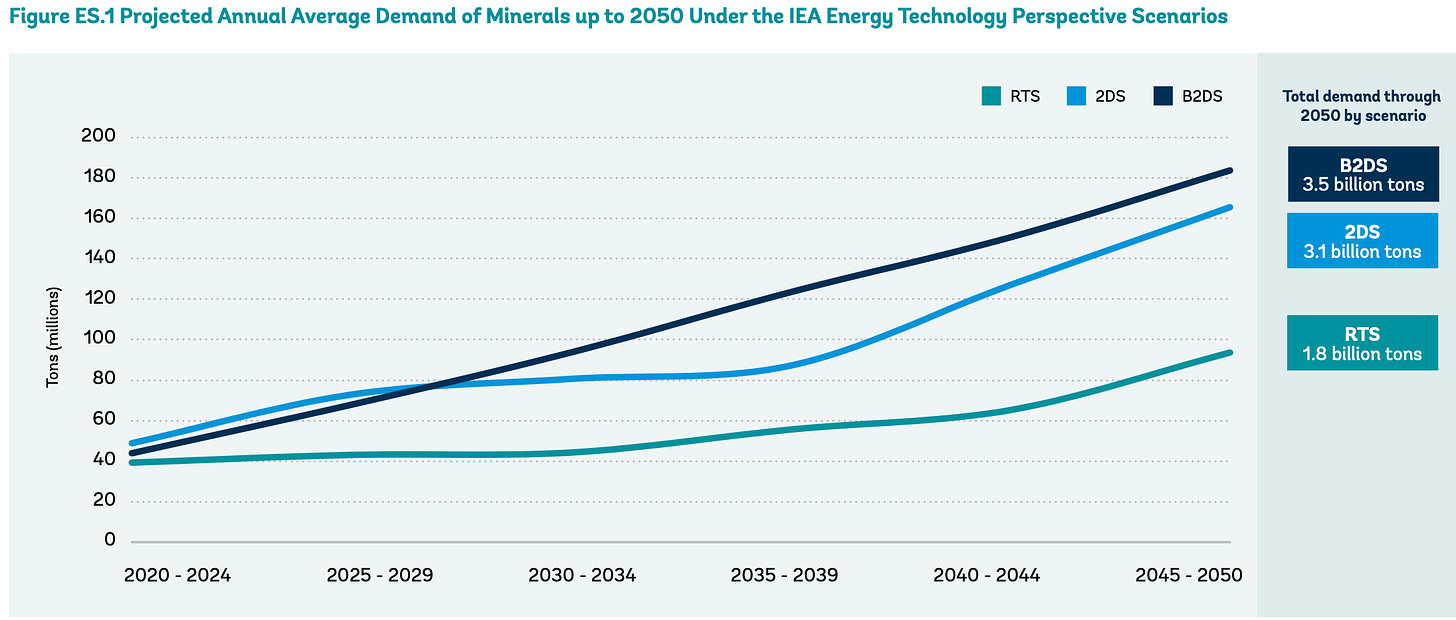

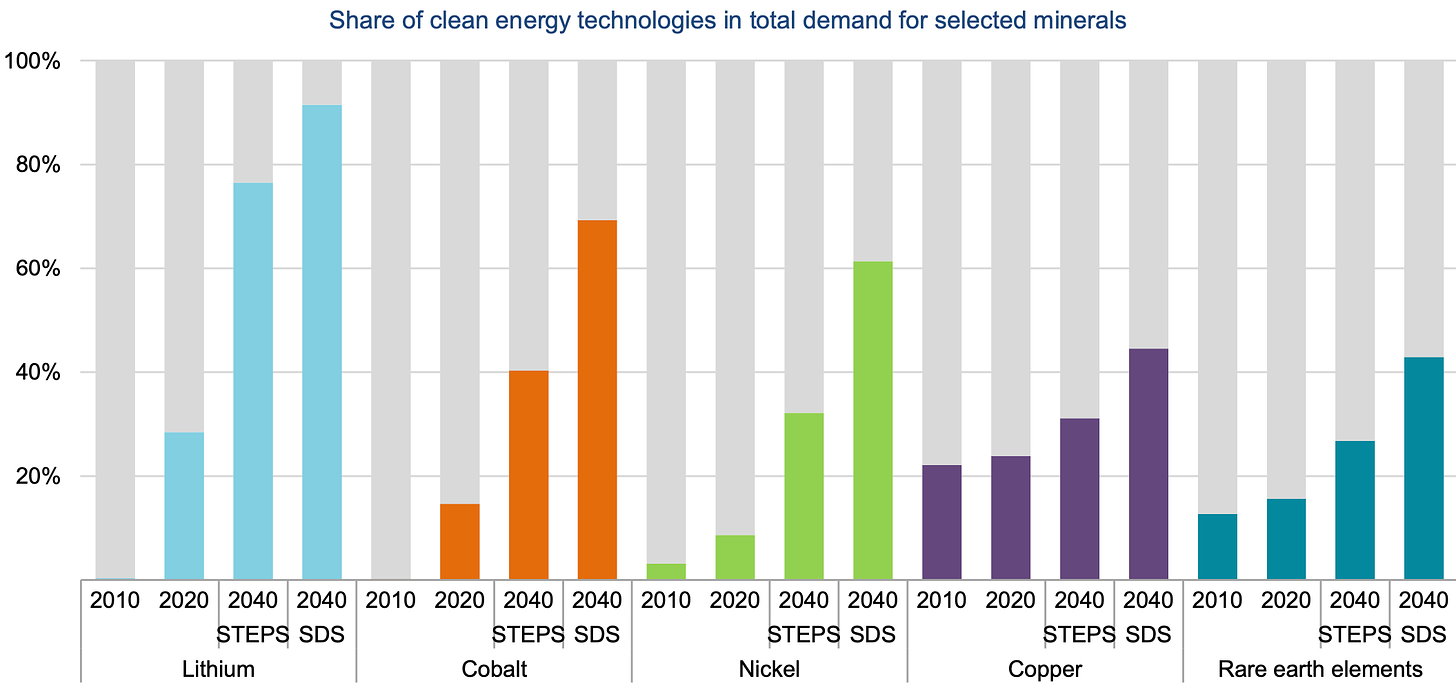

In its encyclopedic 2021 report on the subject, IEA estimates that “a concerted effort to reach the goals of the Paris Agreement would mean a quadrupling of mineral requirements for clean energy technologies by 2040. An even faster transition, to hit net-zero globally by 2050, would require six times more mineral inputs in 2040 than today.”

Some individual minerals will see particularly sharp jumps. The World Bank says, “graphite and lithium demand are so high that current production would need to ramp up by nearly 500 percent by 2050 under a [2 degree scenario] just to meet demand.”

A clean-energy transition sufficient to hit 1.5° will mean an enormous rise in demand for these minerals.

This fact has been seized on by a variety of people to raise questions about the speed and sustainability of the clean-energy transition. Are we just trading one resource curse for another?

So I looked into it. It’s a complicated subject — each of these minerals poses its own specific challenges, with its own specific suppliers, supply lines, customers, and possible pain points. There’s no neat single story here.

Nonetheless, I’ll try to summarize what I found, starting at the end, with what I think are the key big-picture lessons. In the next post, we’ll get into specific technologies and minerals.

The clean-energy transition will be an environmental boon

Yes, it is true that demand for minerals will rise and that several of those minerals are currently produced in environmentally and socially problematic ways. This is a real problem — or rather, a whole nest of problems, which warrant concern and concerted action.

That being said, it’s important to keep in mind that, even under the grimmest environmental prognostications, the transition to clean energy will be a boon for humans and ecosystems alike.

It will certainly involve lower greenhouse gas emissions. The World Bank says that, under a 2 degree scenario, through 2050, renewable energy and storage would contribute approximately 16 gigatons of carbon dioxide equivalent (GtCO2e) greenhouse gases, “compared with almost 160 GtCO2e from coal and approximately 96 GtCO2e from gas.”

If the concern is material intensity, energy researcher Saul Griffith has done some back-of-the-envelope calculations that put the transition in perspective. Here’s what he told me:

Assigning all 328 million Americans equal share of our fossil fuel use, every American burns 1.6 tons of coal, 1.5 tons of natural gas, and 3.1 tons of oil every year. That becomes around 17 tons of carbon dioxide, none of which is captured. It is all tossed like trash into the atmosphere.

The same US lifestyle could be achieved with around 110 pounds each of wind turbines, solar modules, and batteries per person per year, except that all of those are quite recyclable (and getting more recyclable all the time) so there is reason to believe it will amount to only 50-100 pounds per year of stuff that winds up as trash.

That is a huge difference: 34,000 pounds of waste for our lifestyles the old way versus 100 pounds the new, electrified way.

These are only illustrative figures, but they show that the scale of resource extraction in a decarbonized world will be vastly, vastly smaller than what’s required to sustain a fossil-fueled society. Close to 40 percent of all global shipping is devoted to moving fossil fuels around, a gargantuan source of emissions (and strain on the ocean) that clean energy will almost wipe out. In a net-zero economy, there will be, on net, less digging, less transporting, less burning, less polluting.

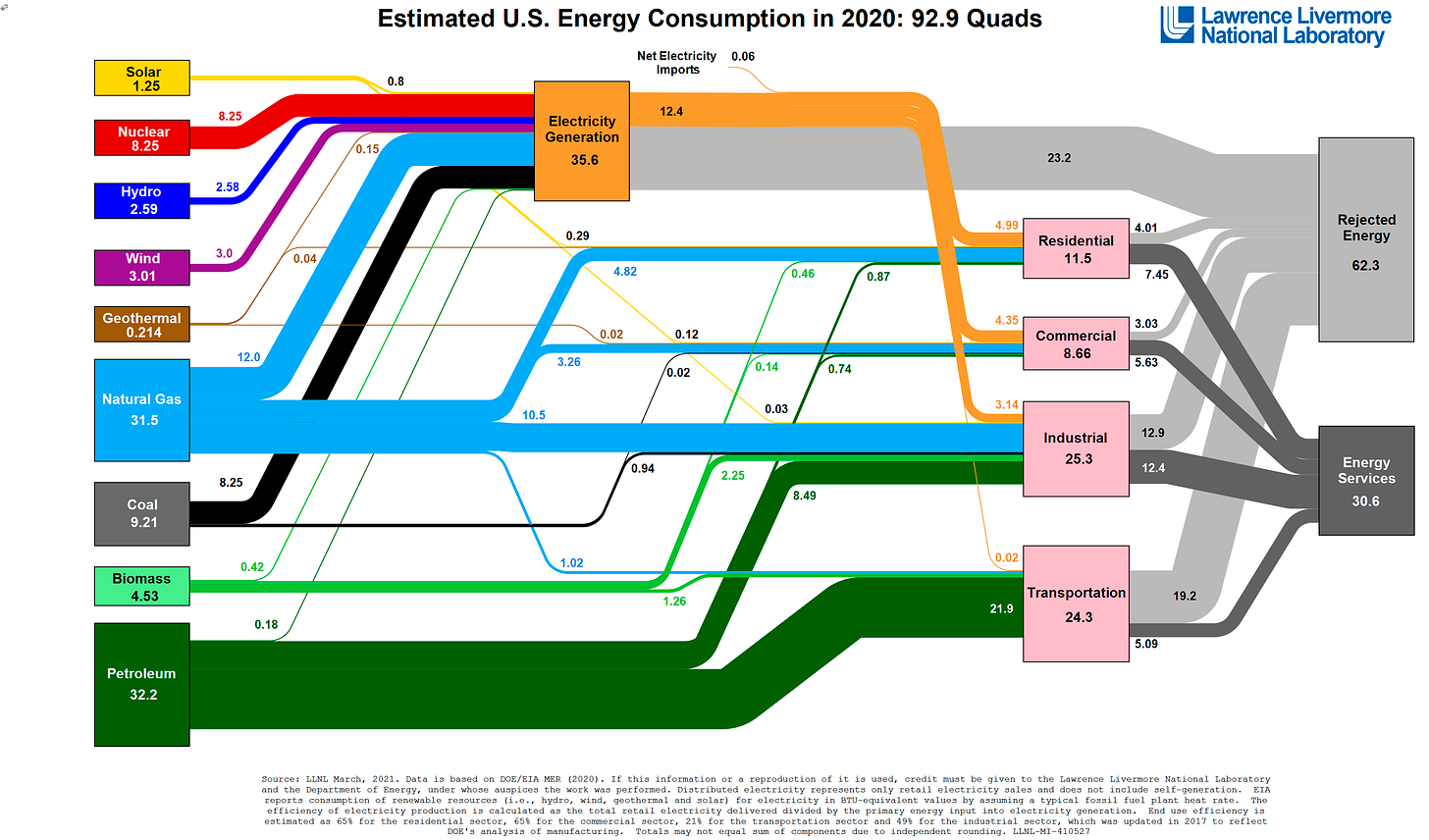

The fact is, fossil fuels are a wildly destructive and inefficient way to power a society. Two thirds of the energy embedded in them ends up wasted.

That inefficiency has been rendered invisible by fossil fuels’ ubiquity and the lack of alternatives. Now that alternatives are coming into view, it’s clear that any shift away from mining, drilling, transporting, and combusting fossil fuels will dramatically ease human pressure on the biosphere and the atmosphere.

Again — I can not emphasize enough — this is no reason to ignore or gloss over the very real environmental impacts of mineral mining, processing, and transport. Though overall environmental pressure will ease in a clean-energy world, it will be concentrated in new places, among people who may not necessarily enjoy the benefits of the transition.

There are ugly and cruel ways to go about an energy transition, and there are sustainable and equitable ways to go about it. I’m strongly in favor of the latter and encourage everyone to do what they can to bring that about.

Nonetheless, either way, the broader cause is environmentally righteous.

These minerals are not rare and there’s no shortage of them

Another common misconception is that the clean-energy transition could fall short because there simply isn’t enough of certain minerals — this especially comes up around the somewhat misleadingly named rare earth elements (REEs).

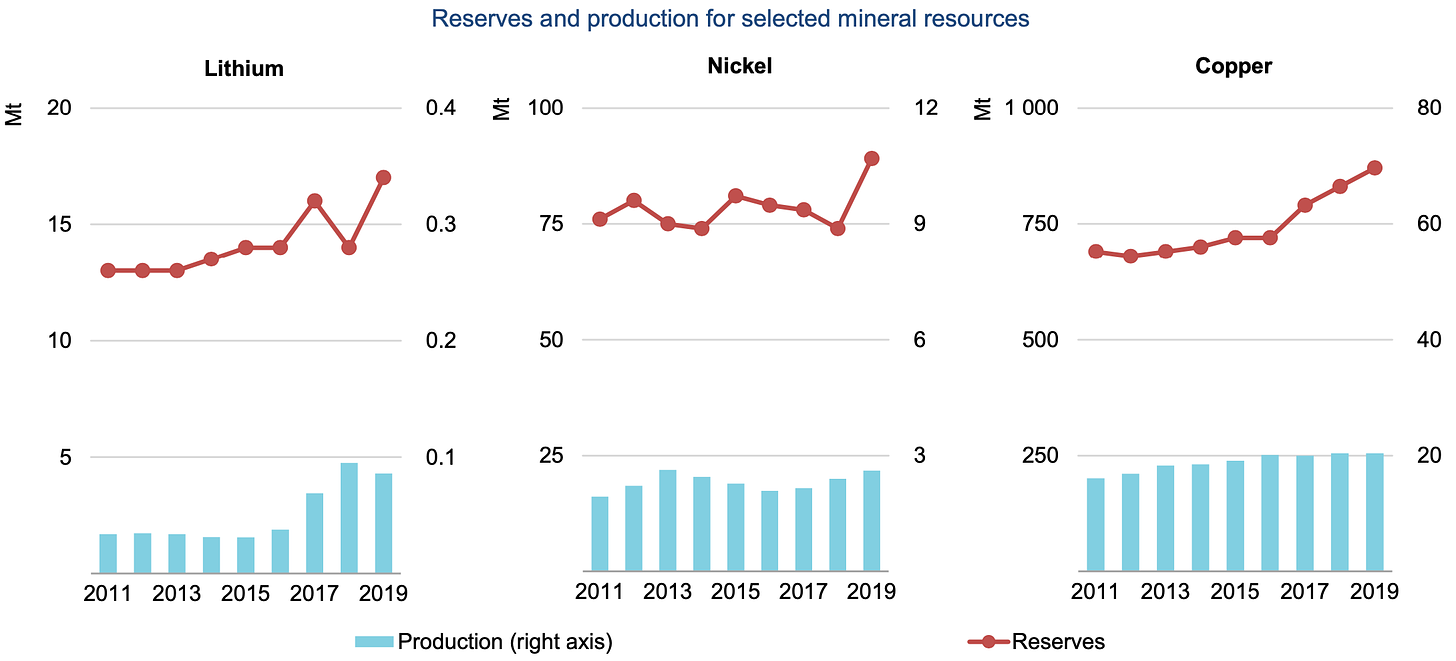

It’s not true. Known reserves of all these minerals, including REEs, are much higher than demand, and “despite continued production growth over the past decades, economically viable reserves have been increasing for many energy transition minerals,” IEA writes. Reserves will rise further with new exploration and detection methods.

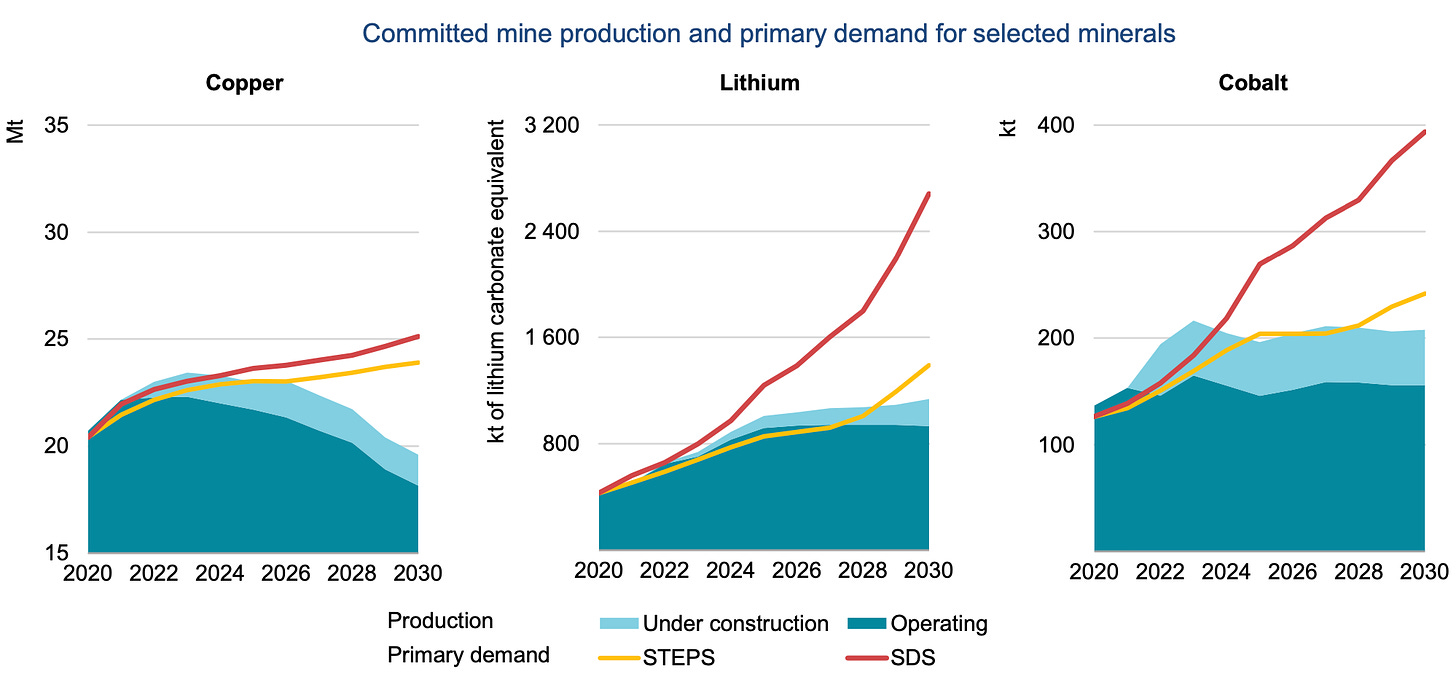

Currently, demand is forecast to grow much faster than supply. As that happens, there are bound to be chokepoints and price fluctuations.

But those stresses will be temporary, especially if policymakers anticipate and prepare for them. New caches of minerals will be found and recycling will increase in scope and effectiveness. There will be supply problems, but there is no Supply Problem, no global scarcity of any mineral that will put a hard limit on the transition.

Minerals do pose risks to the transition

Temporary minerals shortages or disruptions could result in “more expensive, delayed, or less efficient [energy] transitions,” IEA says. Here’s how it summarizes the risks to the transition posed by minerals supply:

(i) higher geographical concentration of production,

(ii) a mismatch between the pace of change in demand and the typical project development timeline,

(iii) the effects of declining resource quality,

(iv) growing scrutiny of environmental and social performance of production, and

(v) higher exposure to climate risk such as water stress, among others.

None of these risks is prohibitive, but if they are not managed, they could slow the transition. Let’s go through them one at a time.

Geographical concentration

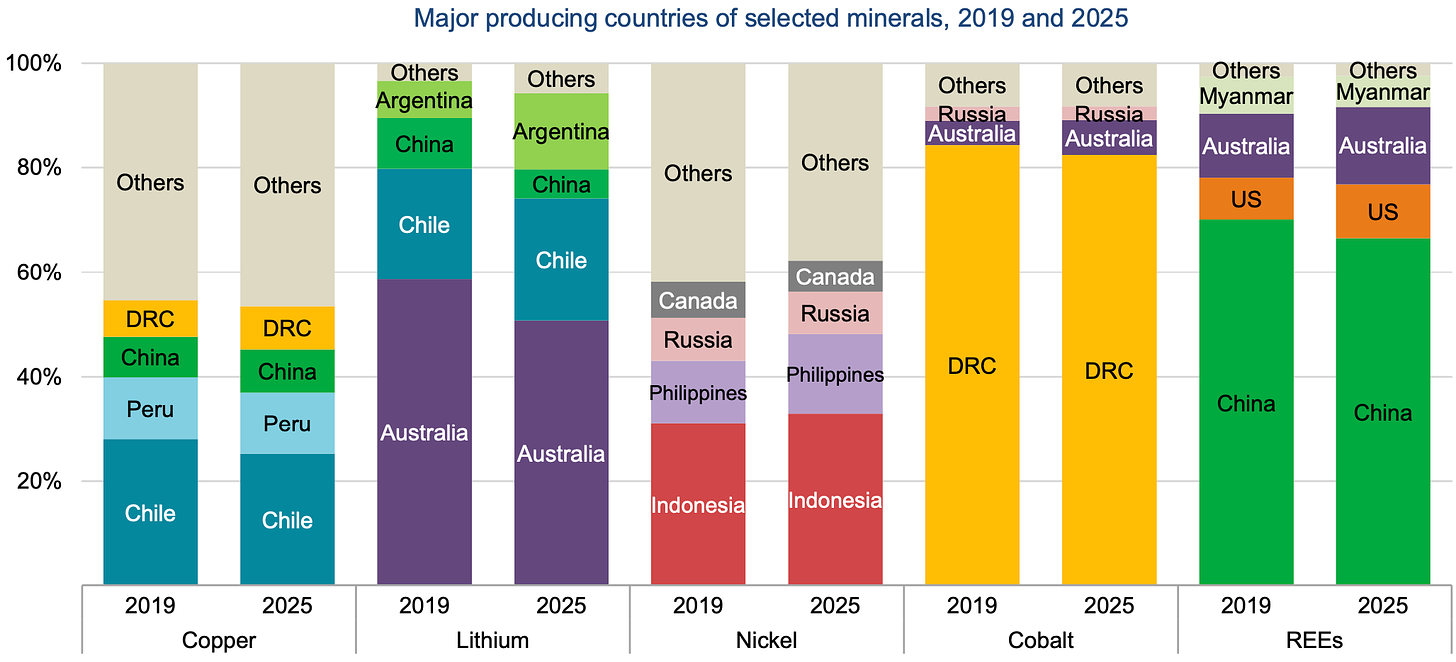

Production of the minerals needed by clean energy technologies is currently more geographically concentrated than oil and gas production.

No single producer dominates in oil and gas markets the way the Democratic Republic of Congo (DRC) dominates cobalt, China dominates graphite and REEs, and Australia dominates lithium.

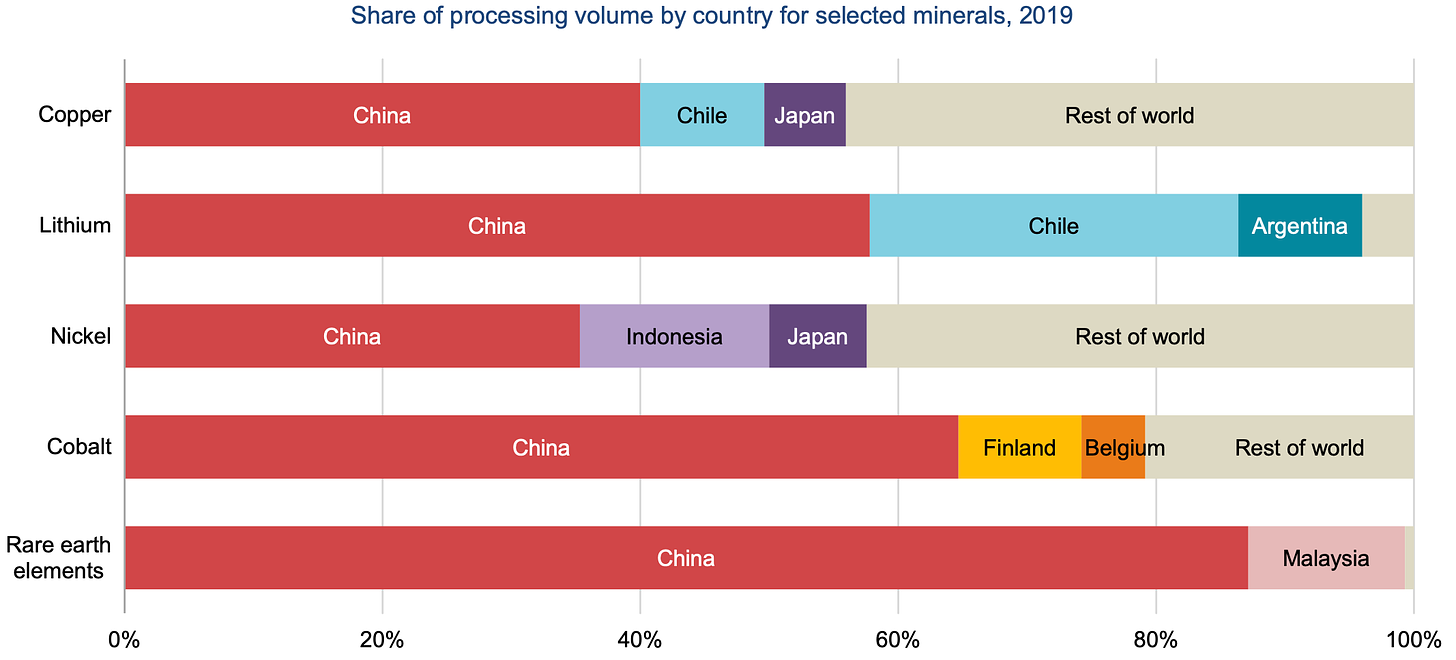

Similarly, processing of these minerals — refining and preparing them for industrial applications — is highly concentrated, but mostly in one place: China, which processes around 40 percent of copper and nickel, around 60 percent of lithium and cobalt, and around 85 percent of REEs.

The US, like most developed countries, has become highly import-dependent in minerals. According to a recent commentary from scholars at the Colorado School of Mines’ Payne Institute for Public Policy, “of the 35 critical minerals identified by the US today, 14 had a 100% net import reliance in 2020, and 14 additional minerals have a net import reliance of greater than 50%.”

The risk of this concentration is not so much that any one country will try to pull some kind of Bond-villain crippling of the world economy, but simply that the fewer producers or processors involved, the more it matters when any one of them runs into regulatory changes, trade restrictions, or political instability. When there’s a robust ecosystem of producers, one country’s bumps can be absorbed. But when there’s only a handful, any bump ripples out as rapid fluctuations in price.

These markets are relatively small, but will grow quickly under decarbonization, so more and more countries will be vulnerable to price fluctuations. In the oil and gas world, there are energy-security measures in place, including strategic stockpiles of some fuels, but there’s not much of that in place for minerals, at least not yet. And markets for minerals are in many cases much more opaque than markets for oil and gas, lacking a shared set of metrics and transparent pricing.

At least through 2025, IEA does not expect the level of concentration to change much.

Aggressive investment in alternative supplies can decrease concentration eventually, but in the short term, solutions will involve drawing producers into more transparent market frameworks, pressuring them to improve social and environmental performance, and developing some buffer reserves of critical minerals.

Timing mismatch

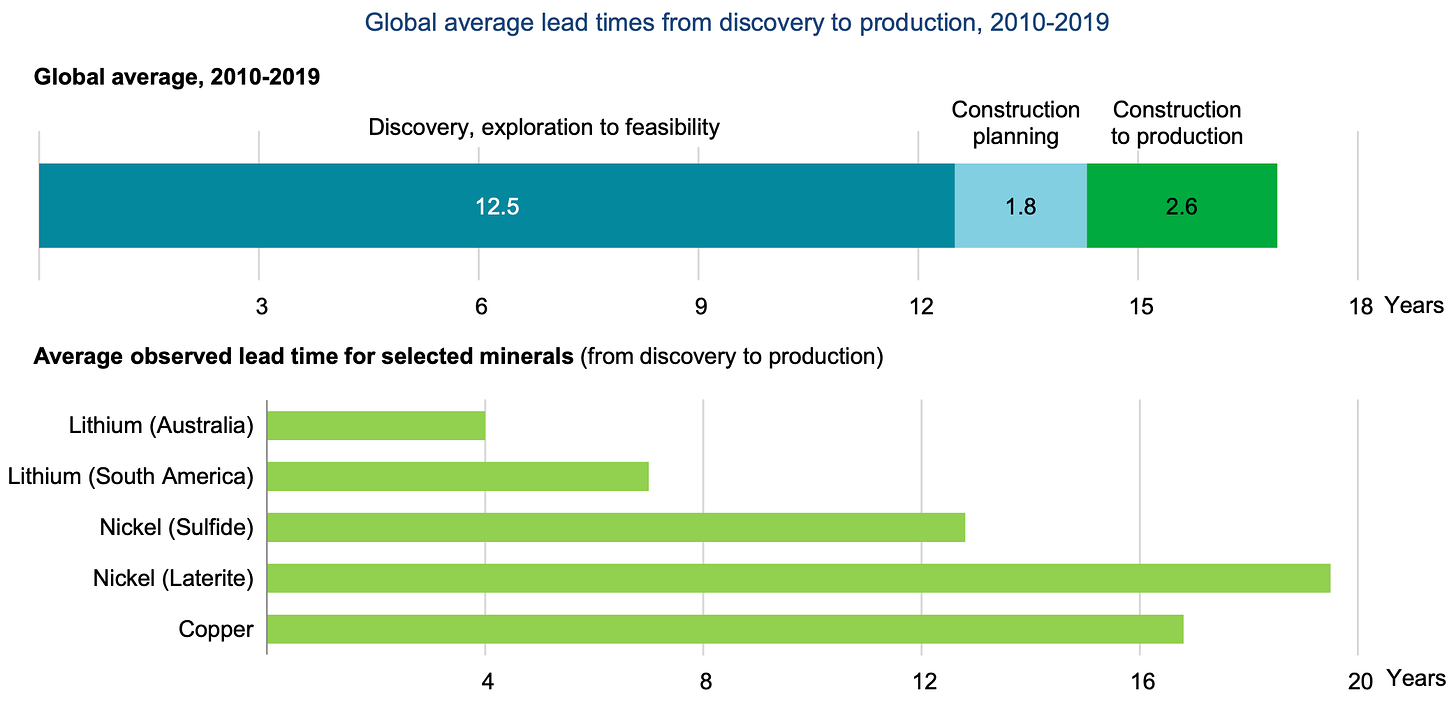

Demand for minerals is already rising and will accelerate rapidly in coming years. Unfortunately, exploration, discovery, and exploitation of new mineral resources are marked by substantial lead times, in some cases over 15 years.

“These long lead times raise questions about the ability of supply to ramp up output if demand were to pick up rapidly,” IEA writes. “If companies wait for deficits to emerge before committing to new projects, this could lead to a prolonged period of market tightness and price volatility.”

To keep up with demand, investors need to think ahead. And lead times need to decline, which will involve substantial investment and governance help from wealthy consumer nations to poorer producing nations.

Declining resource quality

In recent years, two trends have driven down the average resource quality of many minerals: first, the known high-quality deposits have been mined, and two, technological advances have allowed the mining of ever-lower-quality resources.

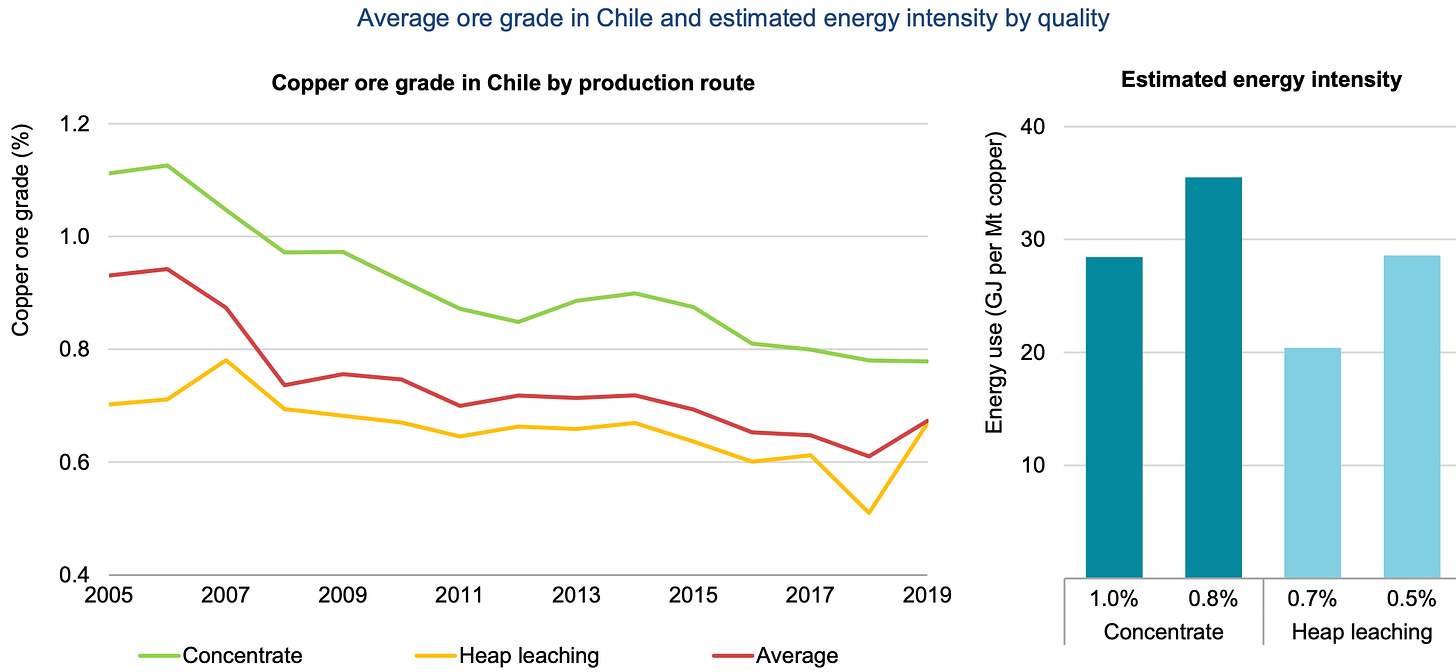

“For example,” IEA writes, “the average copper ore grade in Chile has decreased by 30% over the last 15 years.”

As resource quality declines, the emissions intensity of mining rises, as does the amount of waste. Concerted action and investment will be needed to counteract this trend.

ESG scrutiny

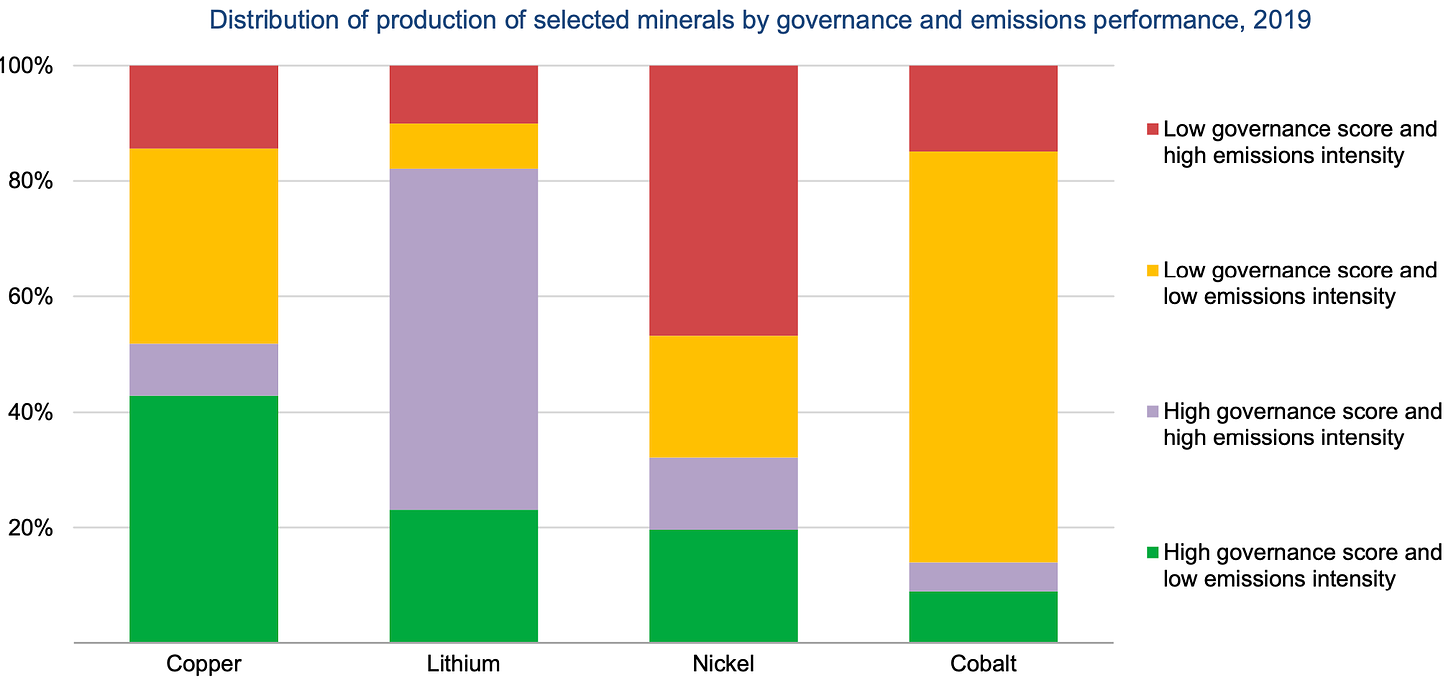

A growing chorus of consumers and investors is calling on the mining sector to take action on its labor and environmental standards and rising carbon intensity. They want companies to disclose concrete plans on environmental, social, and governance (ESG) issues.

This is a big deal in the sector, as the majority of production of many key minerals now takes place in countries with low governance scores and/or high emissions intensity.

This is something clean energy advocates have been loath to talk about, but given the coming boom in minerals, silence is no longer an option. The Payne commentary says, “reports have found as many as 255,000 artisanal cobalt miners in the [Democratic Republic of Congo], 35,000 of whom are children working in exceedingly harsh and hazardous conditions to produce the materials many people use in their $100,000 electric vehicles (EVs) and other ‘clean’ technologies.”

Lithium, cadmium, and REEs are all produced in ways that damage soil and water and release hazardous chemicals that threaten miners and surrounding communities. ESG pressure from governments and the private sector could have a salutary effect on social and environmental performance, but it could also place upward pressure on prices and additional burdens on small-scale artisanal miners, which could pose political problems in some countries.

Exposure to climate extremes

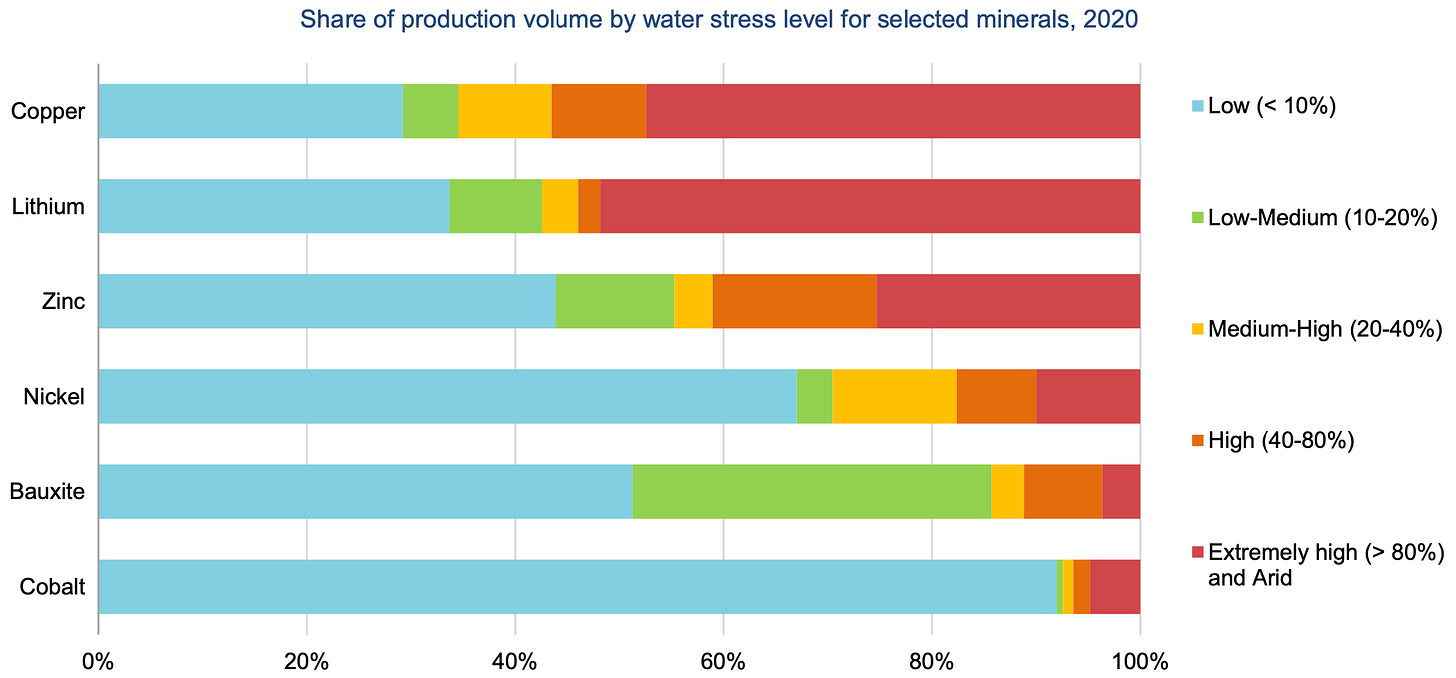

Production of clean-energy minerals is increasingly exposed to climate extremes.

Lithium and copper are perhaps the two most important minerals in an electrified world. Over half the world’s lithium production takes place in areas under high water stress. In Chile, 80 percent of copper output comes from arid or water-stressed regions.

Other producing regions like Africa, Australia, and China have seen increased extreme heat and flooding. Expanding demand could push production into even more vulnerable areas.

Anyway, those are the risks. In a later post, I’ll get into strategies and policies that can help address those risks.

Minerals are the new geopolitics: like oil & gas, but not

Right now, clean energy is a fairly small source of demand for the minerals discussed above, but its share is projected to grow rapidly under a Paris-compliant scenario, to well over half of global demand for lithium, cobalt, and nickel by 2040.

Just as clean energy will be more important to minerals markets in coming years, so too will minerals be more important to clean energy. The rapid deployment of technologies crucial to decarbonization is going to depend on supply chains that are in many cases dominated by one or a handful of countries, fed by mines with low labor and environmental standards, exposed to rising climate extremes, and vulnerable to political and economic disruptions. All of those risks could slow the transition.

The race for minerals courts some of the same dangers that came with oil and gas. Minerals will become crucial to the global energy system and their distribution — both production and consumption — will shape geopolitics. Unplanned supply disruptions could have global consequences, just as with oil and gas.

But it’s also important to remember that minerals are different from oil and gas in crucial respects. The most important is that fossil fuel technologies require continuous fuel input. If there’s a disruption in oil markets, it is experienced by every driver as an ongoing increase in gas and diesel prices.

Minerals are only essential to building of clean energy technologies, not to operating them. They are a materials input, not a fuel input. Supply disruptions or price fluctuations will affect markets for the technologies, but they will not affect existing users of those technologies. Solar energy from existing panels will not get more expensive just because copper does. This insulates minerals somewhat from the volatile consumer politics of fossil fuels.

Secondly, every country in the world has an established relationship to oil and gas — it’s a producer or it’s not — but minerals and mineral markets are much more varied and dispersed. Countries could consciously decide to become producers by exploiting new reserves; they could invest in processing or manufacturing; supply chains will shift and morph. “Individual countries may have very different positions in the value chain for each of the minerals,” IEA writes. This makes the geopolitics of minerals more complicated than fossil fuel geopolitics.

As we’ll see in the next post, the exact course of minerals markets is difficult to predict in advance, because there is rapid development and innovation going on in clean energy. Exactly what minerals will constitute the final balance in a clean-energy world is unknowable at this stage.

But there are predictable stresses ahead and policymakers should strive above all not to do what they’ve so often done with oil and gas — namely, stumble blindly into crises that end up having terrible economic and political consequences. The speed and success of the clean-energy transition depend on a thoughtful and cooperative approach to minerals supply.

Share this post