Here at Volts, I recently spent a week … OK, a month writing about batteries, which store energy for electronic devices, electric vehicles, and, at least for short periods of time (four to six hours), the power grid.

Lithium-ion batteries are extremely good at those tasks — and they’re getting better, and cheaper, all the time.

But here’s the thing: a net-zero-carbon grid is going to need storage that lasts a lot longer than six hours. It’s going to need durations of up to 100, 300, 500 hours or more, and it’s going to need them cheap. Lithium-ion batteries just aren’t going to work for that.

What will work? Good question! No one really knows yet.

Whatever it is will require substantial research, development, and scaling, and possibly some good geographical luck. We can’t know yet what technology or technologies might win that race, but we do have a good sense of what they need to accomplish, thanks to some new research in Nature Energy from a team at MIT (along with Jesse Jenkins, who used to be at MIT but is now at Princeton).

Their findings on long-duration energy storage (LDES) are daunting and somewhat deflationary. In a nutshell: LDES needs to get extremely cheap before it will play a substantial role in a clean grid — cheaper than almost any candidate technology today, and cheaper than any geographically unconstrained technology is likely to get any time soon.

Let’s start with some background on the need for LDES.

Renewables on the grid need firming

The cheapest large-scale renewable energy sources are wind and solar, but wind and solar are variable. They come and go with the sun and the wind, and as you may have heard, the sun is not always shining and the wind is not always blowing. We cannot turn them on or off, up or down.

The supply of wind and solar energy will not always match the “demand curve,” i.e., the level of electricity demand throughout the day. As more and more wind and solar are added to the grid, there’s more and more need for flexible resources that can fill the gaps when supply doesn’t match demand.

Today, those gaps are overwhelmingly filled by natural gas power plants, which are 100 percent “firm” in that they can be turned on at will and run as long as necessary. As the grid is decarbonized, however, fossil fuel plants (at least those without carbon capture) will be phased out of the electricity system and wind and solar penetration will increase. As that happens, other resources will be needed to firm the system.

There are four basic options.

Transmission: connecting larger geographical areas raises the chances that sun or wind will be available somewhere within them.

Low-carbon (“clean”) firm generation: the MIT team’s paper lists “nuclear, fossil fuels with carbon capture and storage (CCS), bioenergy, geothermal, or hydrogen and other fuels produced from low-carbon processes.” (The first three items are anathema to some climate activists, but they may end up being necessary.)

Negative emissions technologies (NETs): technologies that permanently bury carbon dioxide can offset emissions from firm fossil fuel plants.

Long-duration energy storage (LDES): technologies that can store enough energy, for long enough, to displace firm generation.

(Note: natural gas power plants are much cheaper than any of these options, save perhaps some transmission. There will be no market or pressure for any of them unless there are policies that require reduced greenhouse gases.)

NETs are likely to stay expensive and transmission can only do so much, so the real fight is likely to be between clean firm generation and LDES.

The new research is an extremely detailed modeling look at the role LDES might play in a decarbonized energy grid — how much clean firm generation it might displace and how much it might reduce energy system costs.

The LDES “design space”

The researchers took an interesting and (to me at least) somewhat novel approach. The problem with trying to study LDES is that a bunch of incredibly heterogenous technologies are claiming that mantle, with different mechanisms and different performance characteristics, at different levels of development and commercialization, competing for different market niches. It can be difficult to compare them or to say anything meaningful about them as a class.

So instead of focusing on particular technologies, the researchers modeled different combinations of performance characteristics. Specifically, they used a high-resolution model to represent five separate LDES technology parameters:

1) energy storage capacity cost (using a bathtub as an analogy, think of the cost of increasing the size of the tub); 2) charge power capacity cost (cost of enlarging the faucet); 3) discharge power capacity cost (cost of enlarging the drain); 4) charge efficiency (how much water is lost when filling the tub), and 5) discharge efficiency (how much water is lost when draining the tub).

Here’s how they went about it:

We modelled a total of 1,280 discrete combinations of these cost and efficiency parameters encompassing performance levels that are consistent with projections for existing LDES technologies found in academic peer-reviewed studies as well as domains that are currently infeasible but that could be the focus of technology development efforts in the future. Furthermore, we evaluated the technology design space for LDES in multiple power system contexts encompassing different wind, solar and demand characteristics and different assumptions regarding the availability of firm low-carbon technologies.

They present the results in two basic contexts: a Northern Grid representing average New England conditions and a Southern Grid representing Texas.

The methodology was complex but the goal was simple: to determine which LDES performance characteristics would do the most to displace clean firm generation and reduce system costs for a net-zero-carbon grid.

First we’ll look at which parameters made the biggest difference and the aggregate impact they could have. Then we’ll take a quick tour through current LDES techs to see which might make the cut.

What LDES needs to be able to do

The basic question is how much clean firm generation LDES can displace in a model optimizing for total system costs. Here are a few basic findings:

1. Of the five modeled technology parameters, the two that enable LDES to have the biggest impact are energy storage capacity costs (the cost of increasing the size of the tub) and discharge efficiency (how much water is lost draining the tub). The other three parameters don’t matter nearly as much.

A good benchmark for energy storage capacity costs are lithium-ion batteries (LIBs). Last year, BNEF’s annual battery price report had the average capacity costs of LIB battery packs at $137 per kilowatt-hour (down 89 percent from 2010), projected to hit $100 by 2023. Dan Steingart, a materials scientist and co-director of Columbia University’s Electrochemical Energy Center, told me he thinks LIBs are eventually going to get down “somewhere between $45 and $60 per kilowatt-hour.” (To be clear: that’s extremely aggressive and optimistic.)

2. That gives some context to the next finding: not until it hits $50/kWh will LDES even begin to see meaningful deployment or declining costs. Not until $20/kWh will they reduce system costs by 10 percent. And “to deliver more significant savings in electricity costs (>10%), storage technologies must exhibit costs in the $1-10/kWh range and discharge efficiencies greater than 60%.”

That pretty much rules out LIBs. It also, as we’ll see later, rules out quite a few of the technologies currently claiming the mantle of LDES.

3. What’s more, across the full design space modeled, the very best LDES could hope for is to reduce system costs 50 percent; the best existing LDES techs could do is 40 percent. And in a system with more clean firm options available, the max is 20 to 30 percent.

4. What’s even more, not until LDES capacity costs get down to $10/kWh could it displace all firm generation — if firm generation includes only nuclear. If it includes other clean firm generation with lower capital costs and higher operating costs (like natural gas with CCS or hydrogen combustion turbines), then LDES would have to get down to $1/kWh to displace it all.

5. What’s even more more, the modeled cases where LDES displaces the most clean firm generation involve storage durations of 100 hours or more, up as high as 650 hours (concentrated in 100 to 400 hours).

6. As No. 4 suggests, aside from energy capacity costs, the single factor that most influences LDES’ ultimate deployment has nothing to do with LDES tech at all — it’s the cost and availability of other clean firm options. If only or mainly nuclear is available, LDES has a much better shot. If other forms mature and get cheaper and more widely available, LDES will have a harder time.

7. LDES has a harder time on the Northern Grid, and an even harder time on the Northern Grid under scenarios of high electrification. (Electrification in the cold northern winters means a huge winter demand peak, which renewables struggle to meet.)

So, what have we learned? LDES needs to store huge amounts of energy for cheap. Though it will run only intermittently, it needs to discharge energy efficiently. And it needs to be capable of durations of well over 100 hours. Even if it meets those requirements, it will likely displace less than half the clean firm generation required to run a clean grid.

That said, reducing systems costs by even 10 percent represents billions of dollars in savings, so it’s nothing to sniff at.

Let’s take a quick tour through the technologies competing in the LDES space.

The varieties of LDES and their chances of success

Energy wonks are aware of the need for more and better options in the LDES space. ARPA-E has a DAYS (Duration Addition to electricitY Storage) program intended to spur development of energy storage technologies capable of anywhere from 10 to approximately 100 hours duration.

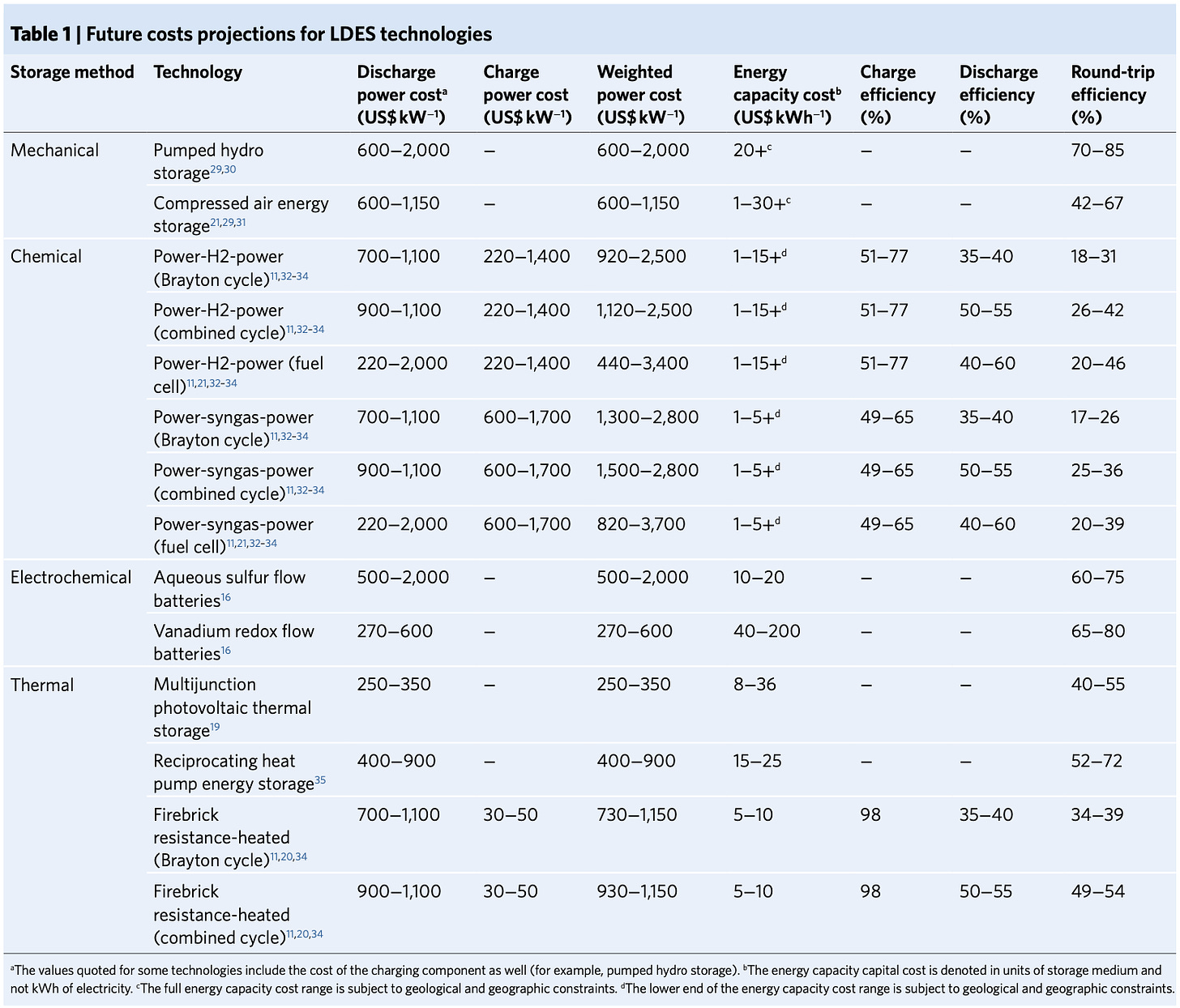

But this new research reveals that LDES will need to run much longer than that, and for dirt cheap. Can any of today’s technologies measure up? Let’s run through the four broad categories of competitors.

Electrochemical storage

There are two big electrochemical contenders. The first is flow batteries, which I wrote about in a previous post. They have the advantage of being able to scale energy storage and power capacity separately, which theoretically opens the door to very high energy capacity for fairly cheap.

Unfortunately, the most common varieties of flow batteries (vanadium redox and zinc bromine) have energy storage capacity costs in the hundreds of dollars per kWh, which means they probably won’t cut it as LDES. (As I wrote, flow batteries are aiming for that awkward mid-duration storage space and getting squeezed on both sides.)

Another electrochemical option (an alternative flow battery tech) is liquid metal batteries, which I also wrote about previously. A company called Ambri is building a 250 MWh demonstration project with liquid metal batteries in Reno, Nevada. In this paper, researchers demonstrated an “air-breathing aqueous sulfur flow battery” with $10-$20/kWh energy capacity costs at 100+ hours duration. That wouldn’t entirely displace firm generation, but it could theoretically get to 10 or 20 percent system cost reductions, which is no small thing.

Chemical storage

Chemical candidates mainly include hydrogen and hydrogen-derived fuels like ammonia and syngas (e.g., synthetic methane). This is something of an odd category, since the result of all these processes is a fuel, which operates just like natural gas, as firm generation. You can see chemical storage as a direct substitute for, or a form of, clean firm generation.

The cheapest forms of chemical storage rely on specific geological features for storage, like compressed hydrogen in caverns and porous rock formations. Energy capacity costs range from $1 to $5/kWh for hard rock caverns all the way down to around $0.5/kWh for some depleted gas or oil fields.

The problem with chemical storage is that, while energy capacity costs are low, there’s lots of infrastructure and conversion processes involved in making hydrogen, storing it, capturing CO2, combining hydrogen and CO2, and then burning the resulting fuel in combustion turbines. This gives chemical storage high power capacity costs and low round-trip efficiency. Lots of work needs to be done to bring down costs, particularly of electrolysis and fuel cells, for making and burning hydrogen respectively.

Mechanical storage

The oldest and still most common form of large-scale energy storage is pumped hydroelectric energy storage (PHES), whereby water is pumped from a lower reservoir to a higher one and then run back down through turbines to recapture the energy. (PHES accounts for about 99 percent of the US grid energy storage market.)

Most PHES installations today are built for diurnal cycling (every six to 24 hours) and have energy capacity costs in the hundreds of dollars per kWh, which makes them unsuitable for LDES.

Some PHES projects with particularly large reservoirs can get over 100 hours of duration at energy capacity costs in the $20 to $30/kWh range, which combined with their relatively high round-trip efficiency means they can probably eat into some clean firm generation at the margins. But those sites are even more geographically limited than PHES generally.

The other viable mechanical LDES technology is compressed air energy storage (CAES), which is just what it sounds like — use energy to compress air, then use the pressure of the compressed air to run a turbine and generate electricity. In the best locations, with access to large saline aquifers, CAES can get down in the $1/kWh range with hundreds of hours of capacity; costs rise in less ideal sites (e.g. salt caverns). Like PHES, CAES is geographically limited (and might compete in some sites with compressed hydrogen storage).

There are many other forms of mechanical energy storage out there, everything from pushing rocks uphill on a train to lifting rocks with a crane to spinning a flywheel, but none of them yet have energy capacity costs low enough to make them eligible as true LDES.

Thermal storage

There are numerous ways to store electricity as heat. The most familiar is concentrated solar power using molten salt, but capacity costs for that technology remain prohibitively high and round-trip efficiency prohibitively low for it to serve as LDES.

There are also (less developed) proposals to store heat in ceramic “firebricks” for electricity or heat applications, with energy capacity costs potentially as low as $5 to $10/kWh and round-trip efficiency over 50 percent. A process called pumped thermal energy storage using reciprocating heat pumps also shows great promise. Thermal storage remains an intriguing area of study, in part due to its usefulness as both direct heat and electricity.

Here’s a roundup from the MIT team’s paper of all the LDES technologies and their projected future costs:

The ultimate potential of LDES

As I said, the research is not explicitly framed this way, but the results strike me as fairly deflationary toward LDES. The low costs and long durations required rule out several existing technologies and set incredibly ambitious targets for others. And even if LDES meets those targets, it won’t erase the need for clean firm generation — at best it will take a good chunk out of it and reduce overall system costs a few dozen percent. That’s not nothing, but it’s not a silver bullet either.

Here’s a visual from a seminar Jenkins gave at Stanford:

Just a few things to note about this graph. The colored boxes are different LDES technologies — the solid lines indicate geographically unconstrained options and dotted lines indicate those that are geographically constrained. You’ll notice that all the options in the $1/kWh box have dotted lines, and aside from CAES, they’re all chemical. There are currently no geographically unconstrained LDES technologies that have even the potential to knock out clean firm generation.

Labels identify a few of the technologies. CAES and hydrogen have huge potential; some thermal technologies and metal-air batteries are intriguing; PHES and reciprocating heat pumps can trim a little off the top.

In reality, there will likely be a mix of LDES technologies in the market, targeting various performance or geographical niches. If I were a betting man — which I emphatically am not — my money would be on hydrogen over the mid- to long-term. It has an advantage similar to LIBs’ advantage in the short-duration market: it can draft off of other, bigger markets.

LIBs for energy storage can draft off of the much larger electric-vehicle market, which is driving their costs down. Similarly, hydrogen and hydrogen-derived fuels for energy storage can draft off of much larger hydrogen markets: industrial applications, possibly airplane or shipping fuel, possibly mixing with natural gas in existing pipelines. Relative to those markets, the market for hydrogen as LDES is likely to be marginal, but it will benefit from the cost reductions driven by scale in those other markets.

Thermal storage might also benefit from being of use in both heat or electricity applications. As I’ve written before, there’s a huge potential market for clean heat.

The practical implication of this modeling is that research and development in LDES needs to focus primarily on driving energy capacity costs as low as possible, while targeting durations of 100 hours or more (beyond the 10 to 100 hours the DAYS program targets) and discharge efficiencies of at least 60 percent.

It’s a tough set of aspirations and there’s no guarantee any technology will get there any time soon, so another practical implication of the research is that we need to start thinking hard about where to find lots of clean firm generation. We probably can’t store enough energy to get around it.

Share this post