Hello there, Voltron! It’s been an interesting week, hasn’t it? A guy writes a tediously long and wonky series on energy transmission and, next thing you know, transmission grids are dominating the news.

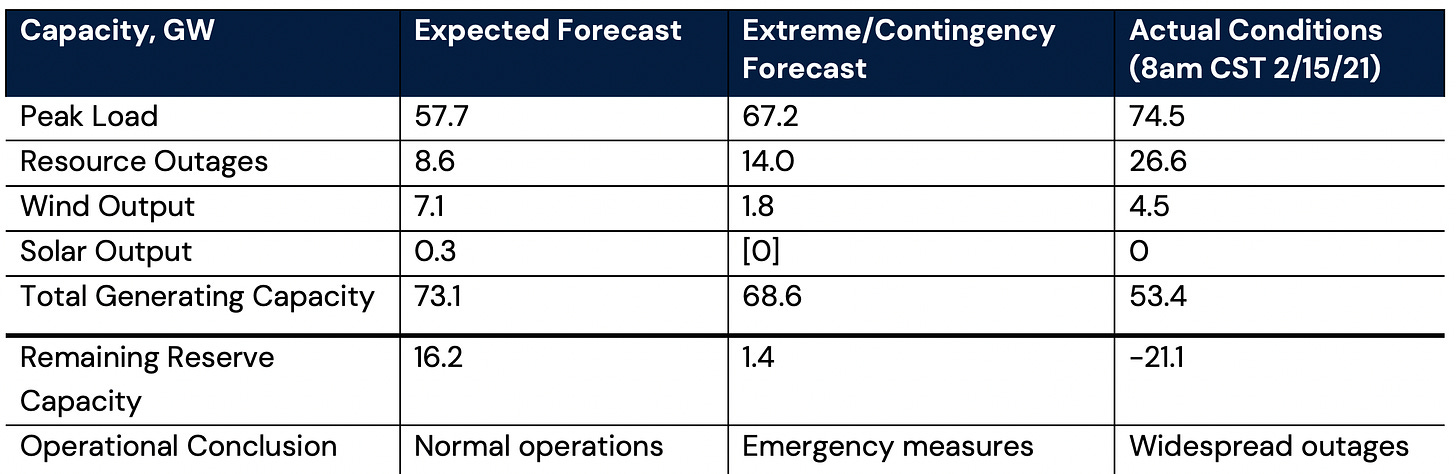

By now, the story of what happened in Texas last week is familiar: an extraordinary cold snap simultaneously a) raised demand on the grid to well higher than the grid operator’s worst-case winter projections, and b) knocked out more than 30 gigawatts worth of energy generators.

Supply and demand must be kept in perfect balance on a self-contained grid like Texas’, so when demand spiked and supply plunged, something had to give — thus the not-so-rolling blackouts.

Most of that lost generation was natural gas and coal. Freezing afflicted not only the water used in power plants but the mining, distribution, and storage of fossil fuels. And, yes, some wind turbines froze, though wind actually performed better than the modest expectations set by ERCOT, Texas’ grid operator.

I’m not going to go through the story in detail. I just want to talk a bit about what it means and what we can learn from it. To learn more about what happened, those affected, and the role Texas’s grid and regulations played in events, I recommend reading the following:

The Houston Chronicle had a great story on the events as they unfolded and is, in general, all over it.

In The New Republic, Kate Aronoff has a great overview, with crucial historical context for why the Texas grid is isolated and why it has an energy-only power market.

In the Atlantic, Rob Meyer has great coverage of the Texas planning failures.

The team at ProPublica has a piece on how Texas regulators “have repeatedly ignored, dismissed or watered down efforts to address weaknesses in the state’s sprawling electric grid.”

In the Los Angeles Times, Sammy Roth has another great wrap-up, with a focus on grid vulnerability.

In the New York Times, a team of journalists pulls together a great backgrounder on Texas’s unique power market structure and grid independence.

In the New York Times, Princeton energy analyst Jesse Jenkins has a piece on the crucial failure of Texas utilities to future-proof their assets.

In the Wall Street Journal, Katherine Blunt and Russell Gold have a story on the implications of the disaster for the energy-only market.

In Utility Dive, Alex Gilbert and Morgan Bazilian write on what happened and what it means for Texas grid regulation.

The New York Times’ Brad Plumer explains what climate impacts will mean for the nation’s power grids.

At Gizmodo, Molly Taft reports on how much the oil and gas industry is paying Republicans to lie about what happened.

And here’s the Wall Street Journal editorial board lying about what happened.

Any handful of those stories (save the last) will fill you in on what happened and why. Now let’s talk about what we can learn from it.

It was going to be bad in Texas regardless

One thing worth emphasizing up front is that Texas just faced an extremely unusual event. It got much colder, much faster, and dumped more snow and ice, for longer, and took out more energy infrastructure than even the grimmest forecasts predicted.

Yes, the state has had cold snaps before — including in 2011 and 2014, producing a set of recommendations and guidelines that state regulators made voluntary and state utilities largely ignored — but this was extreme even in context.

We’re going to touch on better planning, helpful technologies, and reformed regulatory structures, but the grim truth is that there is probably no alternative set of planners or regulations that would have adequately prepared for what took place last week. They certainly could have done better, but this event was fated to be rough.

If we’re going to start seriously preparing the electricity system for long-tail, low-probability events — the kind climate change is making more likely — it will be a new thing, not something that’s been mastered by any current entity or regulatory body.

Small picture: Texas electricity and natural gas systems need to be weatherized

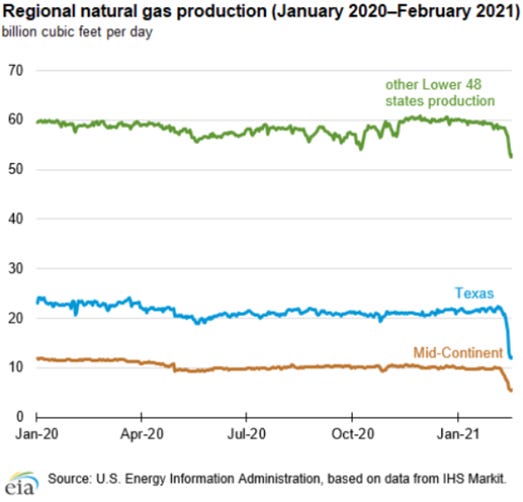

The Texas mess is being characterized as a grid crisis, but it was actually a generation crisis. Two-thirds of the state’s power comes from natural gas, and a) natural gas wells and pipelines froze (cutting normal production by about 20 percent), b) commercial and residential heating got priority access to natural gas, per state policy, and c) natural gas power plants froze.

[Clarification: national natural gas production fell by 20 percent; Texas production fell by 50 percent.]

Some coal plants and wind turbines also froze up, and one of the state’s nuclear plants went offline for unrelated reasons, but the bulk of the 30+ gigawatts of energy generation that went offline was natural gas power plants (many were also down for scheduled winter maintenance).

Natural gas production and distribution falls under the purview of the Railroad Commission of Texas, so it is the RRC that will need to update regulations to make sure this doesn’t happen again on the production side. Given the RRC, that seems … unlikely.

As for power plants, after the 2011 rolling blackouts, Texas should have required all generators to weatherize. It’s perfectly possible for natural gas plants and wind turbines to operate in the cold — there are wind farms in the Arctic. But the weatherization recommendations released in the wake of the blackouts were made voluntary and very few generators followed them.

Some have argued that this failure to prepare can be laid at the feet of Texas’ energy-only market — the only such market in the US.

In other restructured areas (like PJM in the Mid-Atlantic), alongside energy markets there are capacity markets, through which generators can get paid to maintain generation capacity in reserve, in the name of reliability.

Texas has no capacity market. The incentive to maintain reserve capacity is supposed to come from the fact that the price of energy is allowed to swing with supply and demand. In times of high demand and/or constrained supply, prices rise, sometimes to many multiples of their normal level. Generating energy during those times can be incredibly lucrative. That’s supposed to induce generators to set aside (and weatherize) some capacity, to take advantage of those rare moments.

It’s not a “free” market — no electricity market is — but it is more lightly regulated than its regional neighbors.

For the past 10 years, the Texas grid has generally maintained lower reserves than, say, PJM, but it has performed quite well, despite persistent predictions to the contrary. During that time, Texas ratepayers saved quite a bit of money with their lean system.

It’s not clear that if Texas had a capacity market, it would have avoided what happened last week. If a generator is set aside as reserve but it freezes, it doesn’t help. Capacity markets could impose regulations or mandates requiring generators to weatherize, but then again, so could regulators in an energy-only market. It is perfectly within the power of the Texas Public Utility Commission (PUC) to require weatherization. It just didn’t.

Any regulatory system is going to need conscientious regulators and good planning. The larger lesson of the cold snap is that Texas, like the rest of the country, needs to plan its grid around resilience and redundancy rather than optimization, market or otherwise.

Big picture: the Texas grid needs resilience in three directions

The basic climate forecast for Texas is that it’s going to get warmer on average, but there’s a decent chance these freak cold snaps will get more frequent and nastier. (Like all climate science trying to pin down temporally and geographically narrow effects, this is provisional and there is disagreement within the science community.)

That is a brutally wide range of conditions for which to plan and prepare. And the same basic problem will face grids in every region of the country. Climate change means a less predictable, less stable set of futures.

Texas needs to work toward resilience at three levels.

Improving the existing energy system

Even assuming it eventually wants to, or is forced to, it will take Texas a while to decarbonize its grid, working its way free of natural gas. In the meantime, it needs to take steps to ensure the security of supply, including weatherproofing major wells and pipelines and bulking up reserves.

Clearly all power plants need to be weatherproofed, something that falls entirely within the jurisdiction of the Texas PUC.

The Texas grid needs to be better and more finely segmented, so power outages can be more targeted, rather than akin to a lottery (homeowners who happened to be on a circuit with a hospital retained power).

And ERCOT, like all transmission grid operators, could investigate the many ways of increasing the capacity and performance of existing transmission lines (see: transmission month).

Improving local resilience

One thing this crisis highlighted is the desperate need for demand-side resources on the Texas grid (measures the PUC and utilities have traditionally resisted). The state is way behind on “demand response,” whereby large groups of customers can be coordinated to reduce demand at times of grid stress. (FERC recently gave demand response access to capacity markets in areas under its jurisdiction, a decision the Supreme Court backed.)

Perhaps the most basic step would be to better weatherize and insulate Texas’ homes and buildings, so they don’t require as much energy to heat and cool and they don’t lose heat as fast if the power goes out.

Solar panels wouldn’t do much good in a snowstorm, but other distributed energy resources like batteries and electric vehicles can provide emergency power. At the community level, larger battery or other storage installations (perhaps fuel cells or flow batteries) located within distribution systems could help run community resilience centers, where at least people could congregate to stay warm.

And microgrids that could island off from the larger grid and run on stored emergency power in the event of a blackout would have helped many Texans through the worst of the cold.

I recommended the same set of local resilience and distributed energy solutions for California — which has had its own grid woes, despite not having an energy-only market — in a much more detailed piece, if you want to dig in.

Improving interconnection

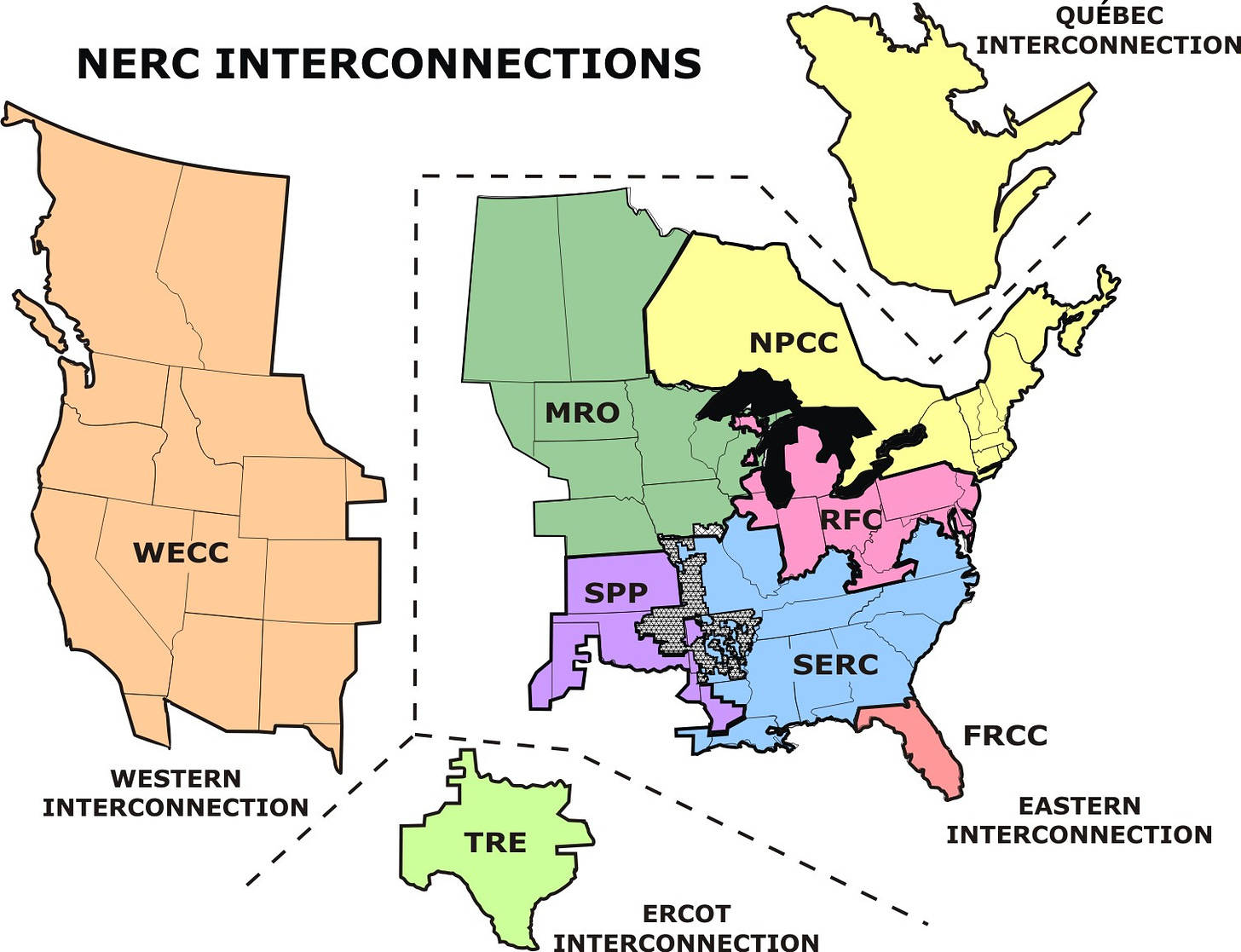

Texas, notoriously, runs its own grid, an island between the Western and Eastern Interconnections.

There’s a long history behind why this is so (read Aronoff’s piece, and also this), but the gist is that, by not transporting electricity across state lines, the Texas electricity system escapes federal jurisdiction, in the form of the Federal Energy Regulatory Commission (FERC).

Texas has long been, and remains, ornery about federal authority.

Because its grid is an island, Texas could not import power from, say, nearby Southeast states, where conditions were somewhat better. It could only cut power to customers.

(Notably, El Paso — which for quirky historical reasons isn’t on the ERCOT grid, but rather on the larger Western Interconnection — survived the storm just fine, because it could import power from neighboring states.)

It’s difficult to envision Texas allowing this arrangement to change. A transmission developer would have to propose an interstate line and ERCOT would have to approve it, at which point FERC could reasonably assert authority. But Texas has fought off such attempts in the past and shows little appetite, even in the face of this crisis, for submitting to the feds. It might bring the dread Green New Deal to the state!

A few years back, a project called Tres Amigas proposed to connect the three US interconnections with HVDC lines. Even though it argued that it wouldn’t trigger federal jurisdiction over Texas, the project ended up dying.

Nonetheless, it’s at least worth noting that it would be to Texas’ benefit to build HVDC lines to the other interconnections. Among other things, it could import power when 30 GW of generation goes offline. Building a few HVDC connections would probably be cheaper in the long run than trying to up-armor the state’s entire natural gas infrastructure and all its wind turbines against once-a-decade cold conditions.

That’s the beauty of a national transmission grid: no region has to prepare for every conceivable weather pattern. When extreme or unusual conditions strike, any region can draw power from elsewhere in the country. All things being equal, interconnection boosts resilience and reduces prices.

Perhaps ERCOT and FERC could work out some sort of deal, whereby the feds promise not to impose a capacity market or other dramatic market changes on the state as long as it meets basic North American Electric Reliability Organization (NERC) reliability standards and takes steps to interconnect with the rest of the country. Everybody wins.

Resilience costs money

All the recommendations for Texas above apply equally to every state and regional grid. They all need to quit planning based on past conditions and instead plan for a future of wider variation, less predictability, and more frequent extremes.

That calls for resilience: improving the performance of existing infrastructure, improving local resilience through efficiency, weatherization, and distributed energy resources, and improving interconnection with neighbors through HVDC lines.

All of that costs money.

Texas has been demonstrating for a decade that it’s possible to operate with slimmer reserves, closer to a just-in-time delivery model, and save quite a bit of money for ratepayers. It works pretty well most of the time, except for once a decade or so, when it catastrophically fails.

In the wake of such failures, with the human costs evident, it’s easy to blame regulators and demand more resilience. But imagine if, five years ago, Texas legislators and regulators had approached the Texas public and proposed to substantially raise its electricity rates in order to weatherproof its electricity system against once-a-decade (or in this case, maybe once-a-century) conditions. It would not have been popular.

It’s just difficult to spend money wisely, with an eye on long-term resilience. The short-term incentives align against it — not just the market incentives, but the political incentives. It’s difficult for Texas, it’s difficult for California, it’s difficult everywhere.

And it’s especially difficult in the US thanks to the fundamental misalignment between our current social and environmental goals — lower carbon, better performance and efficiency, increased resilience and security — and the regulatory incentive structure within which US power utilities operate.

They make money by investing in capital projects. They don’t want to do more with less; they make money by doing more with more.

The US utility regime is designed for expansion, for building out electricity infrastructure to a country without it. Now that the electricity system is built out, now that it needs to be ruggedized and fine-tuned, now that local distribution systems need more autonomy and intelligence, that regime is no longer serving us. We end up, again and again, working against utilities, trying to kludge together artificial incentive structures to persuade them to do stuff they simply aren’t designed to do.

Getting to resilience and national interconnection by fighting through 50 public utility commissions is going to take forever. What’s needed are some federal performance standards and a large-scale program of public investment into electricity infrastructure. Congress needs to step up and act like climate change is a national emergency.

Texas may lose some of its treasured autonomy in the process, but it will gain a more effective and resilient electricity system.

Share this post