According to a new paper out of Oxford University's Institute for New Economic Thinking, previous research has overestimated the future costs of clean energy technologies by underestimating the impact of learning curves. In this episode, co-author Doyne Farmer discusses the exciting implications.

Text transcript:

David Roberts

About a year ago, a group of scholars at Oxford University's Institute for New Economic Thinking released a working paper that made a considerable splash in the world of energy nerds. It has now been peer-reviewed and published in the journal Joule. It is called “Empirically grounded technology forecasts and the energy transition,” which, I think you'll agree, is a title that really gets the blood pumping.

At the heart of the paper is a new way of forecasting technology costs that is more grounded in history and empirical data than the integrated assessment models (IAMs) used by organizations like the IPCC and the IEA. Those models have notoriously overestimated the future costs of clean energy technologies, and consequently counseled insufficient climate action, for decades now.

The Oxford scholars take a different approach, centered on technology "learning curves” (sometimes called “experience curves”). They begin by noting:

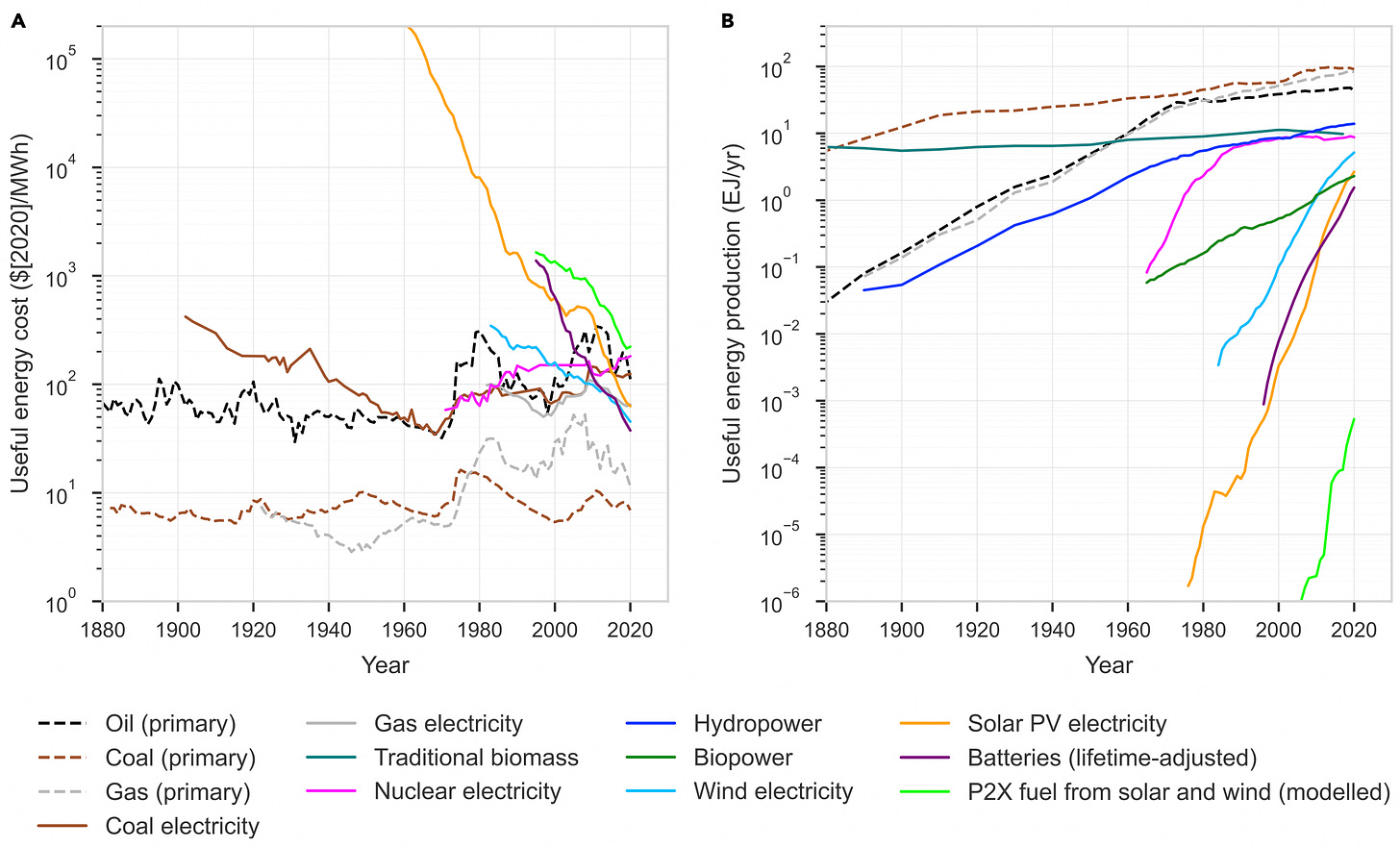

The prices of fossil fuels such as coal, oil, and gas are volatile, but after adjusting for inflation, prices now are very similar to what they were 140 years ago, and there is no obvious long-range trend. In contrast, for several decades the costs of solar photovoltaics (PV), wind, and batteries have dropped (roughly) exponentially at a rate near 10% per year.

Those key clean-energy technologies are on learning curves. For technologies on a learning curve, “costs drop as a power law of cumulative production.” Another way of saying that is, for every doubling of cumulative production, per-unit costs fall by X percent.

What that X figure is will vary among different technologies (and for many if not most technologies, there will be no learning curve at all), but the somewhat eerie thing is, for a given technology, X — the rate of learning — tends to persist over time within a relatively narrow band. Learning curves, historically, have been quite predictable and steady.

Learning curves are the subject of a rich and long-standing literature. What’s novel about the Oxford paper is that it develops a new method of forecasting technology costs grounded in established historical learning curves.

The forecasts make probabilistic bets that technologies on learning curves will stay on them. If that's true, then the faster we deploy clean energy technologies, the cheaper they will get. If we deploy them fast enough reach net zero by 2050, as is our stated goal, then they will become very cheap indeed — cheap enough to utterly crush their fossil fuel competition, within the decade. Cheap enough that the most aggressive energy transition scenario won't cost anything — it will save over a trillion dollars relative to baseline.

We've gotten the sign wrong: the transition to clean energy is not a cost, it's a benefit. The implication is that it makes overwhelming sense to rapidly transition to clean energy technologies, without even counting climate and air pollution benefits. That's why the paper made a splash.

To discuss it, I called one of its co-authors, Doyne Farmer. Farmer is a longtime scientist and entrepreneur who has studied complex systems in physics, biology, and economics. His scientific accomplishments are too many to relate, but among them has been much recent work on learning curves and their dynamics.

I called him to talk about how his projections differ from the conventional sort, what other technologies might get on learning curves, and the implications of his forecasts for the broader energy transition.

Alright, with no further ado, Doyne Farmer welcome to Volts. Thank you for coming.

Doyne Farmer

Very happy to be here.

David Roberts

There's so much to discuss in this in this paper and your research. But let's take a step back and just kind of start with the basics. So maybe let's just start by explaining what is a learning curve — AKA an experience curve — and what is Wright's Law, and how do those relate? Let's just talk about the sort of basic concepts the paper is working with.

Doyne Farmer

Sure. So Wright's Law and learning curve are the same — they're different names for the same thing. It's called Wright's Law because Theodore Wright was the first person to propose this hypothesis. He was a World War II ace who went into the aviation business, and in 1936, noted that for a specific type of plane, produced at a specific factory, the cost of making the plane tended to drop by about 20% every time the cumulative production of the plane was doubled. And he actually became head of aviation for the US during World War II and used his own law to forecast aircraft production prices during the war.

So it's come to be called a learning curve, also, because the hypothesis is that cumulative production is a proxy for experience, doing, and that the reason that costs drop is because people learn. Now, there's other evidence. There's also something called the power law practice in psychology which says that when people do routine tasks, like the original paper was on summing up numbers, that the speed with which they can perform the task drops as a power law of the experience that they have.

David Roberts

Let me ask this then. The Law, Wright's law, it isn't pegged at 20% specifically, right?

Doyne Farmer

No.

David Roberts

It's just the idea that you get a predictable percentage based on doubling of capacity.

Doyne Farmer

That's right. And if you write it in mathematical terms, that means that the cost goes down as what's called a power law, which means slower than exponential, but it still keeps dropping. It drops more and more slowly per amount produced as time goes on because, remember, it's cumulative production, doubling. So it takes an exponential increase in production to get the drop, whatever percentage it will be, to happen.

David Roberts

And so is the idea that the actual percentage will be sort of bespoke to every different product you're talking about?

Doyne Farmer

Yes, that's right. And that's essential here because it turns out that fossil fuels have a very different percentage than renewables.

David Roberts

Right. So how do you determine a learning curve? It just requires historical data, right? You just have to sort of look at history.

Doyne Farmer

The only way to do it is to look at history. Now, sometimes you can guess at the learning curve by looking at a related process that you think is enough, like the one you've got to be a good proxy. But mostly what you really want is history, and the longer the better.

David Roberts

So you grow more confident in the precise learning curve the longer historical data you have, presumably?

Doyne Farmer

That's right.

David Roberts

So there is a long and rich literature on learning curves out there in the world. And as we're going to get to a little bit later, learning curves are even sort of incorporated in current models, albeit in kind of limited ways. So tell us what is new about this research that you've just published in Joule.

Doyne Farmer

So the new thing is that we reformulated the way learning curves are used to produce a reliable and empirically, grounded, probabilistic model.

David Roberts

My next question is what the heck is an empirically validated probabilistic forecast? So let's get right into that.

Doyne Farmer

Yeah. No, I'll explain. I mean, the problem is if you just take the learning curve and you make your forecast, well, fine, you have a forecast, but how accurate is it? It's not going to be perfectly accurate, but what are the error bars? And if you don't have error bars in a forecast, then it's not much good because you don't know whether you can count on it. So to do that, we had to first change the way it's formulated. So we made it, what's called a time series model, meaning that we assume we have points that are ordered in time, and we make a forecast for the cost next year, and the year after that, and so on. That's rooted at the current time.

Another way to say it is we reformulate it as what's called a random walk with drift. In other words, we allow for the fact that the forecast is never going to be completely accurate. And a random walk is something where you have steps and there's some randomness in each step. There can also be some determinism in this step. The random walker may like to walk to the left more than the right. And so we recast the formula for Wright's Law so that it can be used in that kind of way.

Furthermore, we derived a priori — we derived an estimate for the distribution of likely possibilities in the future, assuming that model. So that's what allows us to make it probabilistic because we don't just say, "in 20 years, solar energy prices are going to be this."

David Roberts

Right? If you have a particular percentage learning curve, the straightforward thing to do is just say, you know, based on that percentage X doublings, you get X, you can get, theoretically, a pretty precise number.

Doyne Farmer

That's right. But that number in reality is not going to be very precise, and it's going to depend on things like how accurately do you know the percentage of the learning curve, with finite data You'll never estimate it perfectly. Part of our hypothesis and part of our reformulation is to allow for that inherent variability, which also varies from technology to technology. So transistors, for example, have very little inherent variability. Solar cells have more inherent variability. And we fit that to the data because we see that that matters. Things that have come down in a really steady way in the past, tend to keep coming down in a really steady way. Things that have come down in a bumpy way, tend to come down in a bumpy way.

David Roberts

This is a question I have, and I'm not even sure I can formulate it right. But you go and look at historical data, and you find these learning curves and one of the things you sort of emphasize in your research is that these learning curves tend to be quite regular. Once you've figured it out, it seems to hold really well over time. And so that raises the question to me of, like, what is the causal story here? Why does tech development follow this very regular pattern? What is it about solar cells, for instance, that means, like, exactly 20% drop in cost for a doubling of capacity? When anytime you hone in and look closely at solar cell development, what you see is like a multiplicity of different environments, different economies, different, you know, sort of larger circumstances surrounding it. Like, there's so much variability in circumstance, and, yet, this regularity emerges out of it. Why?

Doyne Farmer

Yeah, so I can answer this in two different ways. My first answer would be I don't know. Nobody knows. But then I'll give you the answer for what we do know. So first of all, I would never say that we know that the the percentage is exactly 20% for solar energy. In fact, empirically, it's a bit higher than 20%. But there are error bars on that number, and our formula takes that into account. Okay? So that amplifies the uncertainty. In fact, the short-term uncertainty is always just the inherent bumpiness. The long-term uncertainty is always the uncertainty and parameters because that grows faster with time.

Now, the other way I would answer this is to say, "we're just looking at the long-term view here. We're not saying anything about the bumps, what's causing the bumps in the road." So for solar energy, for example, the cost of a solar panel is about 1/5,000 of what it was when it was used in the first Vanguard satellite in 1958. And it's come down reasonably steadily. But there have been periods where the price went up due to material shortages. There have been other periods where it dropped faster than usual, say, when the Chinese stepped into the game.

So there are bumps around that. And we don't say anything about what those bumps are because those are probably a lot harder to forecast. It's a little bit like when Wright made his original statement. He didn't know what the improvements in the factory floor were going to be that caused this to happen. He just observed that it happened. We have taken it from something that was originally about a specific airplane and a specific factory, to something that's about the global cost of PV panels from all places that make them. So the use of this has been generalized.

David Roberts

And in your previous research, you went back and looked specifically at a bunch of different technologies, looking for these patterns.

Doyne Farmer

Yeah, we looked not just at energy technologies, we looked at 50 different technologies spanning a gamut of chemical processes, electronic manufacturer, and many others. And we gathered all the data we could. The data allowed us to make about 6,000 forecasts, and we pretended to be in the past, so knowing nothing about what happened from the point in the future. And then we tested our formula by testing to see how well it did making those predictions. And when I said tested our formula, we didn't just test the point forecast, we actually tested the probabilistic formula for the error.

David Roberts

I kind of want to pause and emphasize this because, I think to a lot of sort of lay people listening, they would sort of assume that, like, if you develop a model, of course, you go back and see how well it would have predicted what actually happened, right? That's called backcasting, is that what it's called?

Doyne Farmer

Backtesting. Yeah, they're different name ... backcasting.

David Roberts

But actually a lot of models don't. A lot of models don't do that, and they don't perform particularly well if you do do that. So it's notable, at least, that you guys went back and actually tried to look and see, like, would this have worked if we had made X prediction at X time?

Doyne Farmer

Yes. And that probably comes from my ... I spent eight years as the scientific leader of a quantitative hedge fund, and this is something I beat into everybody, as being the head of research, that that kind of testing is essential. Though, even here, one needs to be careful because if you do that kind of testing enough then you aren't really testing out of sample anymore, and your results can become invalid. One nice thing about this is it worked the first time we tried it. So that's what you like to see.

David Roberts

Yeah, but one last question about the causal thing, though, is which is just on a very general level, sort of if you don't know why this regularity is emerging, doesn't that give you some pause about assuming that it's going to continue emerging? Like it's sort of spooky that it does, right? It's spooky that it keeps happening, but how much do you trust it?

Doyne Farmer

It's somewhat spooky. You're certainly right, that without a good causal explanation, one should be wary. But let me actually say the other answer I would give about what we do understand. So I have a paper, the lead authors, James McNerney, where we developed a theory for why Wright's Law holds. We're building on some work by a couple of other people, but we refined that work.

And the basic idea there is engineers — how do engineers design something? Well, they design something by throwing darts at a dartboard. And there's some kind of measure of the score of how good the throw is. And engineers are just smart enough to pick out the dart that has the best score. So that idea gives you Wright's Law, where every dart throw is like producing something, and it gives you this kind of improvement measure. Now, we actually did it a bit more complicated than that. We assumed we had technologies with more than one piece. So think about, say, an automobile. You've got carburetion, you've got the engine. And so we assumed actually that engineers, in each department, threw their darts, and in order to make an improvement, the dart throws from the engineers in each department have to line up.

And that actually strengthens the prediction because, turns out the percentage depends on how many different departments have to coordinate. Something that's called the design structure matrix. So the more departments that have to coordinate, that is the more complicated the device is, the lower the percentage.

So that gives you some kind of explanation. But it's not a deep explanation that you can say this technology...you have to make some kind of judgment about how complicated it is. And that's probably not the whole story either. But our hypothesis has been tested a couple of times, and it's roughly speaking true. And that's, unfortunately, the best explanation we've got.

David Roberts

The distinction you make in the "Joule" paper is there are sort of two sets of technologies: one set that don't seem to demonstrate learning curves and another set that do. Can we say anything on a general level about why a technology is in one set rather than another? Why... notably in our case, fossil fuel technologies like you say, fossil fuels are inflation adjusted, roughly as costly as they were 100 years ago. Like that. We haven't seen a learning curve. Obviously, the way you determine which technology is in which category is going and looking at the data so that the data will tell you. But do we know anything, in terms of theorizing it, why technologies fall on one side of the line or the other?

Doyne Farmer

Again, my first answer would be no. But we do know something. There are some patterns. For example, things that we mine out of the ground don't seem to improve through time. You can look on the US Geological Survey website where they have data for minerals, for the price of minerals and the quantity produced over more than a century, for more than 100 minerals. And minerals, in this broad sense, includes oil, and natural gas, and things like that, and none of them improve with time by a statistically significant amount.

David Roberts

Just to make a note about that. I mean, people probably think, well, doesn't mining, I've heard about all this automation, all these new mining machines. The practice of mining is improving, but it's working against this other phenomenon of you're getting all the easiest minerals out first. So they sort of balance each other out.

Doyne Farmer

They seem to balance each other out. Now it's a bit peculiar that they balance each other out exactly.

David Roberts

Yes. I was going to say once again, what the heck? Why does that regularity hold across all these minerals, all these different kinds of mining practices?

Doyne Farmer

So the answer is we don't know. I don't know, and nobody else does. But there do seem to be families, like I mentioned, chemical processes. Chemical processes all tend to have fairly similar properties, vis-à-vis Wright's Law. And electronics, performance of a transistor, performance of hard disks, those all tend to drop and behave similarly.

David Roberts

Well, another mystery in this area is, I think, why minerals...I get the dynamic why they don't get on learning curves, and I sort of understand why a modular technology, like solar panels, does get on a learning curve. But what's up with nuclear? Like why hasn't nuclear power gotten on a learning curve, when it seems like you're building this technological thing? It seems like it ought to, right? But it doesn't. Do we know why?

Doyne Farmer

Part of the story is, probably, that nuclear reactors are not cookie cutter items. They're things you construct. They're not things you manufacture. You don't build them in a factory.

David Roberts

Right.

Doyne Farmer

So they aren't really mass-produced. Now there have been attempts to mass-produce them. The French tried to make it more cookie-cutter, and the Koreans have had some luck in bringing the cost down, but only very weakly. You know, Korean nuclear reactors have dropped in cost at about a percent per year, which is pretty slow. And there are proposals to make modular nuclear reactors, to make small nuclear reactors and manufacture them. Now there are inherent scale arguments that work against that. There's a reason why they make nuclear reactors big because it's advantageous to make them bigger, intrinsically advantageous. So for modular nuclear reactors, you're starting at a really high point, and not everything that's modular obeys Wright's Law.

David Roberts

But that's sort of the bet, right? I mean, I think the reason there's so much enthusiasm around smaller modular nuclear is the idea whether people can sort of expressly formulate it or not. But the idea is you're going to get something like Wright's Law kicking in if you're manufacturing more often smaller units.

Doyne Farmer

Yeah, but I will bet a hundred to one against that succeeding.

David Roberts

Really?

Doyne Farmer

Yeah. Anybody that wants to take my bet, I'm happy to make it a formal bet.

David Roberts

Is there a particular reason? Is it specific to nuclear?

Doyne Farmer

Yeah, there's a string of arguments of why modular nuclear reactors are, as I said, they're inherently more expensive than big nuclear reactors. So that's a big gap that has to be overcome. And just because you make them in a factory, doesn't mean that Wright's Law is going to hold. And we have other technologies that are way ahead of them now and that are coming down at 10% per year, satisfy Wright's Law really well. So they're coming from way behind.

David Roberts

Yeah. And they're chasing a receding target.

Doyne Farmer

Exactly. Now fusion is different. Fusion has been, despite the fact that it's been way out for many years. And when I was in graduate school, which is a long time ago, there was already a joke that fusion is just 20 years away and always will be. It does look like fusion is actually coming down, and maybe in 40 years, it will become a player. But I think fission is out of the running.

David Roberts

Interesting. Well, let's turn then to how this all plays out in the modeling. So you note in the paper that the sort of conventional models that are used by the IPCC, and the International Energy Agency and et cetera, et cetera, they're integrated assessment models, IAMs generally. You note that they actually do apply Wright's Law in those models, but they attach some restraints. So like, they put a floor on the amount that the price can fall, or they put a limit on the rate that production can double, and et cetera, et cetera. So your model ends up projecting much lower costs for these key renewable technologies than traditional IAMs. And does that explain the difference, those sort of restraints that they're building in to Wright's Law in those models?

Doyne Farmer

We think that's the biggest difference. We haven't been able to peer inside the guts of these models to really see or do the experiments you need to do because these models are complicated. But we think that's the main difference because of course, if you put a floor, then a floor is a floor, you're not going to go below it. And similarly, if you put a constraint on how fast stuff can happen, that's as fast as things can happen. And the predictions of those models depend sensitively on those assumptions. Now, we have a nice figure in our paper that makes people chuckle because we show the historical floors that have been proposed over the last 20 years, and we just show solar energy prices punching through those floors again, and again, and again. Yet, there's still models out there with floors in them, people are still using them.

David Roberts

But you make the point that if you go back in time and project forward, just with Wright's Law, with no restraints on the pace of doubling, no restraints on the pace of price falling, that gets you the most accurate prediction.

Doyne Farmer

That's right. In fact, I did publish a prediction in 2010 in "Nature", that by 2020 solar energy would be cheaper than coal-fired electricity, or nuclear power. And at the time, that was viewed as a wacky prediction. "The Economist" said in 2014 that solar energy is the most expensive way to deal with climate change. But hey, I was right.

David Roberts

Yeah. Yeah. It's sort of legendary in my circles now that if you look at predictions of solar's spread, the only prediction that got it right in the early 2000s was Greenpeace's. And it wasn't based on empirical anything. It was just sort of like an aspirational prediction. And even they undercounted. Even they undershot by a little bit.

Doyne Farmer

Yeah, well, I undershot by a little bit too. So my prediction was just based on just looking at the data, and fitting Wright's Law to the data, and you can also fit Moore's Law to the data, equivalently. That's kind of another story. But that's all I did. Very simple.

David Roberts

Let's talk about your model then. You modeled three scenarios and no transition, where fossil fuels retain their position, a slow transition, and then a fast transition to renewables. And you find that the fast transition is the least costly, or I guess maybe that's not the way to put it. It's not costly at all.

Doyne Farmer

Saves us money.

David Roberts

Yeah, it saves the most money. So here's my question. So if we're talking about Wright's Law, Wright's Law says you double production, you drop the price by X percent. So it just seems to me to follow from that, as a matter of logic, that the faster you go, the cheaper it is. I mean, it's like you don't even really have to dig too much in the empirics. It's just that — it's just a logical consequence of the law that the faster you raise production, the faster the price is going to fall, and the cheaper the overall transition is going to be. I mean, can we sort of, like, generalize that way? Like, faster is always cheaper?

Doyne Farmer

Yes and no, because there's other things going on that we also look at. Like, in order to make the transition, we have to build out the grid. We need charging stations for electric vehicles, so we have to change our infrastructure. Now, the 20-year timescale that we picked, there are two things about it that are nice that just happen to work out.

One is that it corresponds to just extrapolating the rate at which the technologies have already been getting rolled out. So solar energy has been getting increasing in usage at about 40% per year, for 30 or 40 years now. Wind has been increasing in usage at 20-25% per year, over the last 30 years or so. And batteries, similar story. Electrolyzers, similar story, although not as long. So those are the four key technologies that we use in our scenario. So those technologies have a history, and we just pretty much extrapolate that history or even slow it down. But we don't speed anything up relative to how it's been speeding up, other than, the fact that an exponential increase is inherently speeding up, in linear terms. In other words, photovoltaics, or the deployments, rising exponentially, that means if you plot it on a graph, the slope gets steeper and steeper over time. And in fact, this is typical for technologies. They tend to improve on what's called an "S" curve.

David Roberts

Right.

Doyne Farmer

Where they rise exponentially over periods of time that can be ranged from 20 years to a century. And then they flatten out once they saturate so that they've reached maturity, and they filled up the market that they can fill up.

David Roberts

Right. So I want to kind of pause and underline this, just the fact that all your model is doing is saying, that what has been happening is going to continue happening, right?

Doyne Farmer

That's right.

David Roberts

The conclusions are so stark, and shocking, and out of the sort of mainstream modeling that I think people assume there must be something fancy going on. But really, this is just, we just assume that things are going to keep happening the way they've been happening, which seems so obvious and intuitive. It's a little baffling that no one's done that before.

Doyne Farmer

It is. I sometimes joke that the people at the International Energy Agency don't have any logarithmic craft paper because you plot the data, and you can see it in our paper, you plot it on semi-logarithmic scale. And all four of these technologies have very steady exponential improvement curves. Now, we know at some point they have to start rolling off of them. And that's where the debate comes.

David Roberts

Yeah. So getting back to the "S" curve, you know, listeners will probably be familiar with this. I've published that picture of a bunch of S curves a million times. But so, you know, they sort of start growing very slowly, and then they hit a point where it's like zoom way up, and then they hit a point of saturation where they level off. So all the kind of debates about where these four technologies are going to end up have to do with where are they on that curve. And so, as far as I can tell, what you're saying is for the next 20 years, all four of them are going to be on that upswing. None of them are going to hit the leveling off.

Doyne Farmer

Not quite. Not quite. Solar and wind are well up on that curve. And if you just extrapolate the exponential curve for solar and wind, they become dominant in less than a decade. So they have to start to roll off pretty soon.

David Roberts

Right.

Doyne Farmer

They start to roll off at a point where they're already there, in the fast transition scenario. In fact, in all of them, we have it rolling off starting now, but rolls off slowly in the fast transition, rolls off more precipitously in the slow transition, and it comes close to flattening out in the no transition.

David Roberts

Is there debate about where it plateaus? You could plateau at 99%, you could plateau at 80%. How do you know, or how do you go about guessing where that will happen?

Doyne Farmer

There's two questions. When will it start to plateau? And what level will it plateau at?

David Roberts

Right.

Doyne Farmer

Nobody really knows either of those. And I can stress in our paper, we're just taking scenarios that we think are at least plausible. And then the prediction part is saying, if that scenario holds, this is what the cost will do. And so the second part is the part we're pretty confident about. The first part, we're just saying that we think this is plausible and looking at a range of possibilities. Now, how far it will go before it plateaus depends on how deep the technology penetrates. In our paper, for the transition to happen, we have hard to decarbonize sectors like jet flight.

David Roberts

Right.

Doyne Farmer

So is jet fuel going to come from solar energy? In our fast transition scenario, that's not something that happens in 10 years, but it happens in more like 20 years. And it happens more slowly because electrolyzers are on an earlier stage of the "S" curve. So we have to assume electrolyzers, hydrogen electrolyzers that take electricity and water and make hydrogen, that they have to stay on their exponential rise for 20 years. Solar and wind don't even stay on it for a full decade. And batteries are kind of in between.

David Roberts

Yeah. And this is kind of one of the big enduring ongoing debates in this whole space, is what saturation looks like? What is the sort of nut of fossil fuel use, or emissions, that can't be eliminated? Like, what is saturation?

Doyne Farmer

We assume that eventually they all get eliminated, but some more slowly than others. And in particular, say, take something like jet fuel that relies on having much bigger rollout of electrolyzers and having the cost come down to the point where it can become cost-competitive to make liquid fuels like ammonia, or even fuels that require taking carbon dioxide out and then letting it go back out of the air and putting it back in again. So it's going to require more time to get to the point where those are cost-competitive. But we do the whole business, we do everything. And so we do assume that the final leveling out point is really elimination of fossil fuels.

David Roberts

Is there something general you can say about how long of a historical record is required to get a confident reading on a learning curve? Because, you know, as you say, wind and solar go at this point, you know, 40 years back. 40, 50 years, which is pretty robust, but like, electrolyzers are much newer. How long does the technology have to hang around before you feel confident pegging a learning curve on it?

Doyne Farmer

Well, it depends on how steady the decline is. Because if the technology really declines at a very steady pace, then it's easier. You're going to get a cleaner fit with less data points, and we, you know, with as few as five data points, you can get a forecast that's useful.

David Roberts

You just have bigger error bars if you have less?

Doyne Farmer

Yes, exactly. So as you get more data, the error bars narrow down. Now with electrolyzers, we don't have a long history, and the data is kind of noisy. There are a lot of problems with — is the data even good? Are the measurements reliable? Because these data are not easy to find in many cases. Now, with electrolyzers, let me say I personally have more confidence than what we have in the paper. The paper we just stuck to using the data that we have. I think because electrolyzers are a chemical process, and we have data on other chemical processes, I think it will behave like these other chemical processes, which tend to have percentage drops for doublings around the one that electrolyzers have shown so far.

So I'm personally more confident than what we show in the paper. But in the paper, we just bite the bullet. And the big source of unconfidence in prices, 2050 and beyond, comes from electrolyzers and storage.

David Roberts

When this paper first came out, last year as a working paper, you made a bit of a splash, and there's kind of a game of telephone. And I think a lot of people ended up taking away this notion that clean energy is going to get so cheap that a fast transition is inevitable. So I think it's worth just sort of pausing and noting what you mentioned in passing a second ago, which is unlike IAMs, unlike the sort of IPCC models, you are not attempting to predict the rate of deployment.

Doyne Farmer

Right.

David Roberts

All you're saying is for a particular rate of deployment, this is how much costs would fall.

Doyne Farmer

That's right.

David Roberts

So if you deploy really, really fast, costs will fall really, really fast. You're not saying we are going to deploy really fast. It's an if/then statement.

Doyne Farmer

We're not, and in fact, we want to emphasize that there are bottlenecks out there. There are bumps in the road that we need to get over. The biggest one is the grid. My son works for the Federal Energy Regulation Commission, and he told me that they have enough renewable energy projects proposed, that if they approved them all, and they could all be put online, that we would more than double the electrical capacity of the grid.

David Roberts

Yeah, I think it's like over a terawatt now, I think, is waiting in these interconnection queues.

Doyne Farmer

Yeah, but they can't approve them all because they need grid capacity to put them online. So building out the grid is a big deal, and that requires political will because there may be cases where a right-of-way has to be exercised. And people say, well, that building the grid is going to be really expensive. That's true. But our expected values, because we spent a lot of time looking at what it costs to build the grid too, and because we didn't have historical data, we assume that it's going to cost the same per unit of capacity as it costs now.

David Roberts

So you're not assuming a learning curve for transmission build-up?

Doyne Farmer

No. So we think this is pessimistic, but we try to be conservative across the board. But yeah, it's true. Under the fast transition in 2050, we anticipate that we'll be spending about $670 billion dollars a year on grid. But it's worth noting that even on the no transition, we anticipate spending $530 billion dollars a year.

So, and that's another key point to emphasize here. People say, "oh, it's going to cost so much to make the green transition." Well, it's true, but we're spending money all the time. Right now, we're spending $4 trillion a year to make energy. So you have to really weigh those things across. So it's true that we're anticipating $140 billion dollars a year more expenditure on the grid. On the other hand, we drop the total system cost from 6.3 trillion, under no transition, to 5.9 trillion under fast transition. So the savings more than offsets the expenditure.

David Roberts

Any possible estimate of expenditures is swamped by a trillion dollars of savings.

Doyne Farmer

That's right. One of the reasons the 20-year time scale or 20 to 25 years that we assume there works out well is that there is a built-in time that we're replacing infrastructure. We replace gas stations every 25 years. So if we start putting in charging stations now, we just do that instead of building gas stations, then we can make the transition without stranding assets.

David Roberts

Speaking of the sort of practicalities of it, you don't forecast deployment, you just sort of set these scenarios. But you do say that in your judgment, the fast transition is possible. It's in the realm of possibility. There's no obvious impediments. And I wonder about this. And I mentioned to you when we talked a while ago, there's some new research by Dr. Jessica Jewell, she was on Chris Nelder's "Transition Show" talking about this, which seems to sort of set limits on the kind of the plausibility of the transition. So I just wonder, like, when you say the fast transition is plausible, how confident are you in that? And have you encountered her work at all and thought about that?

Doyne Farmer

Yeah, we've encountered her work, and we don't agree with her critiques. But let me emphasize — we think it's plausible from a physical point of view.

David Roberts

Right.

Doyne Farmer

There are no impediments to doing this in terms of rolling out the hardware and building what we need to build and all that. The impediments are political. We do have a powerful industry that's trying to keep it from happening because it threatens their existence. We have a lot of political impediments to doing it. It's worth noting that if you look right now, solar energy, you might think, "oh, people deploy solar energy where it's sunny first," but that's not what's happened. People deploy solar energy where it's politically favored.

David Roberts

Yeah. Germany is legendarily not particularly sunny.

Doyne Farmer

No, that's right. So over the long haul, there may be, I think we're going to hit a point where my anticipation is that, or my best guess would be that Russia is going to be really slow. They'll be using fossil fuels for a long time there just because they've got it and because, even though renewables are going to get cheaper, they're going to be reluctant to bite the bullet and give up. But they're going to reach a point where they're going to have a hard time selling their oil to anybody else. So I think there are going to be some countries like that that will hang on. In America, we have a rather irrational debate about these things with high fraction of climate deniers and so on.

David Roberts

I'm familiar.

Doyne Farmer

But part of our point is even if you're a climate denier, you should be on board with making a fast, renewable transition because it's just economically profitable to do so.

David Roberts

Right. Well, I was struck by her research because, in a sense, she is attempting to do something a little bit similar to what you guys were trying to do, which is gather historical data on energy transitions and sort of try to tease out regularities, or boundary conditions, on speed based on historical data. So I think at the very least the fast transition, that you model, would be faster than historical precedent, right?

Doyne Farmer

Yeah, but it's already faster than historical precedent. If you look at the first figure in our paper where we show the prices and the deployment of energy through time, what you see is that renewables look completely different than any of the other energy sources that have gone before.

David Roberts

Yeah. A new thing in the world. I think that's a very striking feature of the paper, and I want to sort of emphasize that too, like, really are behaving differently than traditional energy sources.

Doyne Farmer

Yeah, I mean, nuclear power had a very fast rise for a few decades, comparable to solar and wind, but it didn't have exponentially dropping costs. So the thing that makes solar, and wind, and batteries, and electrolyzers unique is that they have a really rapid exponential rise in deployment and a rapid drop in costs, at the same time. And that hasn't been seen before.

It's also the case that solar and wind are both highly modular technologies. You can build a small farm or a big farm, the components get produced in a factory, and you just put it up wherever you can. They have low environmental cost, and so they're relatively easy to permit, compared with nuclear power. So I don't think nuclear tells us anything about what's going to happen, and really fossil fuels don't either. So this is really something new.

David Roberts

One thing you also emphasized, towards the end of the paper, is that despite the sort of startling conclusions about the cost of a transition, in fact, you view that cost projection as kind of a lower bound. You view it as kind of a pessimistic prediction because of well, tell us why. Tell us why you think that even this sort of super cheap fast transition, in a sense, could be in the real world even cheaper than you project.

Doyne Farmer

Yeah. So let me just say two things. One is you call it, I mean, I'm glad you view our results as surprising, but one of the things I would like to do is just make a plot of estimates through time. Because what you see is that, through time, the estimates about the cost and the rate of deployment of renewables, while persistently too pessimistic, have been persistently getting better. That means that we're like completing a process in a certain sense.

David Roberts

Right. Not a huge leap, just an extension of it.

Doyne Farmer

Yeah. Although, let me just say, it is a huge leap in one sense, and there's a big difference between saying, "okay, the renewable energy transition is a burden, but it's not a very large burden" to saying, "it's a net benefit; it's economically the way to go, irrespective of climate change." I think that really reframes the debate to make it an opportunity rather than a burden, and means that countries should be jumping on board, and firms should be jumping on board, because it's the way things are likely to go, and they should be eager to profit from it.

David Roberts

Right. So insofar as it's startling, it's that. It's the sign error, right? It's not a cost. It's literally not a cost at all.

Doyne Farmer

Yeah. It's a change of sign. But back to your first question. We tied our hands behind our back constructing our scenarios by restricting ourselves to technologies where we had data on their performance. In some cases, like the grid, we couldn't do that because we didn't have data, and we had to have that in there. And when we had that, we just assume costs would say constant per unit of capacity. But as a result, we think there are very likely better ways to do this than what we have done.

So for example, we don't assume any load sharing, in the sense of you can geographically diversify and use transmission lines to carry power long distances, and there's good evidence that that may be reasonably cheap thing to do. And I think most people think that's going to be part of the mix in the future. We didn't put that in. We didn't put in several other things that we think could be beneficial,

David Roberts

Including, I'll just note, I'll just throw this in here, the whole cluster of distributed energy demand management, and sort of microgrids, and all this sort of sub-transmission kind of distribution level management of energy from my perspective is hugely generative. It's going to be a huge deal, but we don't have a big historical record for it, so it didn't play a part in this model.

Doyne Farmer

So we didn't put that in there. And whenever we were faced with estimates, we tried to be conservative, and give fossil fuels every benefit of the doubt, and tilt the deck against renewables. We didn't want anybody to accuse us of fudging the numbers, so we really bent over backwards to be conservative. So, yeah, I think our estimates for renewables are actually overly pessimistic.

David Roberts

Are there technologies that you just suspect, on a personal level, that you think are probably on, or going to get on learning curves, and are going to make a big impact that you had to leave out because of the lack of historical record? Like, are there particular technologies that you think are going to mirror this kind of trajectory?

Doyne Farmer

Yeah. For example, I think one should keep an eye on solid-state energy storage. It's striking if you look at the learning curves for capacitors, for example, you look at Moore's Law for capacitors. Capacitors have dropped like 30-40% per year in terms of cost per energy stored, have improved at that same rate in terms of energy that can be stored in a given volume at a given weight. And people are designing nanotechnology, energy storage technologies, that show great promise. Now, probably not over the next 10 or 20 years, but I think in 50 years, I bet that's the way we're going to be storing energy. So if you look at what could be done that way, it's going to be dramatic so that the battery in your electric vehicle is not going to be that big.

David Roberts

Right. And that's going to make things even cheaper. Well, I'm sorry, this is a verbal tick. We have to train ourselves: not cheaper, more profitable.

Doyne Farmer

Yes, that's right.

David Roberts

Just to give people a sense, because we never, I probably should address this earlier on, but just to give people a sense of when I say that when you model the fast transition, you model solar, and wind, and electrolyzers, and batteries getting very cheap. What do we mean by very cheap? To give the listener a sense of like, why these results grab so much attention. Like, it's really striking just how cheap they'll get if we go that fast. So give a sense of the scale here.

Doyne Farmer

Yeah. Now, I'm always bad with numbers. I'm not good at memorizing numbers, but there have already been sales for solar energy farms in the desert in Middle Eastern countries that came in at like two cents per kilowatt hour. And I think it's going to go even lower than that. I mean, I think it may go to the point where the actual generation cost is fairly negligible. The main cost is going to be distribution and storage. Because when you look at the things people are talking about doing, we may have paint, so you can just paint solar panel on your roof.

David Roberts

Right. Or windows, transparent solar panels that are used as windows. Or clothing.

Doyne Farmer

Yeah, I'm looking for it. I'm a sailor. I'm really looking forward to having a fossil-fuel-free sailboat that my boat is a big solar. I have my wind generators and my solar panels coating my whole boat.

Or even the sail itself.

The sail itself, which gives you a lot of area to catch sun with.

David Roberts

Yeah. We had Saul Griffith on the pod a while back, and he made a note of saying that in Australia right now, the cost of delivering energy from a centralized power plant to a house already exceeds the cost of rooftop solar. Even if you discount the price of the energy itself, just the transmission costs are more than the cost of rooftop solar panels in Australia. So in some parts of the world you can already see this. Like, solar generation prices coming down where they're scraping zero, right? Coming down where they are negligible. And I just think that's kind of mind-blowing to think, I mean, who could predict what we'll do with them?

Doyne Farmer

Yeah, it would be pretty interesting. And now in our paper, we assume that we were looking at commercial solar. So we're assuming we're pricing the cost of solar farms, not rooftop on your house, which has also been coming down, but just with an offset because it's more expensive to install and maintain. But over time, that may change. If distribution becomes a dominant cost, then that's going to be a driver to really have more decentralized power generation. My guess is we'll be in a world with a hybrid of personal power gathering and commercial-scale power generation.

David Roberts

Final question here, and this is something you've mentioned in passing a couple of times, but I just want to draw a line under it. You model these three scenarios, and you model this fast transition, which as I recall, gets us to net zero by 2050, I think, in the US. You say that because the speed of the transition, itself, would drive cost down so much that doing that would save us a trillion dollars or more, relative to baseline. Now, what I want to emphasize, and I want to hear you just say a little bit about, is that's purely talking about the cost of energy, saves us a trillion dollars in energy costs ...

Doyne Farmer

12 trillion.

David Roberts

12 trillion. Sorry, these numbers are so big. So save us a ludicrous amount of money, but it's just worth emphasizing, doing so would also reduce to negligible proportions air pollution — pollutant, particulate pollutants and proximate air pollution — and would reduce the amount of climate change that would happen. And neither of those two benefits are getting priced into this model. So when we say save $12 trillion, we're not even talking about the health benefits of reducing pollution and the global benefits of reducing climate change.

Doyne Farmer

That's right. We're just talking about the pure economic benefits, and you're leaving a couple of others out, in that, we can also get energy security this way.

David Roberts

Yes.

Doyne Farmer

Any country that wants to can have energy security with renewables. And secondly, we're getting rid of price volatility.

David Roberts

Yes.

Doyne Farmer

Fossil fuels are inherently very volatile prices. Why? Because the cost of producing them ranges from Saudi oil at $2 a barrel to shale oil at $100 a barrel, in some places. And so as demand fluctuates a little bit and as the suppliers fluctuate, we're moving up and down, making huge swings in the price of fossil fuels.

David Roberts

With consequent inflation, and recessions, and all the economic insanity of the last century.

Doyne Farmer

Right.

David Roberts

So much of it traces back to that volatility.

Doyne Farmer

And whereas renewables have very steady prices because it's just inherently a different story, the costs are pretty uniform. Well, energy is only 4% of GDP. Without energy, the whole economy grinds to a halt. So if we have nice, steady, cheap energy, then that's going to have other side benefits for the rest of the economy. So we're really looking at a fairly long list of co-benefits. Of course, climate change being the biggest one of all. And we haven't priced any of those into this.

David Roberts

Right. So if you did, I mean, assuming you could put a precise price. I mean, I'm trying to imagine like, what is the economic number you put on every country in the world having stably priced domestic energy that meets its own needs? Like, who knows what would happen in the world if that were the case? Like I don't even know how you'd begin to put a price on that benefit. But point being, if you included any of those benefits, that the overwhelming advantage of a fast transition becomes, I don't know, mega overwhelming, super overwhelming. It just is an argument-ender. It just makes the case for transition on economic grounds wildly overdetermined.

Doyne Farmer

That's right. We do quote some numbers. If you include the social cost of carbon, and they're just ridiculous. Once you throw in the social cost of carbon, then the savings are really enormous.

David Roberts

Just before we go, is there a next step for this kind of research, or do you feel like you sort of did what you wanted to do here, or is there a next piece of it?

Doyne Farmer

No, we're definitely moving along, doing new things. One is we want to regionalize the model. We have some discussion about geographic variability because there's a substantial geographic variability in the cost of renewable energy.

So we'd like to make a tool that regional planners can use to think about where they can position themselves. Because we want to make a battery of tools, so that if you're a planner, either in a government or in a firm, and you're asking yourself, "how can my group or my organization be a player in the renewable energy transition?" We can help guide you to the best way to do that. So we want to regionalize this model.

We are also thinking a lot about occupational labor transitions. We have a model for how people transition from one occupation to another and which occupations they can transition to from where. Because when you eliminate the fossil fuel industries, the right answer is not to just retrain all those people to be in the renewable energy business. That's probably not the best fit, both geographically and in terms of skills they need to learn in the retraining. And so you really need to think about the whole landscape of occupational labor and how to navigate the transition. So we think we can put in place tools to make that navigation easy and give good estimates about the effect on the economy.

We're also thinking a lot about supply chain issues because, in the course of making the transition, we're really going to make a fairly dramatic change in the production network of the whole economy.

David Roberts

Yeah, speaking of bottlenecks, like the capacity for producing those minerals and processing those minerals is going to have to jack way up way fast.

Doyne Farmer

Yeah, so that's another one of the things we want to look at in more detail. If you look in this USGS website that I mentioned, the rule of thumb is that while the price of minerals doesn't, the long-term trend is flat. The production of all of them goes up exponentially. So do we have to boost any of those preexisting exponential trends, or are they good enough for us to ride up to where we need to be? And also we may need to be thinking about substitutions.

David Roberts

Yeah, right.

Doyne Farmer

Historically, there have been many cases where people say, "oh, we can't do this because we need this material X, and we don't have enough of it."

David Roberts

Turns out people are pretty clever.

Doyne Farmer

People are pretty clever at finding material Y that is just about as good as material X and, in some cases, better. Chlorofluorocarbons were a good example, where when the refrigeration industry was put under the gun to stop the ozone hole. They moaned, and groaned, and said, "we can't do this, there are no good substitutes." But when they had to do it, they found good substitutes. So those are the kind of issues we're thinking about trying to build a better economic model to really act as a guide through the transition, so that we can do it as quickly, and cheaply, and profitably as we can.

David Roberts

Are you invested at all in trying to get conventional modelers, at the IEA or the IPCC, to sort of integrate these insights that you have in this paper? Are you in dialogue with them at all?

Doyne Farmer

We are not. We would love to be. And that's another, I think, thing we want to do through time is engage more with the influential organizations like the IEA or the EIA ... I always mix up. There's two organizations with those two letters. So we want to engage more.

David Roberts

Yeah. The conventional narrative that all we're discussing, here, is what level of pain we want to accept for future benefits, is so ingrained. I just feel like it's going to take quite a bit of time, and quite a bit of institutional support from those different angles, to beat this new narrative into people's heads because it's really important. The sign change is really important for people to internalize.

Doyne Farmer

I think that's the most important message of the paper. Some other things we're trying to think about is the financial side of this because we really are talking about a lot of investment happening. We're talking about major industry possibly collapsing. Some energy companies, BP and Shell are at least making noise about trying to become a green energy company, but some of the other companies like Exxon aren't really doing that. So we think there's going to be a moment of truth, and those companies play a big role in the economy. And we do want to ensure stable financial markets to make the transition as fast as possible. So we're also thinking about questions around that.

We're thinking about the geopolitical questions because the petrostates really need to tune into this and start taking action right away because otherwise, they're going to be left in the dust and suffer for a long time.

David Roberts

The US, notably having become more of a petrostate in the last, in the last few decades, also has to think about that at the time.

Doyne Farmer

Yeah, we at least have a diversified economy. You know, just sailing along the coast of Algeria. When the price of oil, when they can't sell their oil anymore, their economy is going to just go to hell.

David Roberts

Yeah, the geopolitical stuff is what really breaks my brain. It's just so many effects, so many emerging effects, it's really hard to predict how that will all play out. Well, thank you so much. This is so illuminating, and this research is like very bracing. I love it, and I hope other modelers out in the world take heed. Thanks for coming on and walking through it.

Doyne Farmer

Initially, I was going, "oh, I don't have time to do this." And I actually wrote my son, who works in Washington for the Federal Energy Regulation Commission.

That's the white-hot center of action right now. He's right in the thick of it.

And I said, "well, who are people that I should really be making contact with on this?" And your name was the first one. He said you were, in his opinion, by far the best commentator on this stuff. And I thought, "oh my God, I really need to make contact here." So anyway, shout out from him.

David Roberts

Thank him.

Doyne Farmer

And he's listening to your podcast. So you are having an effect.

David Roberts

Awesome. Well, thanks for that, and thanks for the research.

Doyne Farmer

Thank you.

David Roberts

Thank you for listening to the Volts podcast. It is ad-free, powered entirely by listeners like you. If you value conversations like this, please consider becoming a paid Volts subscriber at volts.wtf. Yes, that's volts.wtf, so that I can continue doing this work. Thank you so much, and I'll see you next time.

Share this post