People of Volts! At long last, Battery Week is here. It is time to get into batteries. Waaay into batteries.

Over the next few posts, I’m going to cover how lithium-ion batteries (LIBs) work and the different chemistries that are competing for market share, but I thought I would start off with a post about why I’m doing this — why batteries are important and why it’s worth understanding the variety and competition within the space.

Lithium-ion batteries are crucial to decarbonization in two important sectors

We know that the fastest, cheapest way to decarbonize, especially over the next 10 years, is clean electrification: shifting the grid to carbon-free sources and shifting other sectors and energy services onto the grid.

LIBs are accelerating clean electrification in the two biggest-emitting sectors of the US economy, transportation and electricity. (Each is between a quarter and a third of emissions.)

First, they are colonizing the EV market and enabling ever-higher performance and range. The global EV market is on the front end of explosive growth:

Researchers at Deloitte expect growth to accelerate through 2030:

As BloombergNEF analysts show in their “Electric Vehicle Outlook 2030,” it’s not just passenger EVs, either. The fastest growing EV segment will be buses, followed by scooters.

The global market for EV batteries alone is expected to hit almost a trillion dollars by 2030. Sustaining that growth is going to require lots and lots of new batteries. The more energy-dense, cheap, and safe LIBs can get, the faster the electrification of transportation will happen.

Second, LIBs are being used both for distributed, building-level energy storage and for large, grid-scale storage installations. As the grid shifts from firm, dispatchable sources of energy like coal and gas to variable, weather-dependent sources like sun and wind, it will need more storage to balance things out and stay stable. Batteries can help at the grid level (they can even serve as transmission assets) and they can serve local resilience at the building and community level.

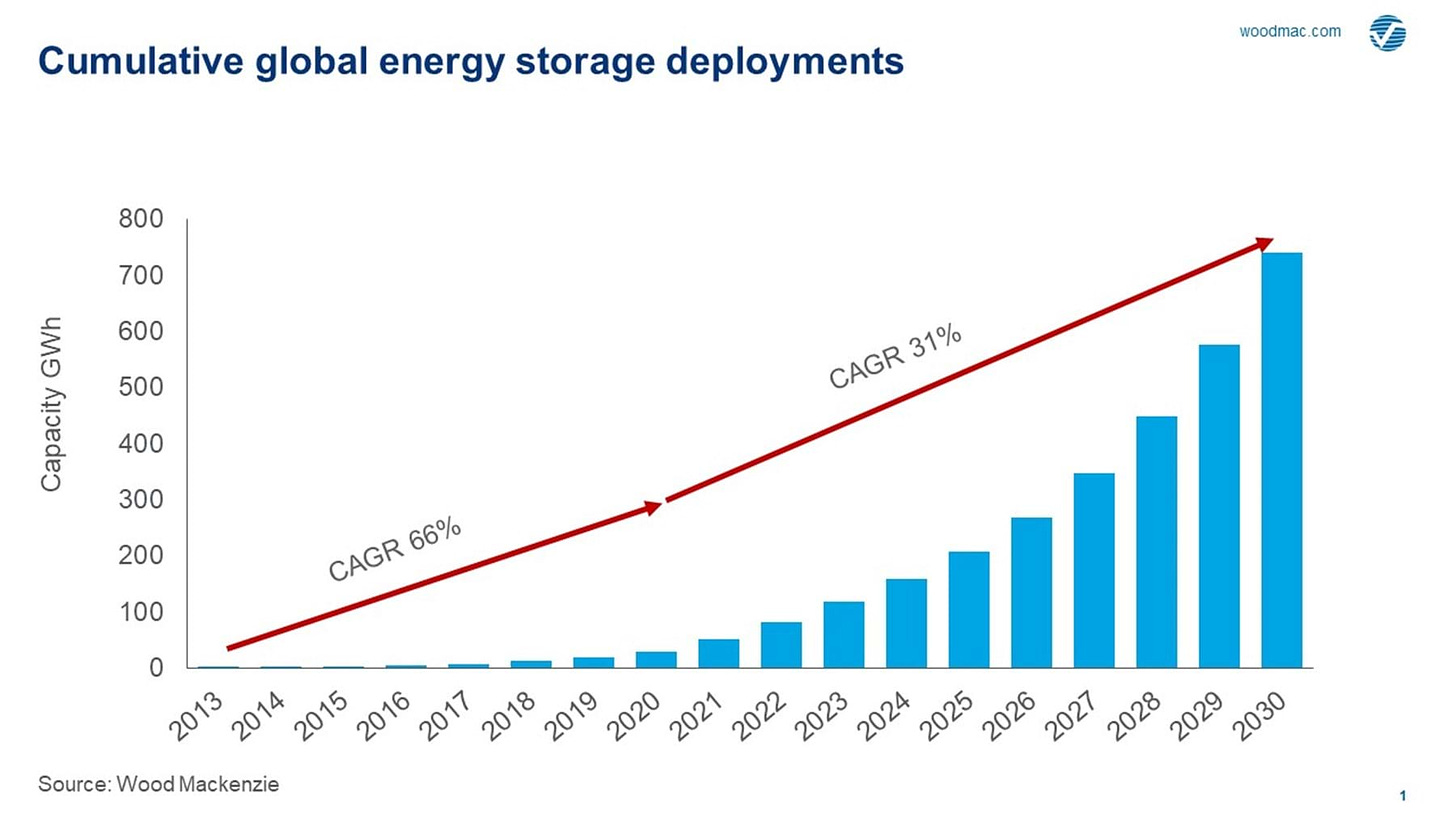

Overall, the research firm Wood Mackenzie expects the global storage market to grow at an average of 31 percent a year over the coming decade, reaching 741 gigawatt-hours of cumulative capacity by 2030.

The more energy-dense, cheap, and safe LIBs can get, the faster storage will be infused throughout the grid and the more renewable energy the grid will be able to integrate.

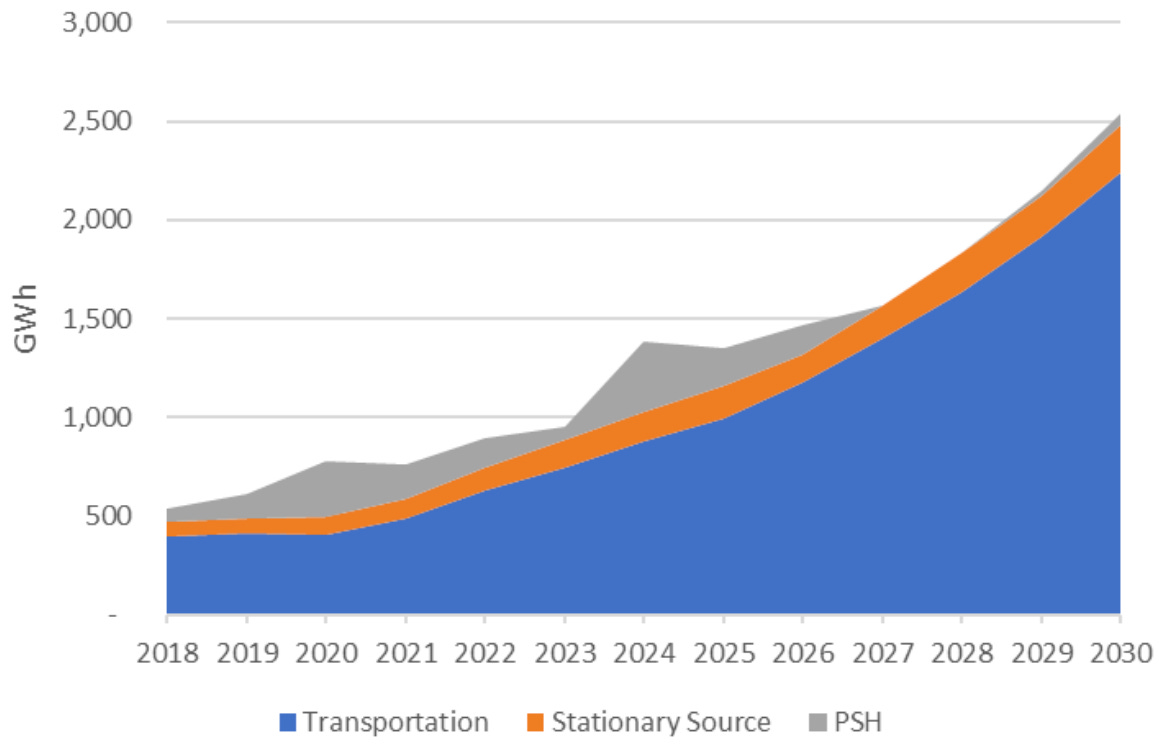

All together, here’s what the Department of Energy projects for the global energy storage market through 2030:

As this graph shows, the vast bulk of the demand for batteries is going to come from transportation, meaning EVs of various kinds. Whatever is used for EVs is probably going to end up getting so cheap, just from scale, that it dominates energy storage as well.

There’s one other cool aspect of batteries that gets too little attention. Storing substantial amounts of electricity for cheap is a relatively new thing in human affairs. We are only just now beginning to explore what can be done with it. What’s happened in the relatively short history of lithium-ion batteries is that, as they get cheaper and more powerful, we find new uses for them.

Way back in 2015, energy analyst Ramez Naam called this the “energy storage virtuous cycle.”

Lithium-ion batteries can do more and more stuff

There’s a reason why, in 2019, the three chemists behind the initial development of lithium-ion technology won the Nobel Prize in chemistry. LIBs boast incredibly high energy density and specific energy, which is to say, they cram lots of oomph into a small, lightweight package, and they are capable of cycling many more times than their predecessors.

The first LIBs, commercially introduced in the early 1990s, were expensive, but found a market foothold in small electronic devices — phones, laptops, camcorders — where energy density is at a premium. They have since all but completely taken over the consumer electronics market.

As manufacturing scale grew, prices fell and more uses opened up: power tools, lawnmowers, scooters. Scale grew more, prices fell more, and LIBs displaced other chemistries as the top choice for EVs.

Especially in recent years, the growth (and anticipated growth) in the EV market has driven an enormous surge of public and private investment to LIBs, with dramatic effects on prices. According to recent research by BNEF, “lithium-ion battery pack prices, which were above $1,100 per kilowatt-hour in 2010, have fallen 89% in real terms to $137/kWh in 2020. By 2023, average prices will be close to $100/kWh.” (It wasn’t that long ago that most experts agreed $100/kWh was an impossible target.)

And so the cycle continues. Prices fall and more new uses open up: big trucks, buses, airplanes, data centers, distributed energy storage, and large-scale grid-storage installations. From BNEF:

BNEF’s analysis suggests that cheaper batteries can be used in more and more applications. These include energy shifting (moving in time the dispatch of electricity to the grid, often from times of excess solar and wind generation), peaking in the bulk power system (to deal with demand spikes), as well as for customers looking to save on their energy bills by buying electricity at cheap hours and using it later.

Experts generally agree that LIBs are going to hit limits, even if it’s just the base price of raw materials, before they become economical for long-duration grid storage. They are being installed for 4-6 hour storage, sometimes 8-hour, and may some day even aspire to 12-hour, but beyond that — the weekly or even seasonal storage a renewables-based grid will need — some other technology or technologies will have to step in. (I’ll likely do a separate post on long-duration storage.)

Nonetheless, continued scaling will ensure that LIBs get even cheaper. Some analysts believe that, with foreseeable improvements in LIB chemistry, prices could hit $40 or even $30/kWh in coming decades. We simply don’t know yet what can be done with storage that cheap.

To take one example, if energy storage gets cheap enough to become an economically trivial addition to building construction/renovations, it will eventually be ubiquitous at the local level, and the benefits of ubiquitous, networked local energy are … well, hard to predict. We know that it would protect vulnerable populations through blackouts like those in Texas or California over the last year. But it could do much more.

Cheap batteries could open up uses we haven’t even envisioned yet. What sorts of urban mobility vehicles, drones, planes, or research outposts could we power? What kinds of ships or trains could we electrify? How could increasingly cheap, ubiquitous storage be coupled with increasingly cheap, ubiquitous solar energy?

We don’t know yet. But we’re going to see some cool shit over the next few years. Batteries have the potential to change our ordinary lived experience in myriad ways. It’s worth the time to understand what’s driving their development and where they might go.

So here’s the question that is driving Battery Week: are LIBs going to be to energy storage what solar PV panels are to solar electricity?

By way of concluding, let me briefly explain what I mean by that.

Solar panels got so cheap, so fast, they swamped all competitors

By “solar panels,” I’m referring to the standard kind — boring old crystalline silicon photovoltaic panels, the kind you see on roofs these days, which I will henceforth just call “PV.”

Thanks to key early US research and development, German feed-in tariffs (which subsidized homeowners to put panels on their roofs), and a massive Chinese manufacturing boom, PV has received an enormous, extended push in the last several decades. As the scale has grown, the price has dropped — a whopping 99 percent in the last 40 years.

PV got so cheap that it has simply steamrolled all competitors. Back in the ‘00s, even after Obama won and was putting together his stimulus bill, multiple solar technologies were in vigorous development: thin-film solar, concentrated solar power (CSP), building-integrated solar, multi-junction solar, all sorts of exotic stuff … there was even this one cool company called Solyndra that made cylindrical solar PV tubes.

There were boosters of all these technologies who could tell you chapter and verse about their advantages over plain old PV. They pulled in a lot of venture capital (and some government loan guarantees) making those pitches. But in the end, they and their funders underestimated PV’s one great advantage: it is dirt cheap and getting cheaper all the time. It’s virtually impossible for anything else to catch up.

PV’s domination of the solar market has some energy analysts concerned, thinking that government ought to step in and encourage innovation and tech diversity in this area, in preparation for the day that PV reaches its limits and plateaus. (Varun Sivaram — a researcher at Columbia University’s Center on Global Energy Policy who was recently made senior adviser to presidential climate envoy John Kerry — has a whole book on this subject.)

Some researchers disagree and think super-cheap PV will be good enough to get us where we need to go. Either way, it’s clear that without concerted government intervention, PV is going to dominate for the foreseeable future.

Is the same true of LIBs? Are they going to dominate in storage markets the way PV has dominated in solar electricity?

They already largely own both the EV and storage markets and have a substantial head start in manufacturing capacity and know-how. That head start is only going to get more daunting over the next decade. This is from a brief on the future of LIBs by a company called SILA Nanotechnologies:

Before Tesla was founded, Li-ion batteries were almost exclusively used in consumer electronics — mainly laptops and cell phones. At the time of the launch of the Tesla Roadster in 2008, the total global Li-ion manufacturing capacity was approximately 20 GWh per year. By 2030, we expect over 2,000 GWh of annual production capacity based on already announced plans by cell manufacturers.

That would be 100X growth in 22 years and a hell of a head of steam for any competitor to take on.

“It would be unwise to assume ‘conventional’ LIBs are approaching the end of their era,” concluded a recent comprehensive review in Nature Communications. “[M]any engineering and chemistry approaches are still available to improve their performance.”

Nonetheless, LIBs do face restraining pressures, especially materials and safety concerns, which we’ll get into later. They could hit speed bumps. And when you’re talking about trillion-plus-dollar markets, even a niche could be worth billions. Will competitors be able to get a foothold? It’s an enormous prize with more researchers and entrepreneurs chasing it every day.

That’s what we’ll be exploring during Battery Week. Next up: a primer on how lithium-ion batteries work!

Share this post