Gorgeous new WPA-style posters celebrate DOE's latest clean-energy technologies

They're getting loan guarantees & they're getting memorialized in cool art.

Way back in early 2016, before we slipped onto the darkest timeline, Obama's Department of Energy issued a series of posters in the style of the art used by the mid-twentieth-century Works Progress Administration in the US. They were meant to celebrate the accomplishments of the Loan Programs Office in stimulating growth in the main pillars of the clean energy transition.

I did a post on them for Vox. Here, for example, is the one for utility-scale PV:

Anyway, today the LPO has new leadership, an invigorated mission, and $350 billion to work with, thanks to the Democrats’ extremely productive legislative session. To get people psyched up, today it is beginning to release some new posters, in the same style, meant to celebrate the energy transition’s backup players, the ones that are going to supplement and stabilize the renewable energy-based system. These are the kinds of technologies that LPO chief Jigar Shah geeked out about on the pod.

There are three new posters, and I thought I’d share them. These technologies are a bit more difficult to capture in iconic images, but I think they’ve given it a good go here. And I just can’t get enough of this style.

Hydrogen

Here's the one for hydrogen:

As Volts subscribers know, hydrogen is carrying a lot of hopes in the energy transition. If it can be made cleanly, it can substitute for fuels in high-temperature industrial applications, be used to make transportation fuels for ships and airplanes, or serve as long-duration energy storage in the power sector.

Example:

The LPO has offered a 500 million dollar loan guarantee to a company called Advanced Clean Energy Storage, for a project in Utah that will combine 220 megawatts of electrolysis with two massive 4.5 million-barrel salt caverns to store the hydrogen. The idea is to capture excess renewable energy when it is abundant, store it as hydrogen, and then use the hydrogen as fuel for the IPP Renewed Project, a hydrogen-capable gas turbine combined-cycle power plant that plans to incrementally shift to 100 percent clean energy by 2045.

Critical materials

Here's the one for “critical materials”:

As Volts subscribers also know, the transition to clean energy is going to radically raise demand for a key set of minerals which are currently mined and processed in countries whose ongoing good will toward the US cannot be guaranteed. One thing the Biden administration is trying to do is move important parts of that supply chain into North America.

Example:

The LPO is offering a $100 million loan to a project called Syrah Vidalia, a facility that will process raw materials into graphite-based active anode materials (AAMs) for use in lithium-ion batteries. Syrah Technologies LLC is building the project in Vidalia, Louisiana; it would be the first large-scale AAM manufacturer outside of China.

Advanced fossil

And here’s the one for (sigh) “advanced fossil”:

During the clean energy transition, certain sectors will require fossil fuels for longer than others, and there are ways to reduce the impact of that fossil fuel use.

Example:

The LPO has offered a loan guarantee of up to a billion dollars to Monolith Nebraska LLC to expand its Olive Creek facility in Hallam, Nebraska. That facility is the first-ever commercial-scale use of methane pyrolysis technology, which converts natural gas into carbon black and hydrogen. Carbon black is used in tires and other rubber products, and in the production of plastics; currently, it is made with fuel oil, a highly carbon-intensive process. The hydrogen will be used in ammonia fertilizer, another product that is extremely difficult to decarbonize. Overall, the process is expected to reduce the carbon emissions of carbon black and hydrogen production by up to 80 percent.

Keeping up with LPO

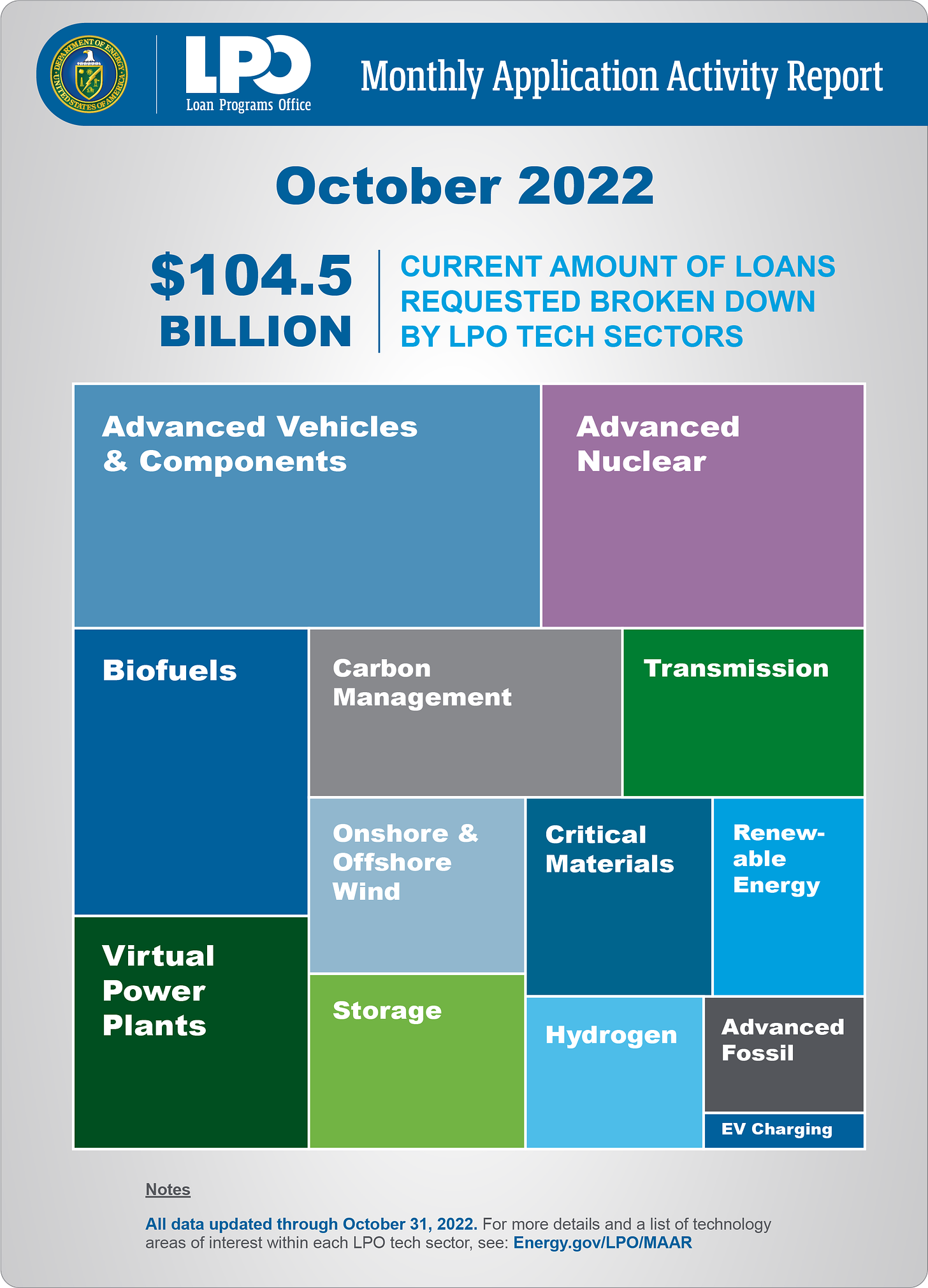

If you are interested in tracking LPO’s ongoing activities, the office releases an activity report every month. Here is October’s.

Since September, the total number of active applications has risen from 91 to 98. The cumulative financing requested in the applications has risen from $92.6 billion to $104.5 billion. The office is currently getting an average of 1.3 applications a week. Here's how the technologies in the applications break down:

So there you go: some good art and an update on the LPO, which is entering a heady period in which it will send billions and billions of dollars out the door, giving an enormous boost to the clean energy technologies the US will need in coming decades. Exciting times.

Updates:

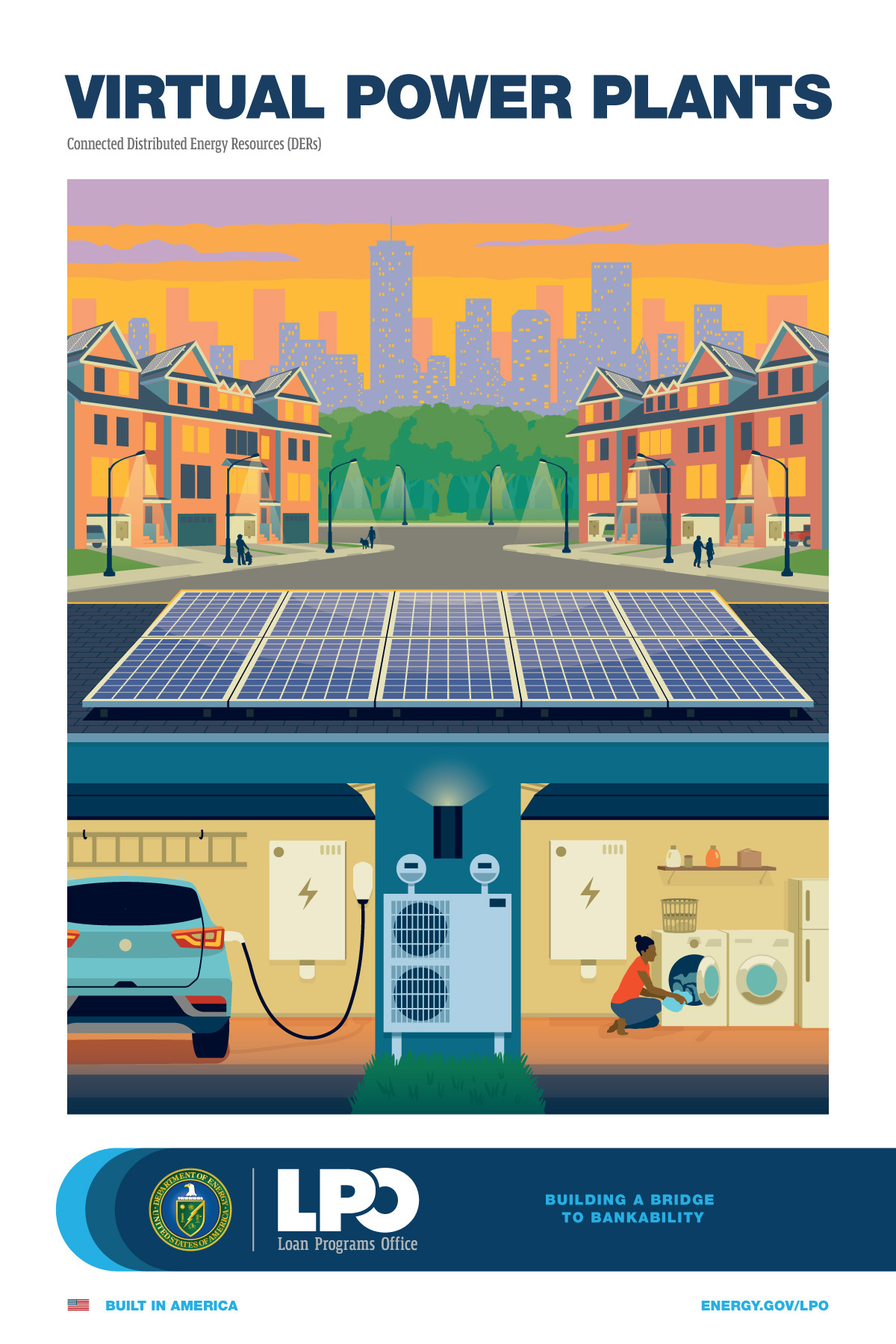

Virtual power plants

Here’s the one for virtual power plants:

This one is a bear to illustrate! A VPP is an aggregation of distributed energy resources (solar panels, batteries, EVs, smart homes & appliances, etc.) into a coordinated entity that can act like a large-scale power generator and/or storage.

The LPO has a series of blog posts on VPPs if you’d like to catch up. See also this piece and this piece, both by LPO head Jigar Shah. (Also, note that a coalition of companies including GM, Ford, and Google has teamed up to support VPPs.)

Offshore wind

Here’s the illustration for offshore wind:

The Biden administration has set a target of 30 gigawatts (GW) of offshore wind power in the US by 2030, up from its meager base of 42 megawatts (MW) today.

The LPO intends to assist in that goal by providing early financing to infrastructure and manufacturing facilities that will help stand up a US supply chain to compete with Europe’s.

Nice, but where's geothermal? In the posters, I mean, 'cause in the wild, it's everywhere!

great interview w Jigar Shah, I finally listened to it! Hope your hands are better, Dave. Thank you again for all your work over these many years.