Arguments over carbon taxes go back as far as discussions of climate change itself. Economists have long insisted that pricing carbon is the most efficient way to reduce greenhouse gases. For years, they hijacked the climate discourse, with untold money and effort put behind proposals for various increasingly baroque pricing schemes, to very little effect.

Over time, political experience with carbon taxes has highlighted a truth that should have been obvious long ago: carbon taxes are taxes, and people don’t like taxes. People don’t like paying more money for stuff.

More broadly, carbon taxes are an almost perfectly terrible policy from the perspective of political economy. They make costs visible to everyone, while the benefits are diffuse and indirect. They create many enemies, but have almost no support outside the climate movement itself. All the political intensity is with opponents. (More here.)

One response to this critique that has grown increasingly popular in recent years is the notion of refunding the tax revenue — giving the money back to voters. Various ways to do this have been proposed, the simplest being an equal dividend to each taxpayer. Some proposals have all the tax revenue refunded; some have a limited portion refunded.

The idea is that the tax would discourage carbon-intensive activities, while the dividend would mute political opposition. In most of the proposed schemes, the lower half of the income scale comes out ahead — dividends are larger than tax burdens — and in some cases, up to 80 percent of taxpayers come out ahead. A refunded carbon tax is basically large-scale wealth redistribution from the biggest fossil fuel users to middle- and working-class citizens.

This kind of “fee and dividend” framework is endorsed by the Climate Leadership Council (centrist/bipartisan elites), the Citizens’ Climate Lobby (left-leaning grassroots campaigners), and one-time presidential candidate Andrew Yang, though they differ on important details.

The logic of the policy is compelling to proponents — and to many people who first hear about it — and they feel deeply confident that it will compel the public too. The evidence, however, is mixed.

Do refunds increase the popularity of carbon taxes? At last, some field research.

There are numerous studies showing that, in a polling or focus-group setting, the inclusion of refunds increases public support for a hypothetical carbon tax — see here and here, among others. But that kind of polling has not translated into victories in, for example, Washington state, where a fee-and-dividend policy lost badly in a public referendum in 2016.

More to the point, because there have been so few fee-and-dividend policies implemented in the real world, there’s been very little field testing of the public’s actual response to it.

That brings us to a new paper in the journal Nature Climate Change by political scientists Matto Mildenberger (UC-Santa Barbara), Erick Lachapelle (University of Montreal), Kathryn Harrison (University of British Columbia), and Isabelle Stadelmann-Steffen (University of Bern). They do something novel: look at public opinion in the places where carbon fee-and-dividend policies have been implemented.

It turns out there are only two.

Switzerland established a rebate program in 2008. The carbon tax reached 96 Swiss francs (about $105) per tonne in 2018; about two-thirds of the revenue is rebated on a per-capita basis, with everyone (including children) receiving an equal share.

Canada established a rebate program in 2019 as part of its national carbon-pricing strategy. So far, the scheme covers four of 10 provinces, with more than half of the national population. The price was initially set at 20 Canadian dollars (about $16 U.S.) a tonne, rising to CA$50 by 2022; recently the government released a new schedule that would target CA$170 by 2030.

The refund, or Climate Action Incentive Payment, is based on the number of adults and children in the household, with a 10 percent boost for rural households. It is highly progressive; 80 percent of households get more back than they pay.

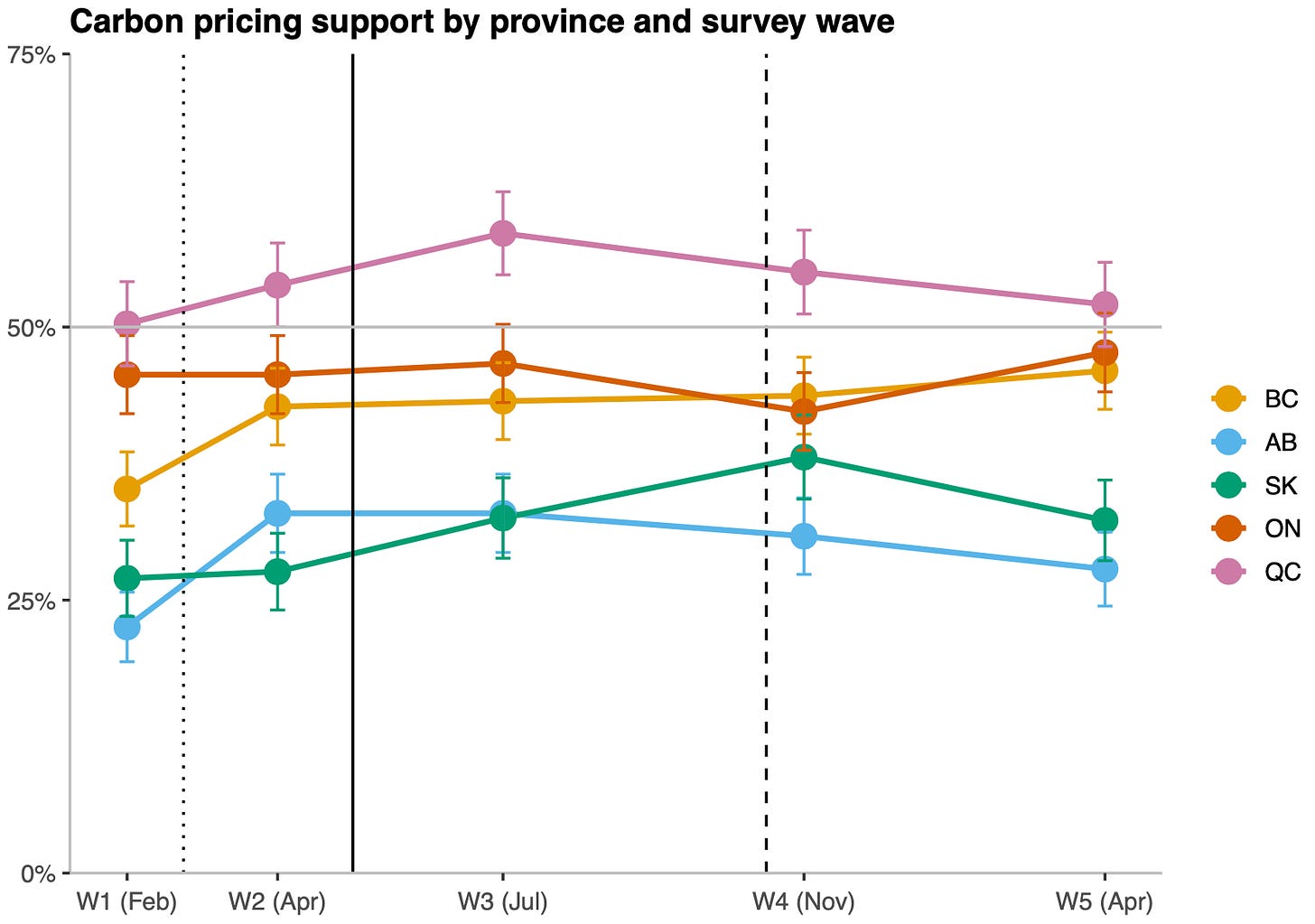

The Nature Climate Change paper looks at public opinion in both countries. In Canada, it draws on a longitudinal study, which surveyed the same residents — “from five provinces, two subject to the federal carbon tax (Saskatchewan and Ontario), one with provincial emissions trading (Quebec), and two with provincial carbon taxes (British Columbia and Alberta)” — five times from February 2019 through May 2020, during which time the scheme was proposed, debated, passed, and implemented.

In Switzerland, the paper draws on a survey of 1,050 Swiss residents in December 2019.

So what do these surveys tell us? It’s not great.

Refunds don’t change opinions much; many recipients don’t know they exist

In Canada, throughout the period in which the refund was hotly debated, passed, and implemented, public approval … didn’t change much.

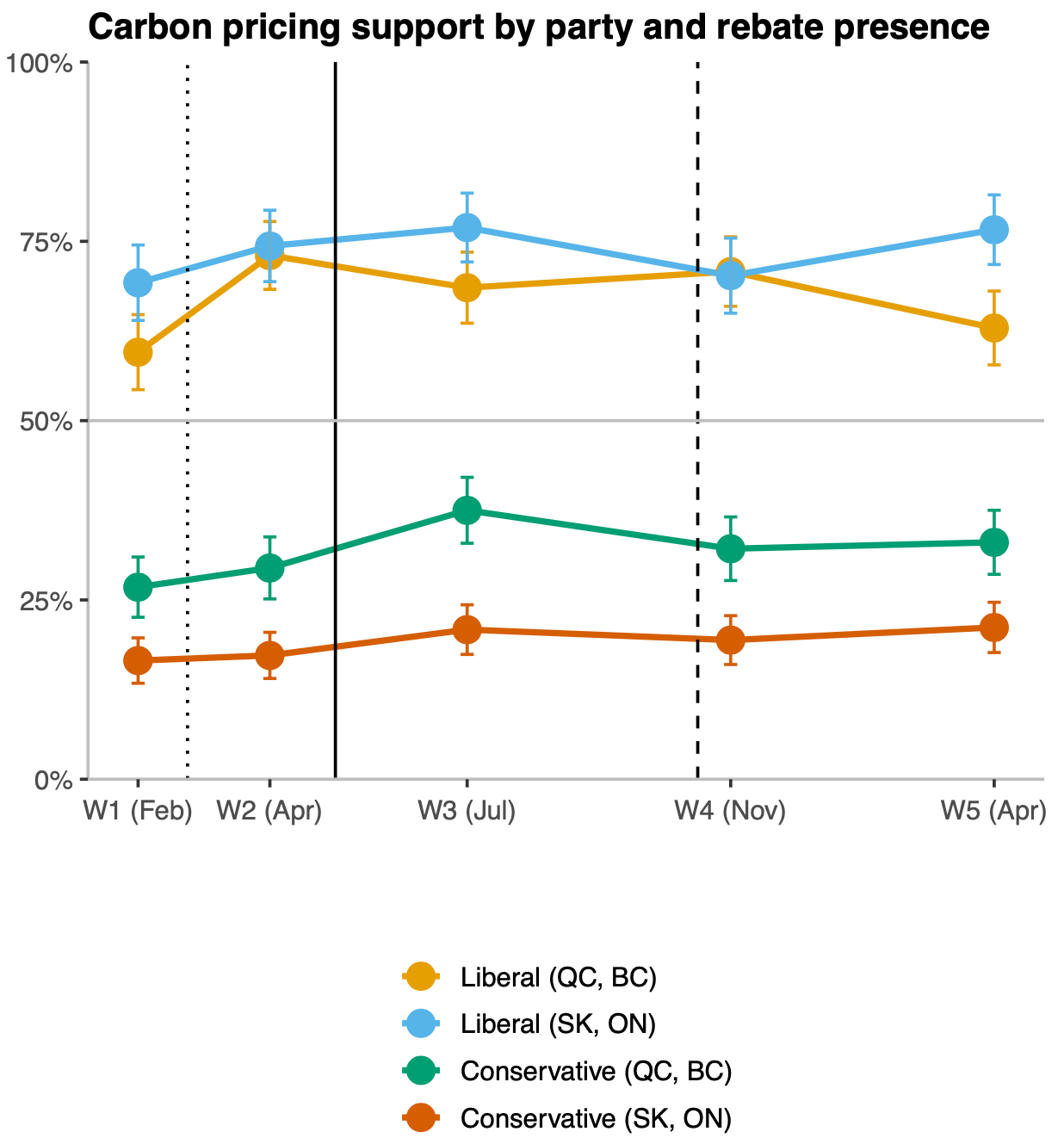

What’s more, opinions on the policy were divided primarily not by who got a refund and who didn’t, or who got a bigger refund. They were divided by (say it with me) partisanship:

By wave 5 [of the survey], 75% and 81% of Liberal supporters in Ontario and Saskatchewan respectively supported carbon pricing, compared to 32% and 13% of Conservatives in these same provinces.

Perhaps more importantly, Canadians remain confused and in many cases ignorant about carbon refunds. When asked whether they got one at all, “many Canadians did not know, including 17% in rebate provinces and between 33% and 36% in non-rebate provinces.”

When asked how big their carbon refund was, many in non-rebate provinces reported positive amounts, while those who did receive one underestimated it by as much as 40 percent on average. “Only 24% of Ontario respondents and 19% of Saskatchewan respondents estimated a rebate amount falling within the correct $100 dollar range of their true rebate.” (Perhaps unsurprisingly, Conservatives underestimated their rebate more than Liberals.)

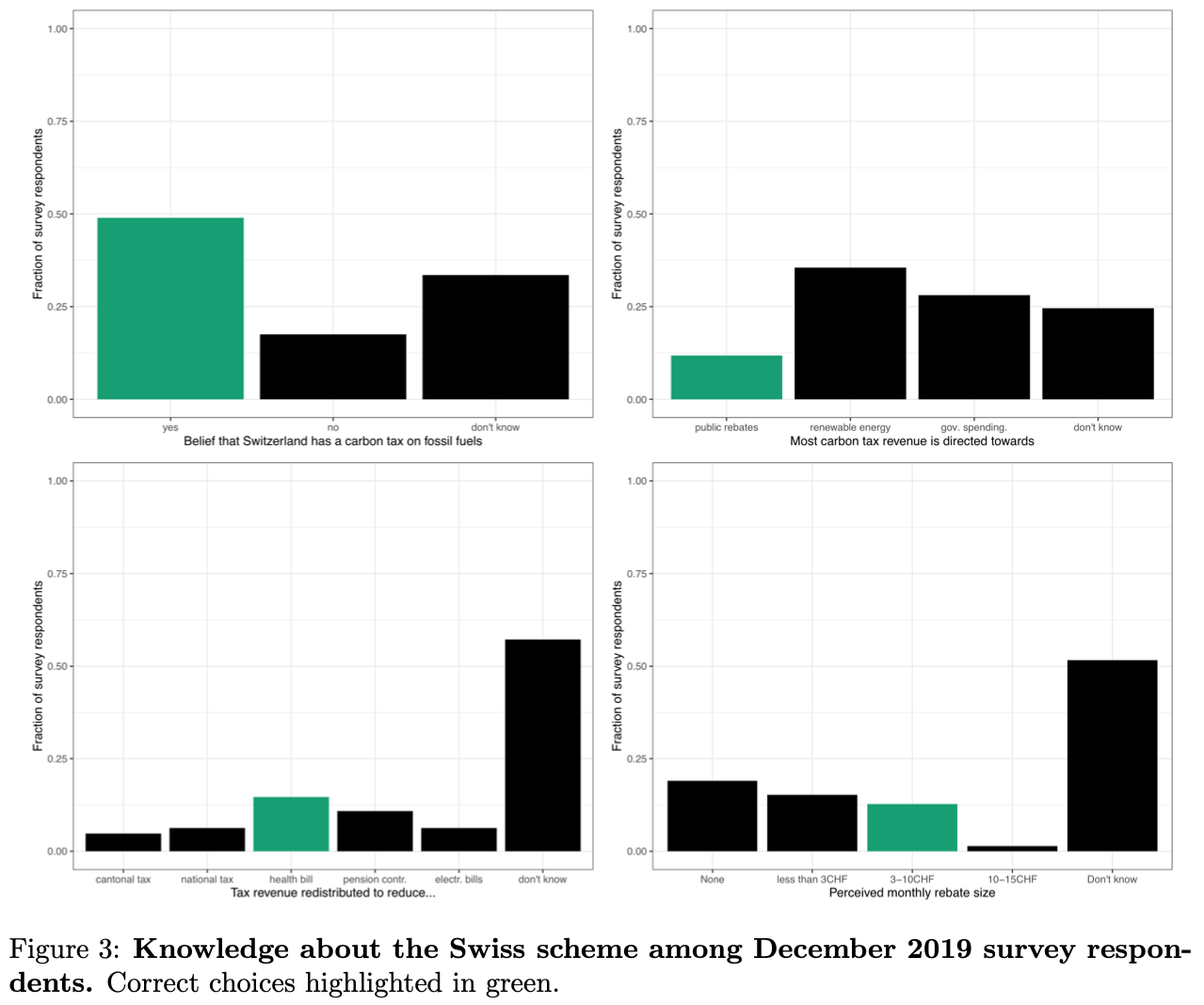

You might think, well, Canada’s program is new. What about Switzerland, where they’ve been receiving rebates for over a decade?

It’s … even worse. Only 12 percent of Swiss respondents know that part of the carbon revenue is refunded; 85 percent did not know they’d gotten a refund at all. D’oh!

Additional information about refunds often doesn’t help

You might think, well, the problem is how these countries administer their refunds. In Canada, it’s a line on your tax return. In Switzerland, it’s a discount on your health insurance premiums. Both are clearly marked, but lots of people don’t exactly scrutinize those documents and keep track of every line item. Surely support would rise if people are made aware of the refund they are receiving, yes?

Er, no.

In both countries, a portion of survey respondents were given individualized rebate information — that is to say, they were shown, on the documents in question, exactly how much they had received in annual carbon refunds.

In Canada, this treatment did not raise support for carbon pricing at all. In fact, respondents who were shown what they received were less likely to believe that they had been made whole (this trend was also more pronounced among Conservatives).

“Canadians who learned the true value of their rebates,” the paper reports, “were significantly more likely to perceive themselves as net losers, even though most Canadians are net beneficiaries.” D’oh!

Maybe Switzerland? There, information about rebates mildly increased support for the current policy (“around one fifth of a standard deviation”) but it did not increase support for an increase in the tax at all. And in fact, in a June 2021 referendum, the Swiss voted against an increase in the tax and the rebates.

In short, the available evidence suggests that carbon refunds don’t do much to reshape public opinion on carbon taxes, even among voters with accurate information about the refund they receive.

Caveats

Perhaps support for these policies will increase over time. Perhaps it would increase if voters didn’t receive just one-time information about refunds, but consistent, repeated information. Perhaps it would increase if the rebates were sent via check rather than buried in bureaucratic documents. (We’ll find out about this — Canada is switching to a checks-by-mail system this summer and researchers are planning more surveys.) Perhaps support would grow if the rebates substantially increased in size.

We can’t know what would happen in these counterfactuals; anything is possible. We can’t know whether some sort of carbon refund scheme might catch on and grow popular at some point. But the current evidence is fairly discouraging for the thesis that rebates will ipso facto increase support for carbon pricing.

The lessons of this research

There was a popular theory among pundits (myself included) when the Democrats took control of the federal government in 2020: the one thing you can’t propagandize voters on is their own lives. If Democrats could improve voters’ social and economic circumstances in tangible ways, it would cut through the disinformation haze and increase public support.

In retrospect, I think that was naive. You can propagandize voters about their own lives. Or, to put it more academically, all of our experiences, even our experiences of our own life circumstances, are mediated. We interpret them through schema and worldviews shaped by our tribes and the stories they tell. These days, we get that stuff through electronic media, with which the world is saturated.

Most people are not aware of exactly how much they pay in gas or carbon taxes a year. Most people do not closely scrutinize their tax returns or health insurance forms. And above all, most people are unaware that they already receive a variety of government benefits, which are often buried in the tax code or otherwise hidden from view. (The best book on this is Suzanne Mettler’s The Submerged State: How Invisible Government Policies Undermine American Democracy.)

Outside of a focus group, out in the real world, people’s assessments of a carbon refund are less likely to be informed by careful economic cost-benefit analysis than they are to be mediated by identity affiliation. And these days, identity has been subsumed by partisanship.

“[I]n the two federal-tax provinces, supporters of the Liberal Party of Canada were 3 to 8 times more likely to support the carbon tax than Conservative Party supporters,” the paper reports. “Similarly, in Switzerland, left-leaning voters were 48% more likely to support rebates relative to right-leaning voters.”

People’s assessments of a policy tend to echo their tribe’s assessment, which they absorb through media and peers, not through an accounting spreadsheet. The amounts of money generally being discussed in carbon refund policies are not large enough to be life-changing for voters. The signal is not big enough to break through the noise of partisanship.

Mildenberger summed it up for me over email:

The entire [carbon refund] logic requires that large parts of the public understand that they make more money from their cheque than they are paying in taxes. But this is not what we see in Canada. And it's no surprise. As long as one group of actors spends its time sensationalizing and dramatizing the costs of carbon taxes, then many people will think they are not being made whole. Why should we expect — in an American society where even basic facts are politicized and vast portions of the public accept outright misinformation — that carbon taxes will be immune to this? What matters is not the actual material reality of people's circumstances, but their perceptions of those circumstances. (my emphasis)

That last line squarely identifies something that Democrats have long been loath to accept. In a sense, carbon refunds are the latest expression of a long-time technocratic dream: that a policy can be so sensible, such a net benefit for so many people, that it will transcend politics. It will argue for itself and its logic will be irrefutable.

But if we’ve learned anything in these past few years (and I fear we haven’t), it’s that nothing transcends politics. Nothing is experienced directly by voters, not even money showing up in their bank account. Everything is mediated.

Politics in the US has been nationalized and fully subsumed by the culture war. No policy, no matter how cleverly designed, can get around that. In our present partisan and information environment, the measurable effect of a carbon refund on voter finances may carry less weight than advocates hope.

Share this post