(If you don’t want to read, you can listen! Just click play above.)

Hello! Welcome back to Battery Week here at Volts … where we use the term “week” somewhat loosely.

Up to now, we’ve been focusing on lithium-on batteries (LIBs) — why they are so important, how they work, and the varieties of LIBs that are battling it out for the biggest battery market, electric vehicles (EVs).

It’s fairly clear from that discussion that LIBs, in some incarnation, are going to dominate EVs for a long while to come. There is no other commercial battery that can pack as much power into as small a space and lightweight a package. Plus, LIBs have built up a large manufacturing base, driving down prices with scale and learning. Their lock on the EV market is likely unbreakable, at least for the foreseeable future.

But there’s another battery market where some competitors hope to get a foothold: grid storage. They think there’s space in that market waiting to be claimed.

Currently, there’s a robust and growing short-duration grid storage market, offering storage of anywhere from seconds (to provide grid services like voltage and frequency regulation) to four hours. LIBs have about 99 percent of that market locked up; in some areas, projects with solar power coupled with four hours of storage are bidding in competitively with natural gas.

Most energy wonks believe that, to fully shift the grid to zero-carbon energy, we will eventually need long-duration storage as well, to the tune of weeks, months, or even seasons. LIBs are almost certainly not going to cut it for that purpose, so it will be some combination of other technologies. (I’ll write about long-duration storage some other time.)

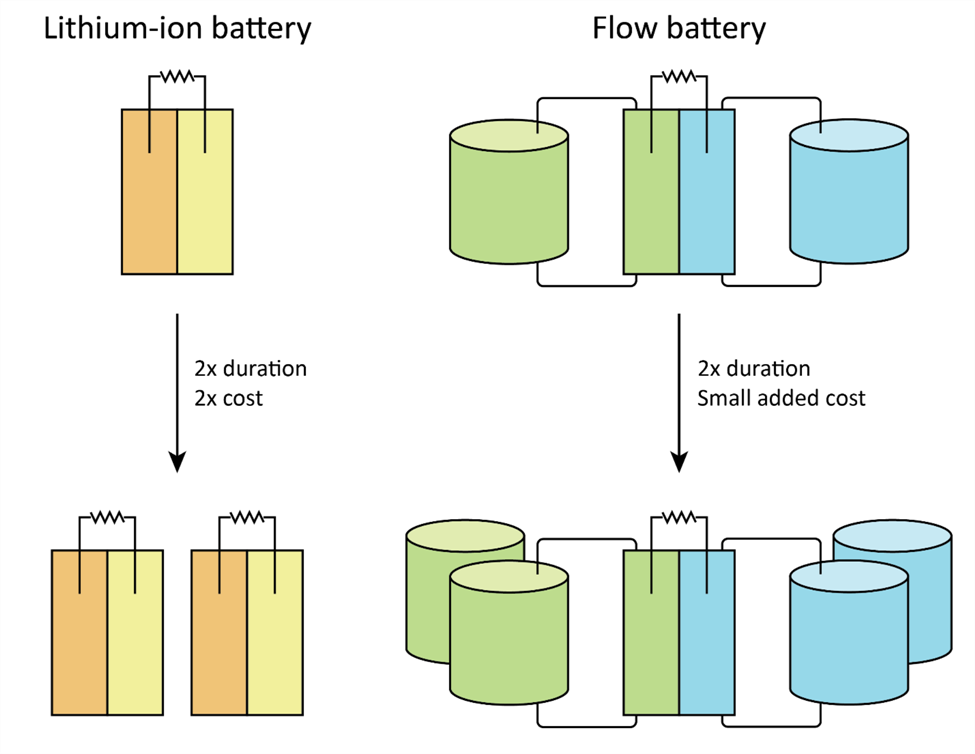

In between short and long, there’s something that might be called mid-duration storage, covering the range between four and 24 hours. What technologies will cover that range? LIBs can do it, of course — theoretically they can cover any duration; you just stack more and more batteries — but the economics get extremely difficult. Mid-duration projects will require lots of capacity but might run comparatively rarely. As duration gets to four hours and above, the cost of LIBs, at least today’s LIBs, starts to get prohibitive.

This is where other batteries come in, challengers to LIBs that hope to beat them at longer durations — though they aren’t quite there yet. “There really aren't competitive technologies in the battery electric vehicle space aside from all these different lithium ion batteries,” says Chloe Holzinger, an energy storage analyst at IHS Markit, but “there's a ton of different battery technologies for grid storage. They just tend to be significantly more expensive than lithium ion batteries.”

These challengers believe they are better suited to the needs of the mid-duration grid storage market, where energy density matters less than capacity, calendar and cycle life, and safety. They think they can bring costs down to competitive levels at those durations. (Some of them think they can find other niches as well, but it’s grid storage that offers the most realistic shot.)

Flow batteries

Flow batteries operate on a fundamentally different principle than the batteries we’ve looked at so far. Rather than storing energy in metals on the electrodes, energy is stored as a dissolved metal in an aqueous electrolyte.

The anolyte is stored in one tank; the catholyte is stored in another; pumps circulate the fluids past electrodes (sometimes in a fuel cell), where they don’t quite mix, thanks to a thin separator, but they exchange ions and electrons, generating electricity.

The key conceptual difference is that flow batteries separate energy (the amount stored) from power (the rate at which it can be released). If you want more power, you make the electrodes bigger. If you want to store more energy, you make the tanks of electrolytes bigger. And electrolytes are fairly cheap, so it’s cheap to increase capacity.

This is in contrast to LIBs, which double in cost with each doubling of energy capacity.

In theory, flow batteries can scale up to almost any size, relatively cheaply. So as the demands for storage get bigger — six hours, eight hours, 12 hours — the economics of flow batteries look better and better relative to LIBs.

A variety of different metals can be used in the electrolyte. For a long while, vanadium was expected to be the breakout candidate, but materials costs remain stubbornly high. Companies have tried with zinc (like the late ViZn, and also see below) and iron (like ESS, which is still going strong). Recent history is littered with failed flow battery companies.

“Flow batteries have been the next big thing for a really long time,” says Purdue University assistant professor and battery expert Rebecca Ciez, “but they've never quite gotten there.”

The problem, as ever, is the steady march of LIBs down the cost curve. “For a three-or four-hour system, a lithium ion battery outperforms any flow battery now,” says Dan Steingart, a materials scientist and co-director of Columbia University’s Electrochemical Energy Center. “Fifteen years ago, that was not predicted.”

Flow batteries can theoretically expand their energy capacity indefinitely, for little more than the cost of the electrolyte goop to fill the tanks (though pumps and other accoutrement add to the cost a bit). But “when we're below $100 per kilowatt-hour on the cost of [LIBs],” says Steingart, “you're really close to the cost of the goop.”

And flow batteries, like all challengers, face the fact that LIBs are well-established and well-understood. “It's easier to finance a lithium-ion battery,” says Steingart, “because of all the existence proofs and their inherent reliability. I can predict the fate and the failure.” That makes the operating and maintenance costs of LIBs incredibly low, on the order of 1 percent of the cost of capital, whereas for flow batteries it is 2.5 percent at best.

There are still flow battery challengers in the field, like Largo Clean Energy (which bought VionX), which is commercializing vanadium flow batteries; Primus Power, which has a zinc bromide battery; ESS, which is selling an iron flow battery; and the mysterious Form Energy, which counts an aqueous-sulfur flow battery among its offerings.

But there is a growing sense in the field that flow batteries aren’t going to be able to catch up to LIBs, at least not any time soon, without government help.

Zinc batteries

Several companies are working on batteries that exchange zinc ions instead of lithium ions — it’s the second-most-popular metal for batteries.

Zinc has the particular advantage of being light and energy dense like lithium, so with relatively modest adjustments, it can slipstream into the lithium-ion manufacturing process.

Zinc is plentiful, cheaper than lithium, largely benign, and makes batteries that are easier to recycle. Like other lithium alternatives, zinc sacrifices energy density, but makes some of it back up in savings on safety systems at the battery-pack level, thanks to the lack of any need for fire suppression. This puts it in the same markets as LFP: smaller commuter/city vehicles, robo-taxies, scooters, e-bikes — and energy storage.

Some in the zinc crew have larger designs: “We think we can coexist with lithium-ion and replace lead acid,” says Michael Burz, president and CEO of EnZinc, which has developed a new zinc anode it says can come close to LIBs on energy density. Remember, lead-acid batteries are still ubiquitous. “Forklifts use them. Airplanes. Snowmobiles.“ says Burz. “Data centers have huge banks of lead-acid batteries they use for switchover power.” It’s still a $45 billion global market.

EnZinc thinks it can hit a sweet spot: close to the energy density of LIBs, close to the low cost of lead-acid, safer than either, and good enough to substitute for a big chunk of both.

Zinc anodes are “cathode agnostic,” so Burz envisions, rather than becoming a battery manufacturer, becoming an anode supplier — “Zinc Inside,” modeled on “Intel Inside” processors. Research is underway on a number of cathodes, from manganese and nickel to, just as with lithium, air. A zinc-air battery “has a system-level specific energy of anywhere between 250 to 350 watt-hours per kilogram,” says Burz, well above most LIBs. The trick is making it controllable and rechargeable. There are zinc-air battery companies offering commercial products that believe they’ve solved those problems, like NantEnergy (formerly Fluidic), which is targeting its zinc-air batteries at off-grid markets in developing countries.

There are other zinc-based technologies as well. A company called EOS is making a “zinc-hybrid cathode” that it says is safe and long-lasting. The much-hyped Zinc8 has developed a zinc-air hybrid flow battery that it claims can beat LIB costs at higher storage durations.

Most of these batteries make the same basic claims: they are less energy dense than LIBs, but they are safer (no fires), they are made with benign and plentiful materials (no supply problems), and they are cheaper at high capacities/durations. It’s just that last part that’s tricky, since the price and capabilities of LIBs are a moving target.

Zinc backers are confident that as the 100-percent-clean-energy pledges being made by cities and companies start to bite and the market for grid storage expands, demand for longer duration storage will expand with it. (California, for instance, is putting lots of money toward zinc battery demonstration projects, with an eye toward diversifying its storage options.)

Sodium-ion batteries

Lithium, nickel, and cobalt all have their issues. You know what material doesn’t? Salt.

Sodium compounds can be substituted for lithium compounds to create sodium-ion batteries (NIBs), which have been the source of considerable hype for at least five years now. The basic idea and manufacturing process is the same for NIBs as LIBs — “you could use existing gigafactory structures to produce a sodium-ion battery,” says Steingart — but unlike the latter, the former can’t use graphite for the anode, because it can’t capture enough of the relatively bigger sodium ions, so something called “hard carbon” is typically used instead.

Research is underway to find more energy-dense sodium compounds for the cathode and cheaper materials for the anode. “Sodium-ion has a lower energy density than lithium-ion,” says Tim Gretjak, an innovation analyst with Con Edison, “so all the materials that go into it have to be correspondingly that much cheaper.”

There have also been some high-profile NIB failures. A promising startup called Aquion, backed by Bill Gates and showered with awards, declared bankruptcy in 2017.

But here, too, there are surviving challengers. A company called Natron Energy is currently selling a NIB that uses Prussian Blue (a dark blue synthetic pigment) as the anode and a sodium-ion electrolyte. It has received “a total of more than $50 million in venture funding and more than $5 million in ARPA-E and DOE funding,” reports Eric Wesoff, and has a product currently on the market. Like enZinc, it is going after some lead-acid applications (data centers and forklifts) and some LIB applications (stationary storage), hoping its long life and safety can carve out a niche.

To my eye, NIBs appear to be stuck in the same spot as the previous two batteries: better than LIBs on some metrics, for some applications, but so far behind on manufacturing and bankability that scaling them up is a Sisyphean task.

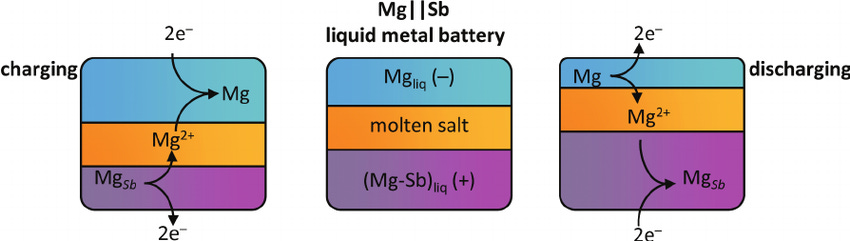

Liquid metal batteries

A company called Ambri was spun out of MIT back in 2010 and has been threatening ever since to commercialize a battery for low-cost, long-lifetime grid storage. It too has received money from Bill Gates.

It ran into problems with its initial battery in 2015, laid off a quarter of its workforce, started over, and now produces a calcium-antimony battery with (according to Ambri’s website) “a liquid calcium alloy anode, a molten salt electrolyte, and a cathode comprised of solid particles of antimony.”

The liquids and suspended particles are contained in a positively charged stainless steel box with a negatively charged electrode plug on top.

The battery will pass no current at room temperature, but on site, the contents of the boxes are super-heated (to 500°C), which activates the materials; the metals alloy and de-alloy, with the cathode being entirely consumed and then reformed, as the batteries charge and discharge.

Because the contents are liquids, the battery has no “memory” — it is not affected or degraded by absorbing or releasing ions. This means it suffers virtually no loss of capacity over its lifetime; in fact, it works better if completely charged and discharged every few days.

From the time they are first activated, liquid metal batteries require no outside heating or cooling for the lifetime of the system, eliminating a ton of system costs, and they can operate in a wide range of temperatures and conditions. Ambri claims the batteries contain materials less than half the cost of LIB materials, can be manufactured for less than half the cost of LIBs, and will run for 20 years at a “fraction of the cost” of LIBs.

After a decade of hype, promises, and false starts, Ambri is currently building a 250 MWh project on the 3,700-acre Energos Reno project in Reno, Nevada. It will be, finally, a field test of the technology. If it pans out, it could establish a foothold in grid storage.

Should we worry about lithium-ion’s headlock on grid storage?

LIBs worked their way up from consumer electronics to appliances to cars to trucks to stationary storage, building momentum and scale. At this point, they have locked up the EV market and the short-duration grid storage market.

At this point, there isn’t much demand for mid-duration storage. The question is, as the grid integrates more renewables and that mid-duration market develops, whether LIBs will simply continue their march to dominance.

Right now, a few LIB competitors can claim lower kWh costs over longer (20+ hour) durations, but Steingart thinks that some variant of the basic LIB architecture is “going to get to somewhere between $45 and $60 per kilowatt hour” eventually. That’s just an incredibly difficult trajectory to keep pace with.

Is it going to make LIBs uncatchable, even in the grid storage space? “I co-wrote a paper last year that basically says, up to eight to 10 hours, the answer is probably yes,” Steingart says, “at least for the foreseeable future.”

Even if they weren’t still sprinting ahead on costs, simply by virtue of their ubiquity and familiarity, LIBs have gained an enormous institutional advantage. When it comes to grid storage projects, says Lou Schick, director of investments at Clean Energy Ventures, “the installed cost is so high that the chemistry of the battery doesn't really affect the cost.”

He explains: “The soft costs of applications engineering, designing the contract, getting permission to do it, satisfying all the building codes, and so forth — by the time I'm done with all that crap, the battery itself is 20 to 30 percent of the installed cost, at most.”

In that context, the differences in performance among different chemistries are less important than simpler criteria, Schick says: “Is it bankable? Can I get insurance for it? Is it standard consumer product?”

This, even more than total long-term costs, is the biggest barrier to LIB competitors: LIBs are bankable. They are familiar. Their performance and failure modes are well-understood. Any competitor has to solve the chicken-and-egg problem of convincing the first several investors to take on greater risks.

This gets us back to an argument I raised in my introductory post: if it is true that a) we will soon need more and longer-duration storage than LIBs can provide, and b) LIBs currently have an unbreakable hold on the market, then perhaps the federal government should proactively take steps to encourage competitors to LIBs.

Recently, the research outfit ITIF released an excellent paper by Anna Goldstein making just this argument, in the context of flow batteries: “in the absence of ‘first markets’ that can rapidly pull flow battery innovation, the U.S. Department of Energy (DOE) should push it forward with investments in research, development, testing, and demonstration.”

The same argument could be made on behalf of any of the battery chemistries discussed above. The market probably isn’t going to mature them fast enough; the feds should help.

After all the time I’ve spent thinking about batteries, I am of two minds about this argument. On one hand, Goldstein makes a good case that the storage needs of the electricity system will soon push past what LIBs can provide. If that’s true, it does seem like it would be better to innovate alternatives now, to be prepared.

On the other hand, analysts have been wrong about the ultimate capabilities of LIBs again and again. LIBs weren’t going to be able to handle cars, then they weren’t going to be able to handle short-duration storage, then they weren’t going to be able to hit $100/kWh, but they’re doing all those things.

If LIBs follow a steadily declining cost curve down to $40-60/kWh, it’s difficult to imagine any competitor that could catch up. The only markets where competitors might have a shot is 20+ hours of storage, and it’s not even clear how much of that will ultimately be needed.

Nonetheless, I think I come down in the “better safe than sorry” camp — there’s no harm in making multiple bets when the stakes are so high. Researching and innovating medium- and long-duration storage technologies will bring all sorts of learning and networking benefits that we can’t predict now.

And if LIBs continue to defy all predictions and get so cheap nothing can compete, well, that will be a nice problem to have.

Guest pup! My darling niece and her family got a darling new puppy. His name is Oscar.

Share this post